Overview

The record generation gap that played out at the voting booth in the last two presidential elections is echoed by large differences by age in attitudes about the tradeoff between reducing the federal deficit and preserving entitlements for older adults, according to a new nationwide Pew Research Center survey.

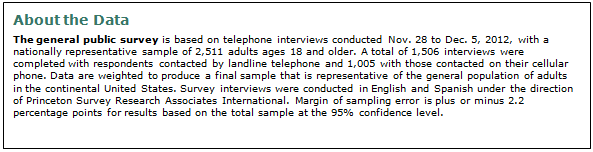

Older adults by a lopsided margin (66%-21%) say that protecting Social Security and Medicare benefits is more important than reducing the federal budget deficit. Younger adults are much more evenly divided on the subject, with 48% saying that the programs for older adults are the higher priority and 41% saying deficit reduction.

The age differences are even more pronounced in response to a survey question about whether the federal government should give a higher priority to programs that benefit older adults or younger adults. Respondents ages 65 and older choose the former by a three-to-one ratio; adults ages 18 to 29 choose the latter by a three-to-two ratio.

In effect, each age group endorses priorities that reflect its generational self-interest. But to do so, each generation–especially older adults–takes a position on these young vs. old policy questions that runs contrary to its broader beliefs about the proper role of government. In general, older adults favor a government that is smaller both in size and scope, while young adults want to see a bigger government that takes on more problems.

The National Exit Poll conducted on Election Day asked voters which came closest to their view: Government should do more to solve problems, or government is doing too many things better left to businesses and individuals. Voters ages 18 to 29 lean heavily toward a more activist government. Roughly six-in-ten (59%) say government should do more to solve problems while only 37% say government is doing too much. By contrast, only about one-third of voters ages 65 and older (35%) favor a more activist government, while a majority (58%) say government should do less.

In spite of these wide gaps between young and old in policy views, the new survey, which was conducted Nov. 28 to Dec. 5, 2012, finds no indication of a broader generational war. Relatively few adults of any age group (28% overall) perceive strong conflicts between young people and older people. In fact, generational conflict ranks at the bottom of a list of potential group conflicts in the U.S. Conflicts between Democrats and Republicans, rich and poor, immigrants and non immigrants and blacks and whites are judged to be much more acute.

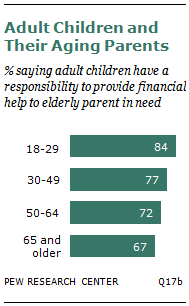

And within families, intergenerational commitments remain strong. The vast majority (84%) of adults ages 18 to 29 say adult children have a responsibility to provide financial assistance to an elderly parent if he or she needs it. And nearly six-in-ten (58%) say it is very likely that, at some point in the future, they will be responsible for caring for an aging parent or another elderly family member.

To be sure, young adults worry about the long-term financial impact if changes are not made to Social Security and Medicare. Fully half (52%) of those ages 18 to 29 say that keeping the benefits from these programs at their current levels will place too much of a financial burden on younger generations. Only about one-third (35%) of adults ages 65 and older agree.

But the young are no more likely than other age groups to embrace potential reforms to these programs that might ease the future financial burden. Solid majorities of young, middle-aged and older adults favor increasing payroll taxes on higher income earners to raise revenues for Social Security. Similarly, the idea of reducing Social Security and Medicare benefits for higher-income seniors is broadly popular across age groups. However, when it comes to increasing the age at which adults become eligible for Social Security, a proposal that does not receive majority support overall, older adults are more supportive than any other age group.

The intersection of politics and generation is complicated on these issues. Young adults tend to be the most Democratic in terms of their party identification, and they voted for Barack Obama over Mitt Romney in the 2012 presidential election by a 60%-to-37% margin. Older Americans voted for Romney over Obama by a 56%-to-44% margin. The age gap in voting in the 2008 presidential election between Obama and John McCain was even wider, as 66% of voters younger than 30 supported Obama compared with 45% of voters 65 and older.

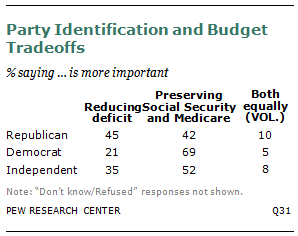

In spite of their strong leaning to Obama and the Democratic Party, the views of young adults line up more closely with those of Republicans when they are asked what is more important: taking steps to reduce the federal budget deficit or keeping Social Security and Medicare benefits as they are. Republicans are evenly divided over this, as are young adults: 45% of Republicans say deficit reduction is more important while 42% choose preserving benefits. Independents and Democrats, on the other hand, strongly favor maintaining entitlement benefits at their current levels over reducing the deficit.

Old and Young Competing for Limited Federal Dollars

The proper role and scope of government was the subject of heated debate in the recent presidential election. The public has grown more skeptical about the government’s reach in this era of weak economic growth and strained resources. Still, there is majority support for government intervention on behalf of the neediest citizens. In the current survey, 57% of respondents agreed that it is the responsibility of government to take care of those who can’t take care of themselves, 37% disagreed.

There is broad agreement across age groups on this issue. Among those younger than 30, 60% agree the government has the responsibility to care for those who need assistance. Some 58% of those ages 30 to 64 agree with this as do 54% of those ages 65 and older. Roughly one-in-five from each age group completely agrees that the government has this responsibility.

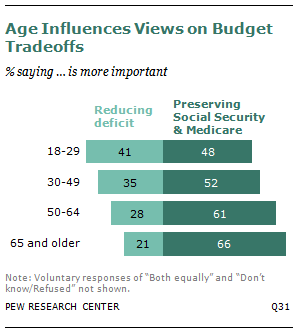

In allocating its resources, the public clearly believes the government should give a higher priority to programs that benefit older adults (47%) rather than those that benefit younger adults (27%), although a significant share (17%) volunteers that both types of programs are equally important.

Adults younger than 30 have much different views on this issue than do their older counterparts. Only 34% of those ages 18 to 29 say programs that benefit older adults should be given a higher priority. This compares with 47% of those ages 30 to 49, and 48% of those ages 65 and older. Adults ages 50 to 64, most of whom are part of the Baby Boom generation, are more likely than any other age group to say the government should concentrate its resources on programs that benefit older adults. Fully 59% say these programs should be a higher priority, while only 15% say programs that benefit younger adults should be given a higher priority. Many in this age group have parents who are currently relying on these programs (56% have at least one living parent ages 65 or older),1 and many are on the cusp of retirement themselves.

There are also significant differences by race. By about a two-to-one margin (50%-24%) whites believe programs that benefit older adults, rather than young adults, should be given a higher priority. Blacks are more evenly divided. Four-in-ten say programs that benefit older adults should be given higher priority, 33% say programs that benefit the young deserve more attention, and another 26% say both are equally important.

Republicans, Democrats and independents all say, on balance, programs that benefit older adults should be a higher priority than those that benefit the young. Of these three groups, Republicans are the most likely to prioritize programs that benefit the old (58% among Republicans vs. 44% of Democrats and 45% of independents).

The Family Safety Net

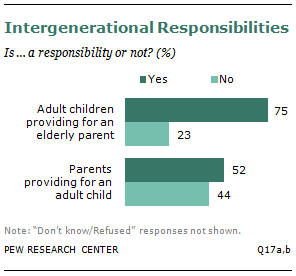

Regardless of attitudes about the government’s role, a majority of adults from all age groups believe that adult children have an obligation to support their aging parents. Overall, 75% of the public says adult children have a responsibility to provide financial assistance to an elderly parent if he or she needs it. Only 23% say this is not a responsibility.

Young adults are more likely than middle-aged or older adults to say providing financial assistance to an elderly parent in need is a responsibility. Among those ages 18 to 29, 84% say this is a responsibility. The share who views this as a responsibility goes down gradually with age. Some 77% of those ages 30 to 49 say adult children have a responsibility to provide financial assistance to an elderly parent in need; 72% of those ages 50 to 64 say the same as do 67% of those ages 65 and older.

Many adults are already providing financial support to their aging parents. Overall, 32% of all adults with at least one parent ages 65 or older say they have given financial support to their parent in the past 12 months.

Adults of all ages are much more reluctant to say parents have a responsibility to support their grown children. Overall, 52% say parents have a responsibility to provide financial assistance to an adult child if he or she needs it; 44% say this is not a responsibility. This compares with 75% overall who say adult children have a responsibility to assist their aging parents.

Among young adults, many of whom may have found themselves in this very situation, 53% say parents have the responsibility to provide for their adult children, if their children need the support; 44% say parents do not have this responsibility. Young adults’ views on this issue are nearly identical to those of their parents’ generation. Among adults ages 50 to 64, 54% say parents have a responsibility to provide for their adult children, while 43% say this is not a responsibility. Adults ages 65 and older have similar views: 57% say this is a responsibility and 35% say it is not. Adults ages 30 to 49 are somewhat less likely to say this is a responsibility: 47% say it is and 51% say it is not.

Deficit Reduction vs. Maintaining Entitlement Benefits

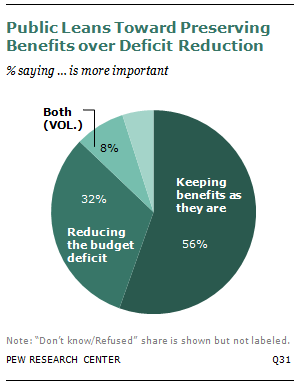

While young and older adults have similar views on the responsibilities family members have to one another, their views differ sharply on some key policy issues relating to generational responsibility. Overall, when faced with the tradeoff of taking steps to reduce the budget deficit or keeping Social Security and Medicare benefits as they are now, the public favors keeping benefits as they are now by a margin of 56% to 32%.

Young adults are closely divided on this issue: 41% say deficit reduction is more important while 48% favor keeping Social Security and Medicare benefits at their current levels. Among those ages 65 and older, fully two-thirds (66%) choose preserving entitlement benefits, while 21% say reducing the deficit is more important.

There are sharp differences on this issue along party lines as well. Republicans are evenly divided over which goal is more important: 45% say taking steps to reduce the budget deficit is more important, while 42% choose keeping Social Security and Medicare benefits at their current levels. Democrats lean heavily toward preserving these entitlement benefits. By a more than three-to-one margin (69% to 21%), Democrats say keeping benefits where they are now is more important than reducing the deficit.

The Future of Social Security and Medicare

The public’s views on the future of these large entitlement programs are somewhat contradictory. On the one hand, a majority says keeping benefits as they are now should be a priority, on the other hand, fully half question whether that approach is even tenable. Among all adults, 51% say it is not likely that there will be enough money in these programs to maintain current benefit levels in the future. Only 45% say it is likely there will be enough money to do this.

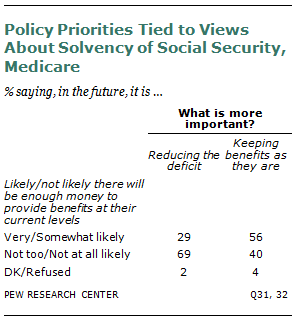

Views about the future solvency of these programs are closely linked to policy preferences. Those who favor deficit reduction over maintaining current benefit levels are among the most likely to doubt there will be enough money in these programs going forward: 69% of those who say reducing the deficit is more important than preserving Social Security and Medicare benefits also say it is not likely these programs will have enough money in the future to provide benefits at the current levels.

Those who favor maintaining benefits over reducing the deficit are much more confident about the future of these programs: 56% say it is likely there will be enough money in the future to provide benefits at their current levels, while 40% say the money is not likely to be there.

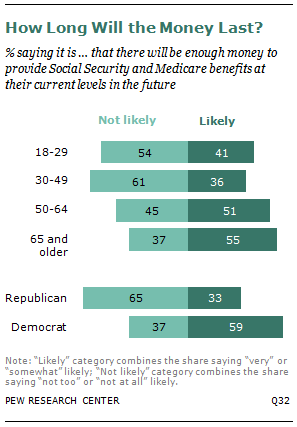

Perceptions of the future solvency of Social Security and Medicare also differ by age. On balance, young adults are skeptical that there will be enough money in the future if current benefits levels are maintained. Among those younger than 30, 41% say it’s likely there will be enough money, while 54% say this is unlikely. Adults ages 30 to 49 have the most negative view in this regard: 61% say it is not likely that there will be enough money in the future to provide benefits at their current levels (including 25% who say this is “not at all likely”).

Those ages 50 to 64 are about evenly divided on this issue: 51% say it’s likely these programs will have enough money in the future and 45% say it is not likely. And those ages 65 and older are the least concerned about the future solvency of these programs. A slight majority (55%) says it is likely there will be enough money in the future if current benefits levels are maintained, while 37% say this is unlikely.

There is a sharp partisan divide in perceptions about whether, in the future, benefits can be maintained at their current levels. Roughly two-thirds of Republicans (65%) say it’s not likely there will be enough money in these programs in the future to provide benefits at their current levels; only 33% of Republicans say there will be enough money. Democrats are much more confident: 59% say there will be enough money in the future to pay out benefits at their current levels, while 37% say there will not.

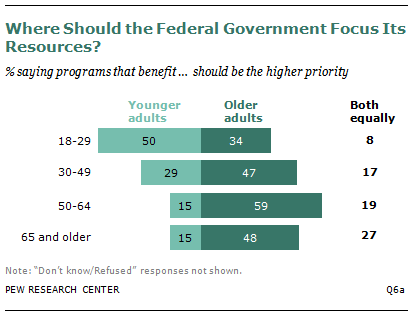

Related to the ability of Social Security and Medicare to continue to provide benefits at their current levels is the question of whether future spending will place an undue burden on younger generations. The public is divided over this issue. Some 44% of all adults say keeping benefits at their current levels will put too much of a financial burden on younger generations. Roughly the same proportion (45%) say continued spending will not adversely impact the young.

Again, views on this issue are closely related to age. However, here the gap is between those younger than 50 and those ages 50 and older. Among those ages 18 to 49, 50% say keeping spending at current levels will place too much of a burden on younger generations, while 40% say it will not. Among those ages 50 and older, only 38% say keeping benefits as they are now will burden the young, while 52% say it will not.

Support for Entitlement Reforms

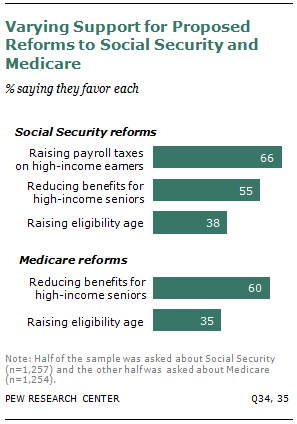

The public has mixed views on some potential reforms to the Social Security and Medicare programs. In general, there is broad support for reforms that involve reducing benefits for higher-income seniors, and most adults favor the idea of asking wealthier Americans to pay more in payroll taxes. There is much less support for the idea of raising the age at which people can begin to receive either of these benefits.

Half of the poll’s respondents were asked about reforms to address financial concerns about the Social Security program, and the other half were asked about reforms to help shore up the Medicare program. Of the three proposals for changing Social Security tested in the survey, the most popular is the idea of raising payroll taxes on high-income earners. Two-thirds of all adults favor this proposal, while 29% oppose it. A smaller majority of adults (55%) say they would favor reducing Social Security benefits for seniors with higher incomes; 39% oppose this proposal. When asked about gradually raising the age at which people can begin to receive Social Security benefits, only 38% were in favor, while a majority (56%) opposed this idea.

The public has a similar set of views on possible reforms to the Medicare program. Six-in-ten adults say they would favor reducing Medicare benefits for high-income seniors (33% oppose this). At the same time, only about one-third of adults (35%) say they would favor gradually raising the age of eligibility for receiving Medicare.

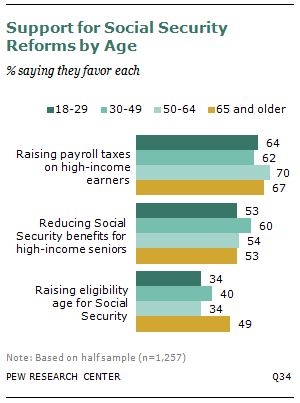

Majorities of young, middle-aged and older Americans support raising payroll taxes on high-income earners. There is no significant difference of opinion between adults ages 18 to 29 and those ages 65 and older on this issue – 64% of young adults favor this proposal as do 67% of older adults. Among those ages 30 to 64, a similar share (66%) favors this.

When it comes to reducing Social Security and Medicare benefits for higher-income seniors, similar shares from each age group say they are in favor. Some 53% of those ages 18 to 29 favor reducing Social Security benefits for seniors with higher incomes; 57% of those ages 30 to 64 favor this proposal as do 53% of older adults.

There is less agreement on the issue of raising the age of eligibility for Social Security. Older adults stand out in terms of their relative support for this proposal. Among those ages 65 and older, 49% say they would favor gradually raising the age at which adults can begin to receive benefits. This compares with 34% among those 18-29, 40% among those 30-49 and 34% among 50- to 64-year-olds. Similarly, younger adults are more likely than their older counterparts to oppose raising the age of eligibility for Medicare. While only half of adults ages 65 and older oppose this proposal, about six-in-ten of those younger than 65 oppose it.

Partisanship and Entitlement Reform

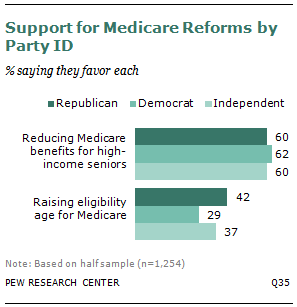

If there’s one thing Republicans, Democrats and independents may be able to agree on in tackling entitlement reform it’s the idea of reducing benefits – both Social Security and Medicare – for the wealthiest older Americans. About half or more from each partisan group favor reducing Social Security benefits for wealthier adults, and roughly six-in-ten from each group favor the same for Medicare benefits.

While solid majorities of Democrats (77%) and independents (70%) support raising payroll taxes on high-income earners to help shore up the Social Security program, only 46% of Republicans would support this measure. Republicans and independents are more supportive than Democrats of proposals to raise the age of eligibility for Social Security or Medicare. Even so, these proposals do not garner majority support from any party group.