Amid reports of the Great Resignation, Pew Research Center conducted this study to better understand the experiences of individual workers who switched employers in any given month from January 2019 to March 2022.

Part of the study is based on the analysis of monthly Current Population Survey (CPS) data from January 2019 to March 2022. The CPS is the U.S. government’s official source for monthly estimates of unemployment. About three-quarters of the people interviewed in one month of the CPS are also interviewed in the next month, and about half of the people interviewed in one year are also interviewed in the same month the next year. The analysis exploits these features to study the monthly transitions of individual workers from, say, employment to unemployment, and to examine the changes in their earnings from one year to the next.

Another part of the study is based on a nationally representative survey of U.S. adults conducted by Pew Research Center from June 27 to July 4, 2022, using the Center’s American Trends Panel. The survey encompassed 6,174 adults, including 3,784 employed adults.

The COVID-19 outbreak affected data collection efforts by the U.S. government in its surveys, especially in 2020 and 2021, limiting in-person data collection and affecting the response rate. It is possible that some measures of economic outcomes and how they vary across demographic groups are affected by these changes in data collection.

“Employer switchers” or “job switchers” are workers who were employed in two consecutive months but report having changed employers. The switch may have happened voluntarily or involuntarily. Some of these workers may have been unemployed for up to four weeks in the transition from one job to the next.

“Unemployed” refers to workers who are currently without a job but are actively seeking work. “Not in labor force” refers to workers who are neither employed nor actively looking for work. This group includes those who are retired, as well as workers who intend to return to the labor force sometime in the future.

White, Black and Asian adults include those who report being only one race and who are not Hispanic. Hispanics are of any race. Other racial and ethnic groups are included in all totals but are not shown separately.

“High school graduate” refers to those who have a high school diploma or its equivalent, such as a General Education Development (GED) certificate, and those who had completed 12th grade, but their diploma status was unclear (those who had finished 12th grade but not received a diploma are excluded). “Some college” include workers with an associate degree and those who attended college but did not obtain a degree.

“Real earnings” refers to earnings adjusted for inflation.

The Great Resignation of 2021 has continued into 2022, with quit rates reaching levels last seen in the 1970s. Although not all workers who leave a job are working in another job the next month, the majority of those switching employers are seeing it pay off in higher earnings, according to a new Pew Research Center analysis of U.S. government data.

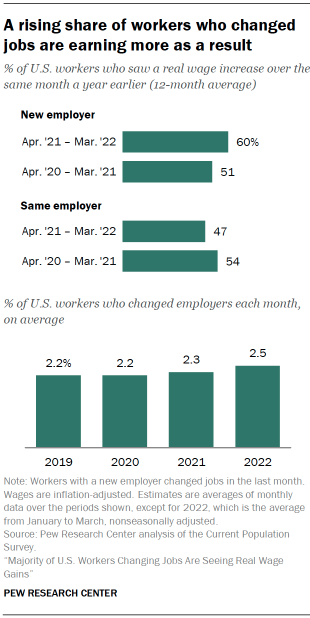

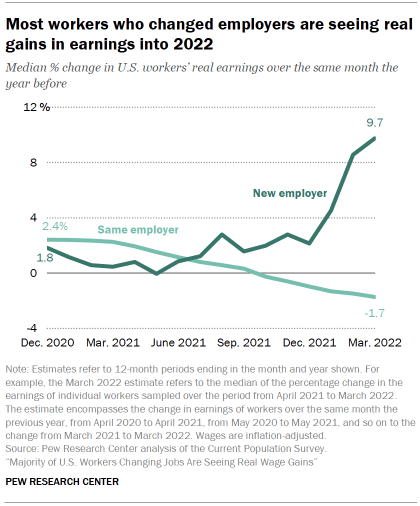

From April 2021 to March 2022, a period in which quit rates reached post-pandemic highs, the majority of workers switching jobs (60%) saw an increase in their real earnings over the same month the previous year. This happened despite a surge in the rate of inflation that has eroded real earnings for many others. Among workers who remained with the same employer, fewer than half (47%) experienced an increase in real earnings.

Overall, 2.5% of workers – about 4 million – switched jobs on average each month from January to March 2022. This share translates into an annual turnover of 30% of workers – nearly 50 million – if it is assumed that no workers change jobs more than once a year. It is higher than in 2021, when 2.3% of workers switched employers each month, on average. About a third (34%) of workers who left a job from January to March 2022 – either voluntarily or involuntarily – were with a new employer the following month.

When it comes to the earnings of job switchers, the share finding higher pay has increased since the year following the start of the pandemic. From April 2020 to March 2021, some 51% of job switchers saw an increase in real earnings over the same months the previous year. On the other hand, among workers who did not change employers, the share reporting an increase in real earnings decreased from 54% over the 2020-21 period to 47% over the 2021-22 period. Put another way, the median worker who changed employers saw real gains in earnings in both periods, while the median worker who stayed in place saw a loss during the April 2021 to March 2022 period.1 Perhaps not coincidentally, Americans cited low pay as one of the top reasons why they quit their job last year in a Pew Research Center survey conducted in February 2022.

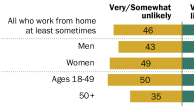

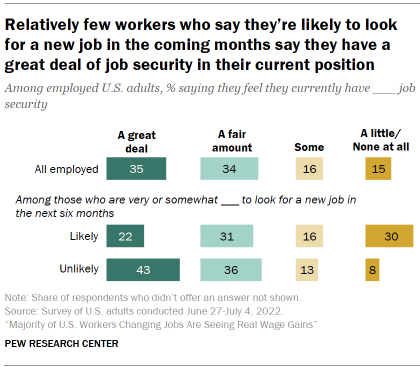

A new Pew Research Center survey finds that about one-in-five workers (22%) say they are very or somewhat likely to look for a new job in the next six months. And despite reports of widespread job openings, 37% of workers say they think finding a new job would be very or somewhat difficult. Workers who feel they have little or no job security in their current position are among the most likely to say they may look for new employment: 45% say this, compared with only 14% of those who say they have a great deal of security in their job. Similarly, those who describe their personal financial situation as only fair or poor are about twice as likely as those who say their finances are excellent or good to say they’d consider making a job change (29% vs. 15%).

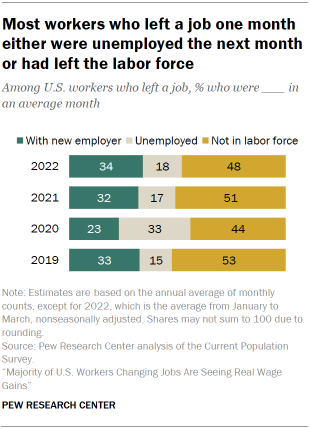

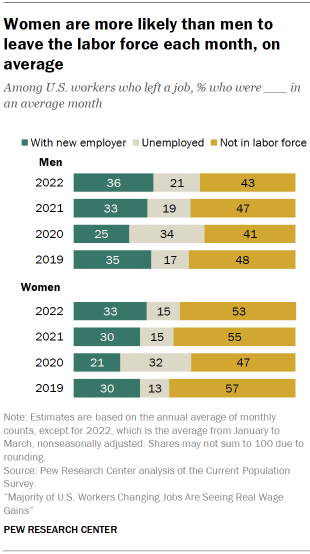

Among workers leaving a job between 2019 and the first quarter of 2022, the majority were either unemployed the next month or had left the labor force and were, at least temporarily, not actively seeking work. Except for in 2020, between 15% and 18% of workers who left a job one month were unemployed the next month and 48% to 53% had left the labor force. In 2020, the year the coronavirus pandemic began, a third (33%) of workers who left a job were still unemployed the next month, reflecting the impact of the COVID-19 recession.

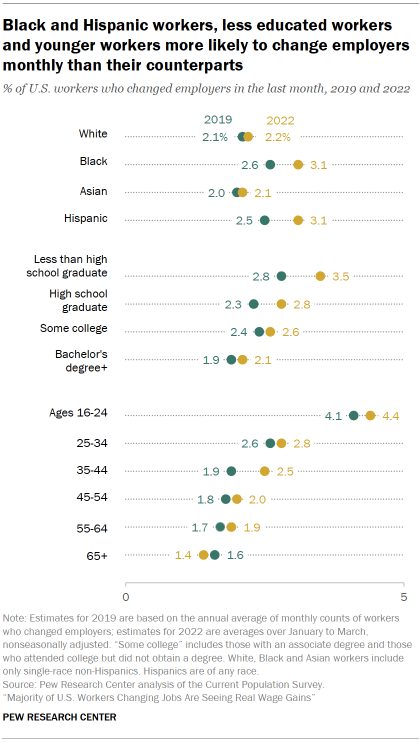

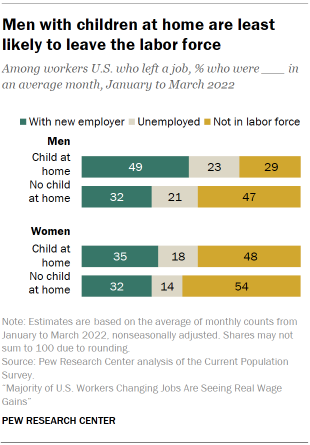

Looking across key demographic groups, Black and Hispanic workers, workers without a high school diploma and young adults are more likely to change jobs in any given month. About half of job switchers also change their industry or occupation in a typical month, but this share has not changed since 2019. Women who leave a job are more likely than men who leave a job to take a break from the labor force, and men with children at home are least likely to do the same.

These findings emerge in part from the Pew Research Center’s analysis of monthly Current Population Survey (CPS) data from January 2019 to March 2022. The CPS is the U.S. government’s official source for monthly estimates of unemployment. In principle, about three-quarters of the people interviewed in one month of the CPS are also interviewed in the next month. Similarly, about half of the people interviewed in one year are scheduled for interviews in the next year. Much of the analysis exploits these features to study the monthly transitions of workers from, for example, employment to unemployment, and to examine the changes in their earnings from one year to the next.

The report also draws on findings from a nationally representative survey of 6,174 U.S. adults, including 3,784 employed adults. The survey was conducted June 27 to July 4, 2022, using the Center’s American Trends Panel. See the methodology for more details.

The U.S. government’s job quits rate

The “quits rate,” reported by the U.S. Bureau of Labor Statistics (BLS) each month, is a measure of voluntary departures from employment. Workers who retired or transferred to another location are excluded from the quits rate but are included among “other separations” from employment. In addition, workers are classified as having been discharged or laid off, separating from their jobs involuntarily.

The quits rate stood at 2.8% in May 2022, up from a recent low of 1.6% in April 2020, seasonally adjusted. The increase since 2019 – when the quits rate averaged 2.3% for the year – is less sizable. The overall job separations rate stood at 3.9% in May 2022, about the same as a pre-pandemic average of 3.8% in 2019.

Not all workers who quit a job voluntarily one month are employed the next month. Based on its survey of business establishments, the BLS estimates roughly 4 million workers had quit their jobs each month in 2022. Separately, based on the Current Population Survey (CPS), a survey of households, the BLS reports that roughly 800,000 workers who were unemployed in an average month in 2022 were job leavers. Although these two estimates are based on different universes, they suggest that a substantial share of workers who voluntarily quit their jobs are unemployed, at least temporarily. Yet others may be taking a break from work.

The measures used in this report

This report focuses on three groups of workers who have seen a change in their employment status since the previous month. One group consists of workers who changed employers. They had jobs in both time periods but made a switch, whether voluntarily or involuntarily. It is possible that some of these workers were unemployed for up to four weeks in the transition from one job to the next. This group differs from the universe for the quits rate for two reasons: It includes involuntary departures, but it excludes those who were either unemployed or not seeking work the next month.

The second group of workers in the report consists of those who separated from employment but were still unemployed the next month. The third group is comprised of workers who were not seeking work in the month following a job separation. They are not necessarily retired and may return to work later.

The estimates in this report are derived from the CPS, whereas the official quits and separation rates are based on a survey of establishments. There are several differences between these two surveys, including the fact that only the CPS encompasses the unincorporated self-employed, unpaid family workers, agricultural workers and private household workers.

Black and Hispanic workers, workers with no college education and younger workers are more likely to change jobs in any given month

The rate at which workers switch jobs on average each month has seen its ups and downs since 2019. The turnover rate in the first quarter of 2022 (2.5%) was higher than in mid-2020, when the monthly rate had dropped to 1.9% during the COVID-19 downturn. However, it is similar to the rate that prevailed in the first quarter of 2019 (2.3%).2

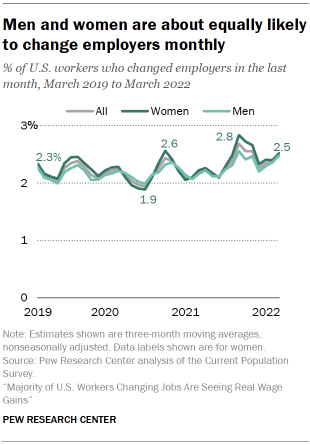

Men and women changed employers monthly over the 2019-2022 period at a roughly comparable rate. Starting at 2.3% in the first quarter of 2019 for each, the monthly turnover across employers for men and women hit a low near 1.9% in mid-2020. Subsequently, the rate neared a peak for both women (2.8%) and men (2.6%) in the third quarter of 2021. In the first quarter of 2022, the shares of men and women who had changed employers in the last month both stood at 2.5%.

The presence of children at home is also not related to the shares of men and women changing employers. In the first quarter of 2019, the monthly rates for men and women with children at home stood at 2.1% and 2.2%, respectively. In the first quarter of 2022, the rates for these two groups of parents stood at 2.3% each.

Among the major racial and ethnic groups, Hispanic and Black workers are more likely to switch employers than White and Asian workers. In 2019, 2.6% of Black workers and 2.5% of Hispanic workers moved from one employer to another on average each month, compared with 2.1% of White workers and 2.0% of Asian workers. Moreover, while the likelihood of changing employers increased among Hispanic workers from 2019 to 2022 – to 3.1% – it remained about the same among White and Asian workers.

There is also a clear pattern across workers of different levels of education. Less educated workers are more transient, with workers without a high school diploma moving across employers at a monthly rate of 3.5% in 2022, up from 2.8% in 2019. Workers with a bachelor’s degree or higher level of education switched at a rate of 2.1%, about the same as in 2019.

Similarly, young adults (ages 16 to 24) are more likely than older workers to change employers in an average month. Young adults moved across employers at a monthly rate of 4.1% in 2019 and 4.4% in 2022. Workers nearing retirement (ages 55 to 64) moved at a rate of 1.9% in 2022.

Workers who move from one employer to another in the space of a month may experience unemployment in the interim, especially those whose departure was involuntary. Thus, one possible factor behind the patterns observed among demographic groups is how the unemployment rate varies across groups. Historically, there is little difference in the unemployment rate between men and women. However, compared with their counterparts, Black and Hispanic workers, less educated workers, and younger workers tend to experience higher rates of unemployment through all stages of the business cycle, whether through voluntary or involuntary separations from their previous jobs. As a result, relatively higher shares of these workers are on the lookout for new job opportunities at any point in time or have switched jobs from one month to the next.

Workers who changed jobs saw higher wage growth than other workers following the COVID-19 downturn

After increasing by only 1.4% from December 2019 to December 2020, U.S. consumer prices surged by 7.0% from December 2020 to December 2021. The pace has only picked up since then. As a result, the share of workers overall experiencing an increase in real earnings – over and above inflation – fell from 54% over the April 2020-March 2021 period to 47% over the April 2021-March 2022 period.

Considered another way, half of U.S. workers sampled in the April 2020-March 2021 period saw a real wage gain of 2.3% or higher, compared with the same month the year before. The other half either experienced a gain of less than 2.3% or saw their earnings decrease. But the script flipped a year later, with half of the workers experiencing a real wage loss of 1.6% or more over the April 2021- March 2022 period. Thus, the median worker in the U.S. has not fared well financially in the current inflationary environment.

However, most workers who switched employers continued to experience an increase in real earnings, and amid a surge in demand for new hires, their advantage over other workers in this respect appears to be widening.

From January to December 2020, half of the workers who changed employers in some month that year experienced a wage increase of 1.8% or more, and half of the workers who stayed put saw an increase of 2.4% or more, compared with their wages in January to December 2019. The next year, from January to December 2021, the median worker among those who changed employers saw a wage increase of 2.1%, and the median worker who did not switch employers saw a loss of 1.0%. From April 2021 to March 2022, half of the workers who changed jobs experienced a real increase of 9.7% or more over their pay a year earlier. Meanwhile, the median worker who remained in the same job experienced a loss of 1.7%.

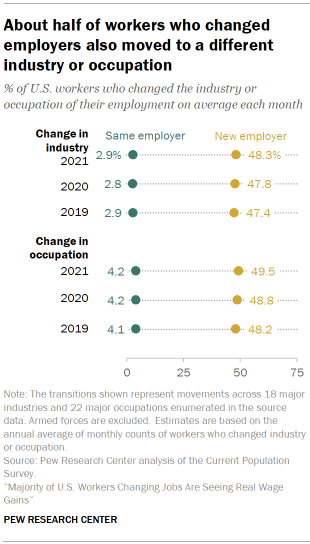

Workers often change industry or occupation as they move from one employer to another

Wages are not all that change for workers moving across employers; many often change the industry or occupation in which they are working as they move from one employer to the next. From 2019 to 2021, about 48% of workers who changed employers also found themselves in a new industry, on average each month – a pattern undisturbed by the pandemic. Because large firms may operate in more than one industry, workers who did not change employers are not entirely lacking in this opportunity. But only about 3% of these workers moved from one industry to another in a typical month.

A similar pattern played out with respect to changes in occupation. Roughly half (49.5%) of workers who changed employers also changed occupations in an average month from 2019 to 2021. Some 4% of workers not changing employers experienced a change in occupation, an opportunity that may present itself through training or career progression within the same establishment or firm.

Overall, about 4% of all workers changed industries in an average month from 2019 to 2021. In 2021, the average rate at which workers left an industry for another in a single month varied from 2.2% in Educational Services to 5.8% in Social Services. The rates of departure from Hospitals and Other Health Services and Public Administration (about 3% or less) were also relatively low, and exits from Repair and Maintenance Services, Personal and Laundry Services/Private Household Services, and Arts and Entertainment (about 5% or higher) were relatively elevated. This general pattern was also present in 2019 and 2020.

About 5% of workers overall switched occupations in 2021. The share of workers leaving an occupation in a typical month in 2021 tended to be lower in professional occupations, such as Education, Instruction and Library Occupations and Legal Occupations (about 3% each), and relatively higher in more blue-collar jobs, such as Transportation and Material Moving, Production, and Farming, Fishing and Forestry Occupations (about 6% or higher). A similar pattern prevailed in 2019 and 2020.

Among workers who quit or lose a job one month, women are more likely than men to leave the labor force by the next month

In addition to workers who successfully transition from one employer to another within a month there are workers who are left unemployed and others who opt to leave the labor force. The latter two groups combined outnumber those moving from job to job.

From January to March 2022, about 9 million workers separated from their place of employment each month, on average. This included 3.1 million workers (34%) who were on the job with a different employer the next month. An additional 1.6 million workers (18%) were unemployed and looking for a new job, and 4.3 million (48%) had left the labor force, at least temporarily.

A similar pattern had existed in 2019 and 2021, when only about a third of workers who left employment one month were at work the next month, on average. In 2020, the year the pandemic struck and forced widespread business closures, only 23% of workers who left employment one month were at a new job within a month. About a third (33%) were still looking for a job, roughly double the shares in 2019, 2021 and 2022.

Among workers separating from employment in any given month, women are more likely than men to leave the labor force by the next month. For example, in 2021, 2.5 million women and 2.1 million men left the labor force on average each month. This represented 55% of women and 47% of men who separated from their previous place of employment.

The departure of workers from the labor force is balanced by the return or the new entry of workers into the labor force. From January to March 2022, some 2.9 million women and 2.5 million men entered the labor force each month, on average.

Overall, a greater number of women than men tend to enter or exit the labor force in an average month. To some extent, this is likely driven by the demands of childbirth. But women also generally devote more time than men to familial duties, whether caring for children or on household activities, and are more likely to adapt their careers to care for family.

Among workers with children at home who leave employment in any month, there is a significant gap between men and women in the shares that opt to leave the labor force. About half (48%) of women with children at home did so on average from January to March 2022, compared with 29% of men with children at home. Men with no children at home are also more likely than men with children at home to exit the labor force monthly. That is, in part, due to the fact that adults with no children at home are older on average, encompassing many of the workers nearing retirement age.

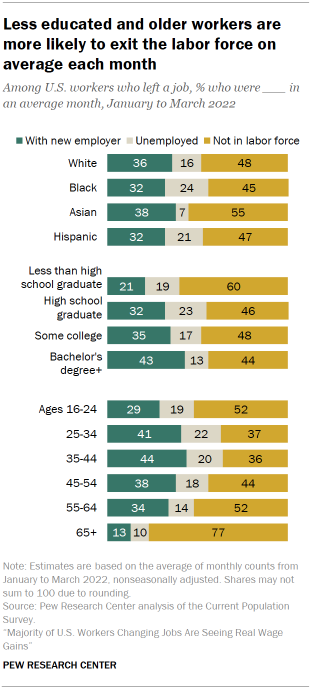

Among racial and ethnic groups, Asian workers leaving employment one month are less likely than other workers to still be unemployed the next month. On average from January to March 2022, only 7% of Asian workers were unemployed the month following a job separation compared with 24% of Black workers, 21% of Hispanic workers and 16% of White workers.

Workers with at a least a high school diploma are less likely to exit the labor force and more likely to be with a new employer a month after leaving a job compared with their counterparts. Among workers who did not receive a high school diploma, 60% of those who left employment one month had left the labor force by the next month and only 21% were reemployed. On the other hand, among workers with a bachelor’s degree or higher level of education, 43% were reemployed the next month, about the same as the share (44%) that left the labor force.

Not surprisingly, a large share (77%) of workers ages 65 and older – the traditional retirement age bracket – exit the labor force monthly. About half of young adult workers (ages 16 to 24) and those nearing retirement (ages 55 to 64) also exit the labor force monthly upon separation from employment. Among adults in the prime of their working years (ages 25 to 54), 38% to 44% are reemployed within a month, about the same as the share that step away from the labor force.

Roughly one-in five workers say they’re likely to look for a new job in the next six months

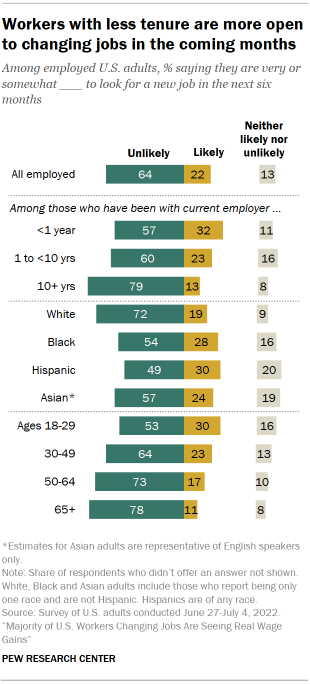

While most workers have no near-term plans to leave their jobs, 22% say they are very or somewhat likely to look for a new job in the next six months. Most (64%) say they are very or somewhat unlikely to look for a new job in the coming months.

Workers who have been with their employer for less than a year are significantly more likely than those who’ve been in their current job longer to say they’re likely to look for a new job in the next six months. About a third (32%) of those who’ve been in their job for less than a year say this, including 20% who say they are very likely to seek a new job. Among those who’ve been with their current employer between one and 10 years, 23% say they’re very or somewhat likely to look for a new job; 13% who’ve been in their job longer say the same.

The likelihood of changing jobs in the near future also differs across key demographic groups. Higher shares of Black (28%) and Hispanic (30%) workers, compared with White workers (19%), say they are very or somewhat likely to look for a new job in the next six months. About a quarter of Asian workers (24%) say the same. And younger workers are more likely than middle-aged and older workers to say this: 30% of workers ages 18 to 29 say they are likely to look for a new job in the next six months, compared with 23% of workers ages 30 to 49, 17% of those ages 50 to 64 and 11% of those 65 and older. This is related to the fact that younger workers are by far the most likely to have been with their current employer for less than a year.

The share who say they are likely to look for a new job in the coming months does not differ significantly by educational attainment.

Workers who are more downbeat about their own financial situation are more likely to say they may make a job change. Among those who describe their current financial situation as only fair or poor, 29% say they are likely to look for a new job in the next six months. Only 15% of those who rate their financial situation as excellent or good say the same.

Roughly four-in-ten workers say it would be easy to find a new job if they looked today

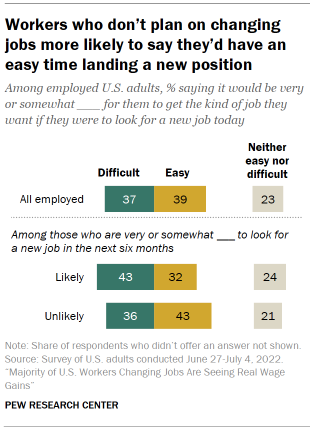

Workers are split over how easy or difficult it would be for them to get the kind of job they’d want if they were to look for a new job today. About four-in-ten (39%) say it would be very or somewhat easy, while a similar share (37%) say it would be very or somewhat difficult. About a quarter (23%) say it would be neither easy nor difficult for them to get the kind of job they want if they were looking right now.

Workers who aren’t actually intending to look for a new job soon are more likely than those who are to say it would be easy for them to find one. Among those who say it’s unlikely they will look for a job in the next six months, 43% say it would be easy for them to get the kind of job they want if they were looking today. Among those who say they are likely to look for another job soon, 32% say the same.

Upper-income workers are significantly more likely than middle- and lower-income workers to say they’d have an easy time finding a job if they were looking today. Fully half of upper-income workers say it would be easy for them to find the kind of job they wanted, compared with 38% of middle-income workers and 34% of those with lower incomes.3

Perceived job security is linked with likelihood of looking for a new job

Most workers feel they have at least a fair amount of job security in their current position. About a third (35%) say they have a great deal of job security, and a similar share (34%) say they have a fair amount. Smaller shares say they have some (16%) or a little (9%) job security, and 6% say they have none at all.

Job security is more tenuous for those workers who say they’re likely to look for a new job in the next six months. Only 22% of these workers say they have a great deal of job security in their current position. By contrast, among those who say it’s unlikely they’d look for a job in the coming months, 43% say they have a great deal of security in their current job.

Workers who’ve been with their current employer for 10 years or longer are among the most likely to say they have a great deal of job security: 46% say this, compared with about a third (32%) of those who’ve been with their employer between one and 10 years and 26% who’ve been with their employer less than a year. There are wide differences by income as well: 51% of upper-income workers say they have a great deal of job security, compared with 35% of middle-income workers and 25% of those with lower incomes.