The American Trends Panel survey methodology

Overview

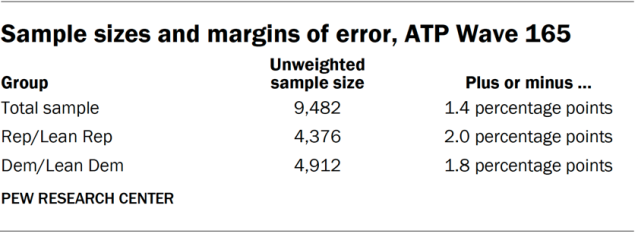

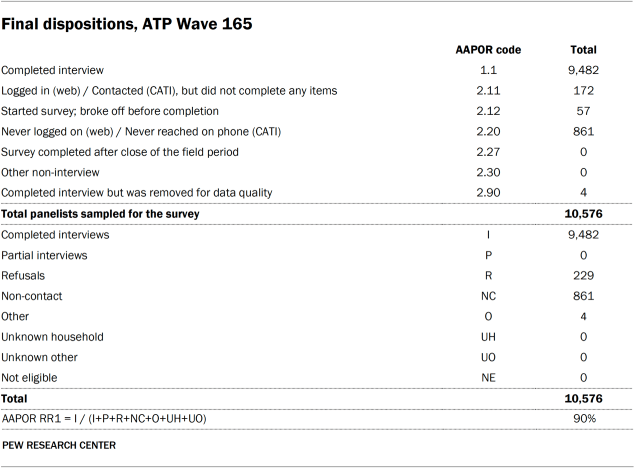

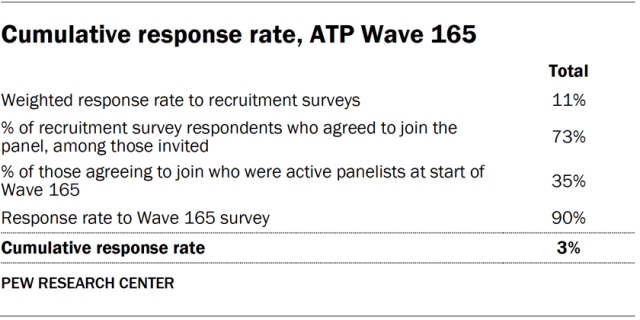

Survey data in this report comes from Wave 165 of the American Trends Panel (ATP), Pew Research Center’s nationally representative panel of randomly selected U.S. adults. The survey was conducted from March 10 to March 16, 2025. A total of 9,482 panelists responded out of 10,576 who were sampled, for a survey-level response rate of 90%.

The cumulative response rate accounting for nonresponse to the recruitment surveys and attrition is 3%. The break-off rate among panelists who logged on to the survey and completed at least one item is 1%. The margin of sampling error for the full sample of 9,482 respondents is plus or minus 1.4 percentage points.

SSRS conducted the survey for Pew Research Center via online (n=9,231) and live telephone (n=251) interviewing. Interviews were conducted in both English and Spanish.

To learn more about the ATP, read “About the American Trends Panel.”

Panel recruitment

Since 2018, the ATP has used address-based sampling (ABS) for recruitment. A study cover letter and a pre-incentive are mailed to a stratified, random sample of households selected from the U.S. Postal Service’s Computerized Delivery Sequence File. This Postal Service file has been estimated to cover 90% to 98% of the population.1 Within each sampled household, the adult with the next birthday is selected to participate. Other details of the ABS recruitment protocol have changed over time but are available upon request.2 Prior to 2018, the ATP was recruited using landline and cellphone random-digit-dial surveys administered in English and Spanish.

A national sample of U.S. adults has been recruited to the ATP approximately once per year since 2014. In some years, the recruitment has included additional efforts (known as an “oversample”) to improve the accuracy of data for underrepresented groups. For example, Hispanic adults, Black adults and Asian adults were oversampled in 2019, 2022 and 2023, respectively.

Sample design

The overall target population for this survey was noninstitutionalized persons ages 18 and older living in the United States. All active panel members were invited to participate in this wave.

Questionnaire development and testing

The questionnaire was developed by Pew Research Center in consultation with SSRS. The web program used for online respondents was rigorously tested on both PC and mobile devices by the SSRS project team and Pew Research Center researchers. The SSRS project team also populated test data that was analyzed in SPSS to ensure the logic and randomizations were working as intended before launching the survey.

Incentives

All respondents were offered a post-paid incentive for their participation. Respondents could choose to receive the post-paid incentive in the form of a check or gift code to Amazon.com, Target.com or Walmart.com. Incentive amounts ranged from $5 to $20 depending on whether the respondent belongs to a part of the population that is harder or easier to reach. Differential incentive amounts were designed to increase panel survey participation among groups that traditionally have low survey response propensities.

Data collection protocol

The data collection field period for this survey was March 10 to March 16, 2025. Surveys were conducted via self-administered web survey or by live telephone interviewing.

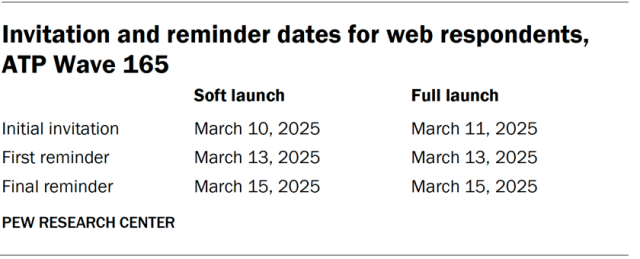

For panelists who take surveys online:3 Postcard notifications were mailed to a subset on March 10.4 Survey invitations were sent out in two separate launches: soft launch and full launch. Sixty panelists were included in the soft launch, which began with an initial invitation sent on March 10. All remaining English- and Spanish-speaking sampled online panelists were included in the full launch and were sent an invitation on March 11.

Panelists participating online were sent an email invitation and up to two email reminders if they did not respond to the survey. ATP panelists who consented to SMS messages were sent an SMS invitation with a link to the survey and up to two SMS reminders.

For panelists who take surveys over the phone with a live interviewer: Prenotification postcards were mailed on March 7. Soft launch took place on March 11 and involved dialing until a total of four interviews had been completed. All remaining English- and Spanish-speaking sampled phone panelists’ numbers were dialed throughout the remaining field period. Panelists who take surveys via phone can receive up to six calls from trained SSRS interviewers.

Data quality checks

To ensure high-quality data, Center researchers performed data quality checks to identify any respondents showing patterns of satisficing. This includes checking for whether respondents left questions blank at very high rates or always selected the first or last answer presented. As a result of this checking, four ATP respondents were removed from the survey dataset prior to weighting and analysis.

Weighting

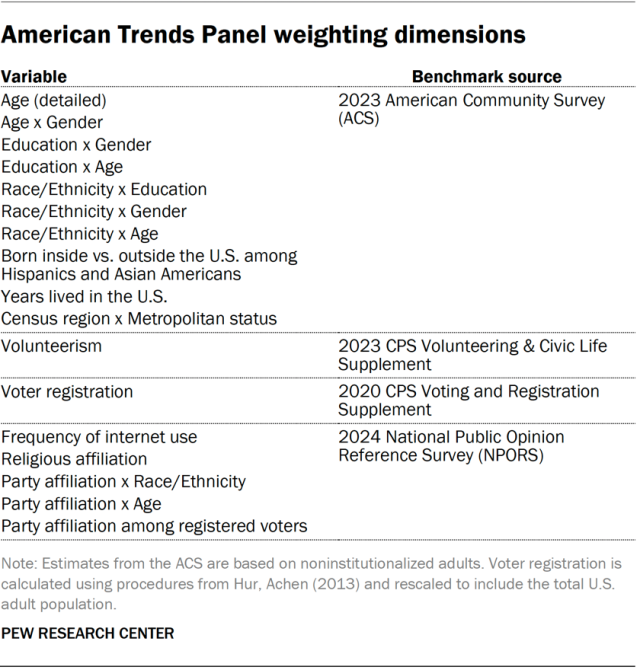

The ATP data is weighted in a process that accounts for multiple stages of sampling and nonresponse that occur at different points in the panel survey process. First, each panelist begins with a base weight that reflects their probability of recruitment into the panel. These weights are then calibrated to align with the population benchmarks in the accompanying table to correct for nonresponse to recruitment surveys and panel attrition. If only a subsample of panelists was invited to participate in the wave, this weight is adjusted to account for any differential probabilities of selection.

Among the panelists who completed the survey, this weight is then calibrated again to align with the population benchmarks identified in the accompanying table and trimmed at the 1st and 99th percentiles to reduce the loss in precision stemming from variance in the weights. Sampling errors and tests of statistical significance take into account the effect of weighting.

The following table shows the unweighted sample sizes and the error attributable to sampling that would be expected at the 95% level of confidence for different groups in the survey.

Sample sizes and sampling errors for other subgroups are available upon request. In addition to sampling error, one should bear in mind that question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of opinion polls.

Dispositions and response rates

Selection of news sources

We limited ourselves to 30 news sources in this survey to avoid putting an undue burden on survey respondents, who may have trouble processing an even longer list. We used a variety of criteria, such as web traffic, TV ratings and the results of previous surveys that indicated people’s main sources for news, to make decisions about which sources to include among the 30.

We also set out to ask about a range of sources across different platforms (e.g., internet, television, print, radio, and new media like podcasts and social media). Relatedly, we wanted to capture different elements of the information environment, such as both legacy news outlets and newer, nontraditional news sources.

The sources include:

- News divisions of the three major broadcast commercial television networks (ABC News, CBS News, NBC News)

- Three major cable TV news networks (CNN, Fox News Channel and MSNBC)

- Two major Spanish-language TV networks (Univision, Telemundo)

- Two major public broadcast radio or TV networks (NPR and PBS)

- Four of the largest newspapers by U.S. national circulation, according to a Pew Research Center analysis of Alliance for Audited Media data for the third quarter of 2024 (The New York Times, The Washington Post, The Wall Street Journal and the New York Post)

- Four outlets named by at least 0.5% of respondents in a 2024 open-ended question asking about respondents’ main source for election news (Newsmax, BBC News, The Daily Wire, The Associated Press)

- One outlet named in the 2024 election main source open end that also was recently given office space at the Pentagon (Breitbart)

- The most-named podcast in a 2022 open end asking about the primary podcast Americans listen to the most (The Joe Rogan Experience)

- One source named in a 2024 survey asking what news influencer first comes to mind for Americans who regularly get news from news influencers, who also has comparatively high social media follower counts (Tucker Carlson Network)

- Seven news websites, regardless of their original platform, that primarily cover general or political news and had comparatively high numbers of U.S. unique visitors during the second and third quarters of 2024, according to Comscore Media Metrix® Multi-Platform data (USA Today, HuffPost, Newsweek, Politico, The Hill, The Atlantic and Axios)

- One international news website with the highest number of U.S. unique visitors during the second and third quarters of 2024, according to Comscore (The Guardian)

- One business news website with the highest number of U.S. unique visitors during the second and third quarters of 2024, according to Comscore (Forbes)

Questions asked about news sources

First, respondents were shown a list of 30 sources, including their logos, and asked to select the sources that they had heard of. They were then shown a list of the sources they indicated they had heard of and asked to select those they generally trusted as a source of news. They were then shown a list of sources that they had heard of, but did not say they trusted, and asked to select those they generally distrusted as a source of news. Finally, they were shown the list of all of the sources they had heard of and asked to select those that they regularly get news from. Refer to the questionnaire for exact question wording.

Calculating each news source’s trust ratio

Some graphics in the report and the data tool visualizing trust and distrust in each news source use a trust ratio. If the share of respondents who said they trusted the news source was greater than the share who said they distrusted the source, the ratio was calculated as trust divided by distrust. If the share who said they distrusted the source was greater than the share who trusted the source, the ratio was calculated as a negative distrust value divided by the trust value, so that a source may be “__ times more trusted than distrusted” or “__ times more distrusted than trusted.”

Average placement of news sources by audience party and ideology

The average audience placement of each of the 30 news sources in a number line is based on an index of respondents’ self-reported party identification (or those who lean toward either party) and political ideology. Each respondent was assigned a value on an eight-point index based on their responses to questions about their party identification and political ideology. The placement of each source’s audience is based on the average index value of U.S. adults who report regularly getting news from each source. The number values in the index (from left to right) are:

- 1 = Very liberal Democrat/lean Democrat

- 2 = Liberal Democrat/lean Democrat

- 3 = Moderate Democrat/lean Democrat

- 4 = Very conservative or conservative Democrat/lean Democrat

- 5 = Very liberal or liberal Republican/lean Republican

- 6 = Moderate Republican/lean Republican

- 7 = Conservative Republican/lean Republican

- 8 = Very conservative Republican/lean Republican