The rates for government-backed student loans — known as Stafford loans — are set to double today after lawmakers on Capitol Hill failed to reach a compromise for heading off the increase. An estimated 7.4 million university students will be affected and the added cost for the average borrower will be $2,600 over 10 years, according to the congressional Joint Economic Committee.

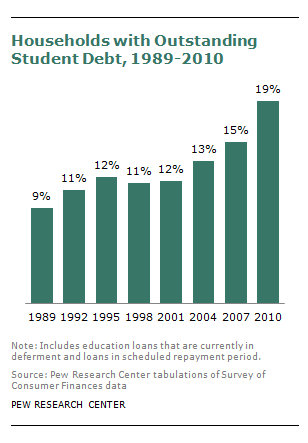

The weight of debt from college loans has already made a substantial impact on U.S. households. A Pew Research Center analysis of government data that became available last year found that 19% of the nation’s households owed student debt in 2010, more than double the share two decades earlier, and a significant rise from the 15% that owed such debt in 2007, just prior to the onset of the Great Recession.

A record 40% of all households headed by someone younger than age 35 owed such debt, by far the highest share among any age group, the analysis also found.

As of 2010, the average outstanding student loan balance increased to $26,682 in 2010 from $23,349 in 2007 among households owing student debt. Most debtor households had less than $50,000 in outstanding student debt in 2010, but the share of households owing elevated amounts has increased. In 2007, 10% of student debtors owed more than $54,238. By 2010, 10% of student debtor households owed more than $61,894 (all dollar figures adjusted for inflation and in 2011 dollars). Read more