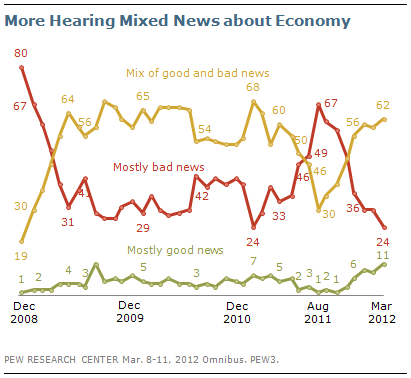

Perceptions of economic news have improved sharply since last summer, a time many feared the nation could be slipping back into recession. However, opinions about national economic conditions remain overwhelmingly negative.

The percentage saying they are hearing mostly bad news about the economy has fallen from 67% last summer to 24% in the current survey. Over this period, the proportion saying that economic news is a mix of good and bad has more than doubled, from 30% in August to 62% today. The percentage hearing mostly good news now stands at 11%, up from just 1% last August.

Perceptions of news about several sectors of the economy – including the

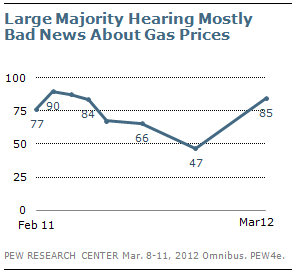

job situation, the financial markets and real estate values – also have become much less negative. Still, news about gas prices is viewed much more negatively. More than eight-in-ten (85%) say they are hearing mostly bad news about gas prices, up from 47% in November.

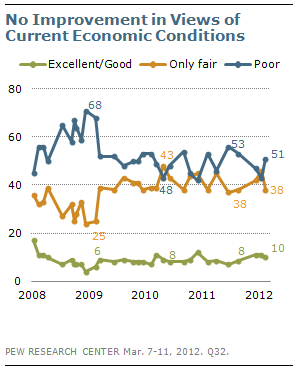

Public views of current ec

onomic conditions remain stubbornly negative. Just 10% describe the economy as excellent or good, while about nine-in-ten (89%) say conditions are only fair (38%) or poor (51%). Taken together, the negative assessments have changed little in many months.

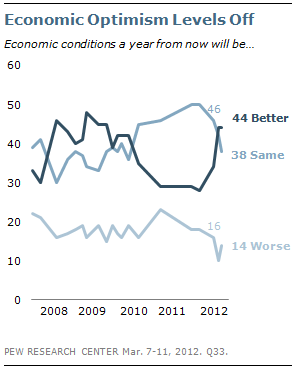

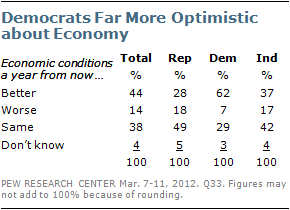

In addition, optimism about the economy, which had increased in recent months, has leveled off. Overall, 44% say they expect economic conditions

to be better a year from now, 14% say conditions will be worse, and 38% say they will be the same. That is about the same as last month. From December to February, the percentage saying they expected economic conditions to improve rose 16 points (from 28% to 44%).

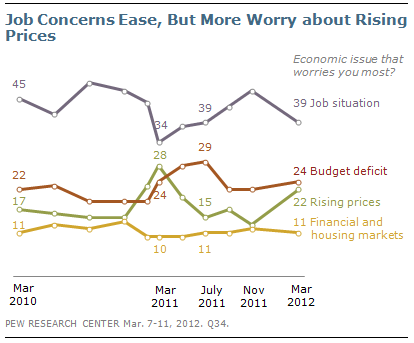

Growing concern over gas prices may be reflected in the public’s changing economic concerns. As has been the case for the past two years, a plurality of Americans (39%) say the job situation is the national economic issue that worries them most. But the percentage citing jobs has declined by eight points since November (from 47%), while the share citing rising prices has risen, from 13% then to 22% today.

In the current survey, about as many view rising prices as the top economic concern as cite the federal budget deficit (24%). Last July, nearly twice as many viewed the budget deficit than jobs as their top economic worry (29% vs. 15%).

Shifting Perceptions of Economic News

Though the public has seen more of a mix of good and bad news about the overall economy in recent months, the news about gas prices is now seen as overwhelmingly bad.

Currently, 85% say news about gas prices has been mostly bad, rivaling the percentage saying this during the run-up in fuel prices in early 2011. Just 12% now say they are hearing a mix of news about gas prices; 2% say they are hearing mostly good news.

Last March, 90% said news about gas prices had been mostly bad. But by last November, that had dropped to 47%.

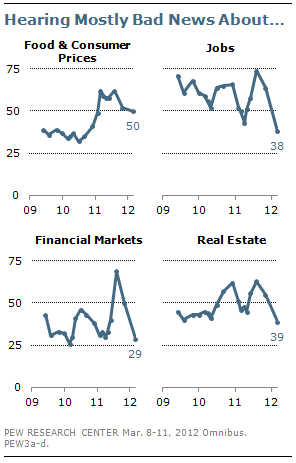

Negative perceptions of news about gas prices stand in contrast with views of news about other sectors of the economy. There have been substantial declines in the percentages hearing mostly bad news about the job situation, financial markets and real estate values. In fact, the percentages hearing mostly bad news about those sectors are among the lowest since many of these questions were first asked in 2009.

About as many now say they are hearing mixed news as mostly bad news about the job situation (42% vs. 38%); 17% say they are hearing mostly good news about jobs. That is the lowest percentage saying they are hearing mostly bad news about jobs – and the highest percentage hearing mostly good news – since the question was first asked in June 2009.

As recently as last November, 64% said the news they were hearing about the job situation was mostly bad, 28% said it was mixed and just 5% said the news was mostly good.

Views of news about financial markets also are notably more upbeat. Currently, 29% say they are hearing mostly bad news about financial markets, down from 50% in November and 69% in August. Perceptions of news about real estate values have followed a similar trajectory: 39% now say they are hearing mostly bad news about real estate values, compared with 55% in November and 63%in August.

There has been less improvement in perceptions of news about prices for food and consumer goods. In the current survey, 50% say they are hearing mostly bad news about consumer prices, 38% say the news has been mixed and just 7% say the news has been good. That is largely unchanged from November (52% mostly bad). In August, 62% said news about prices for food and consumer goods was mostly bad.

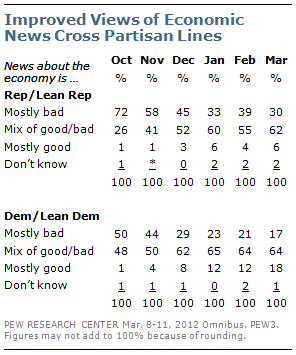

There continue to be partisan differences in perceptions of economic news generally, as well as in views of news about economic sectors. But since last fall, the percentages of both Republicans and Democrats who say economic news is mostly bad has fallen across partisan lines.

In the current survey, 30% of Republicans and Republican-leaning independents say they are hearing mostly bad news about the economy, down from 58% last November and 72% in October. The decline has been comparable among Democrats and Democratic leaners: Just 17% now say the news is mostly bad; last October, 50% expressed this view.

Partisan Differences in Views of Economy

Large majorities of Democrats (82%), independents (92%) and Republicans (96%) rate current economic conditions negatively, describing them as either only fair or poor. But Republicans are far more likely to see conditions as poor: 68% say this, compared with 54% of independents and just 35% of Democrats.

Partisans also offer sharply different assessments of how the economy is likely to fare over the next year. About half of Republicans (49%) expect economic conditions will be about the same a year from now. Nearly three-in-ten (28%) say conditions will be better, while 18% expect conditions to be worse.

Democrats are much more upbeat: 62% expect conditions to be better, 29% say they will be about the same and 7% say conditions will be worse. Among independents, 42% say conditions will be about the same, 37% say they will be better and 17% say they will be worse.

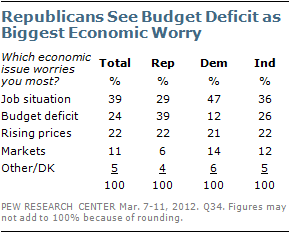

In terms of the most worrisome economic issue, Democrats and independents are most likely to cite the jobs situation (47%, 36%), while Republicans are most likely to cite the federal budget deficit (39%).

Last November, about as many Republicans cited jobs (39%) as the deficit (36%) as their top economic worry. But the percentage of Republicans citing the job situation has declined by 10 points since then while the percentage citing the deficit is unchanged. The proportion of independents citing the job situation as their top economic worry also has fallen 1o points (from 46% to 36%) since November.

Democrats’ concerns over the job situation have remained fairly steady, but their concerns over the budget deficit have fallen since last summer. In July, 24% cited the budget deficit as their top economic worry, double the percentage in the current survey (12%).

Rising prices are of particular concern to those with low family incomes. Among those with family incomes of less than $30,000, 28% cite rising prices as their top economic worry, compared with 21% among those earning between $30,000 and $74,999 and 16% among those earning $75,000 or more. Still, jobs are the top concern across all income categories.