The nation’s worst economic meltdown since the Great Depression has had a disproportionate impact across generations. While Americans of all ages have felt the effects of the recession, Millennials have been hit harder on the job front, and Boomers and Generation Xers have suffered the greatest losses in terms of home values, household finances, and retirement savings. The Silent generation has survived the economic downturn in better shape. With the help of income from Social Security, Silents view their financial situations more positively than do younger generations.

Moreover, a report by the Pew Research Center’s Social & Demographic Trends project shows that Americans 65 and older have made dramatic gains relative to younger adults in their overall economic well-being over the past quarter of a century. (For more, see Pew Social & Demographic Trends’ “The Rising Age Gap in Economic Well-Being,” Nov. 7, 2011.)

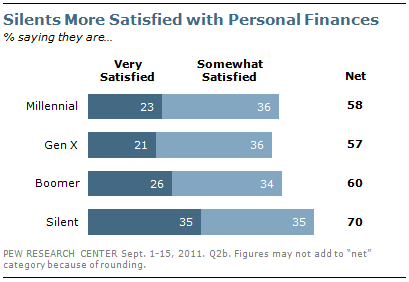

In the current poll, Silents express a higher level of satisfaction with their personal financial situation than do younger people. Seven-in-ten Silents say they are satisfied with their current finances (35% are very satisfied, another 35% are somewhat satisfied).

Among Boomers, six-in-ten are satisfied with their personal financial situation, with only one-in-four (26%) saying they are very satisfied. Similar shares of Gen Xers (21%) and Millennials (23%) say they are very satisfied with their finances.

In a survey last year by Pew Social & Demographic Trends, nearly half of the public (48%) said that their household finances were in worse shape than before the recession. Boomers suffered the most in this regard: More than half of Boomers (54%) said their household finances gotten worse over the course of the recession, with as many as one-in-five saying their finances were in much worse shape. Among Silents, 44% said they were in worse financial shape as a result of the recession, but just as many volunteered that their finances had not changed during the recession.

Millennials, despite their precarious situation in the job market, were more likely than any other generation to say their finances had improved over the course of the recession (33%). Gen Xers said they suffered more than Millennials but slightly less than Boomers. (For more, see Pew Social & Demographic Trends’ “How the Great Recession Changed Life in America,” June 30, 2010.)

Gen Xers Feeling More Pinched

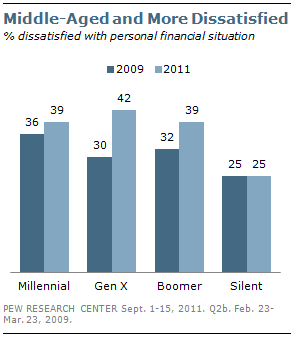

Overall, Americans are less satisfied with their personal financial situation now than they were in 2009. Millennials, Gen Xers and Boomers all express lower levels of satisfaction now than they did two years ago. Silents’ assessments about their personal financial situation have not changed significantly over this period.

Gen Xers show the most dramatic change in this regard. In the current survey, 57% of Gen Xers say they are satisfied with their personal financial situations while 42% are dissatisfied. In early 2009, more than twice as many Gen Xers were satisfied than dissatisfied with their personal finances (68% vs. 30%).

More Boomers also express dissatisfaction with their finances: 39% are currently dissatisfied, compared with 32% two years ago. Millennials’ views of their personal finances, like those of Silents, have changed very little since 2009.

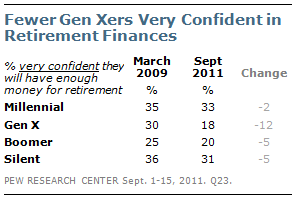

The increased anxiety about personal finances among Gen Xers and Boomers may be fueled in part by mounting concerns about retirement savings. Although the stock market has rebounded somewhat from its low point in early 2009, Americans have less confidence now than they did in early 2009 in their ability to provide for themselves in retirement. In 2009, roughly seven-in-ten adults were at least somewhat confident that they would have enough income and assets to last throughout their retirement years. In the current poll, 63% expressed at least some confidence.

Over the past two years Gen Xers have lost a great deal of confidence in their ability to provide for themselves in retirement. In the current survey, only 18% of Gen Xers say they are very confident they will have enough income and assets to last throughout their retirement years, down from 30% who were very confident in just two years ago.

Boomers, like Xers, are not highly confident in their retirement finances, though their opinions are largely unchanged from two years ago. Just one-in-five Boomers (20%) say they are very confident in their retirement finances; in March 2009, 25% said the same.

Older Workers and Retirement

Retirement is still a long way off for most Gen Xers, but it is right around the corner for many Boomers. In the current survey, about two-thirds of Boomers (67%) say they are not retired. Among that group, the average age at which they expect to retire is 66. Nearly one-in-four (23%) say they expect to work until they are 70 or older, and 12% say they never plan to retire.

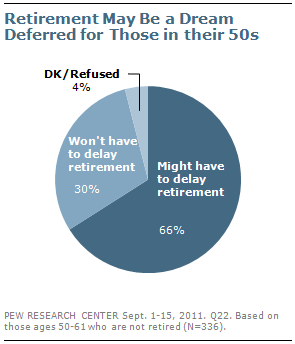

The recession has had a major impact of some Boomers’ retirement plans. Among Boomers ages 50-61 who are still in the labor force, fully two-thirds (66%) say they might have to delay their retirement because of current economic conditions.

The vast majority of Silents are already retired – 90% in the current survey. A small share of Silents and Boomers who are retired report that they still do some type of work for pay. Among older Boomers and Silents who are not yet retired, 42% say they already have had to delay their retirement because of the economy.

Housing and Jobs

The collapse in the housing market has had relatively little impact on Millennials, largely because they are less likely than older Americans to own a home. In a Pew Research survey conducted earlier this year, only 18% of Millennials reported that they owned their own home.

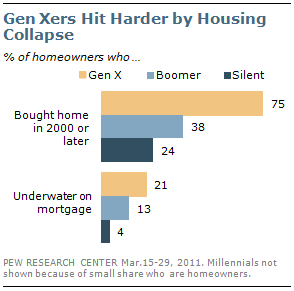

The share of homeowners among Gen X is much higher – 57%. And among Gen Xers who own homes, three-in-four say they bought their home in 2000 or later, during the dramatic rise and fall in home values. One-in-four of these homeowners say their house is worth a lot less than it was before the recession, and 21% say they are underwater on their mortgage – that is, they owe more on their home than they could sell it for today.

Boomers are more likely than Gen Xers to own a home (75%), but they are less likely to have bought their home during the real estate bubble of the past decade. Fewer Boomers than Gen Xers (13%) say that they are underwater on their mortgages.

Silents – the vast majority (82%) of whom are homeowners – are even more removed from the housing crisis. Only 24% of homeowners from the Silent generation bought their home in the past decade; twice as many (50%) bought their home before 1990. Just 4% of Silents report that they are underwater on their mortgages. (For more, see Pew Social & Demographic Trends’ “Home Sweet Home. Still.” April 12, 2011.)

Finding a job during the recession has been a challenge for Americans of nearly all ages, but Millennials have been hit particularly hard. Over the course of the recession, the overall unemployment rate increased by roughly five percentage points. The increase was sharpest among the nation’s youngest workers. Pew Social & Demographic Trends’ 2010 report on the differential impact of the recession showed that 19.1% of workers ages 16 to 24 were unemployed in the fourth quarter of 2009, according to the Bureau of Labor Statistics. That was eight points higher than the unemployment rate for this age group in the fourth quarter of 2007. Both the levels and changes in the unemployment rate were less sizable among older age groups.

In the current survey, two-thirds of Millennials (67%) say they are employed: 38% are employed full-time and 29% are employed part-time. Among Millennials who are not currently employed, 63% say they are looking for work. A similar proportion of Gen Xers who are not working (59%) say they are looking for a job. Among Boomers, only 27% of those who are not working are actively looking for work.

Family Responsibilities

In addition to the broader economic forces that have battered Americans over the past few years, there are other financial burdens and responsibilities closer to home. Many parents and children feel a sense of financial obligation to each other. With the population growing older, the need for family members to provide assistance to one another may increase.

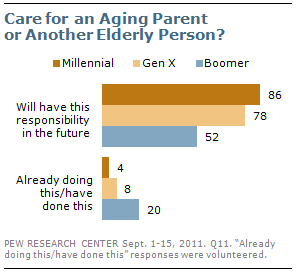

Roughly six-in-ten Americans (62%) think that at some point in their life they will be responsible for caring for an aging parent or another elderly person. Another 13% volunteer that they are currently caring for an aging adult or have done so in the past.

Large majorities of Millennials (86%) and Gen Xers (78%) say they think they will end up caring for an aging parent or another elderly person. Fewer Boomers (52%) expect to care for an aging adult, but 20% say they currently do so or already have done so.

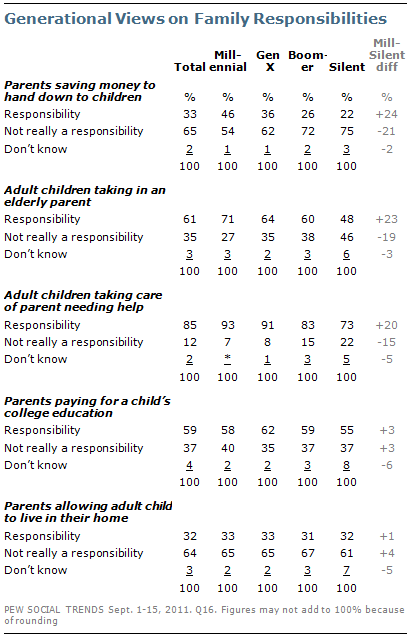

There are wide generational differences in opinions about the responsibilities of family members to each other. On issues relating to aging parents, Millennials advocate a greater level of responsibility on the part of both the parents and the adult children than do older generations.

More than nine-in-ten Millennials and Gen Xers say adult children have a responsibility to care for their elderly parents if they need help. A strong majority of Boomers (83%) agrees this is a responsibility. Most Silents (73%), many of whom are elderly parents themselves, also see this as a responsibility. However, more than one-in-five disagree.

Fully seven-in-ten Millennials (71%) and 64% of Gen Xers say adult children have a responsibility to take an elderly parent into their home if that’s what the parent desires. Among Boomers, 60% say this is a responsibility. Silents are much less likely to agree: 48% say adult children have this responsibility, nearly as many (46%) say they do not.

Millennials are also more likely than those in older generations to say parents have an obligation to leave an inheritance for their children. Nearly half (46%) say parents have a responsibility to save money to hand down to their children after they die. Gen Xers are less likely to see this as a responsibility (36%). Just 26% of Boomers and 22% of Silents agree.

There is much more agreement across generations on the two additional items tested in the poll. Most adults, regardless of generation, agree that parents should pay for a child’s college education. Roughly six-in-ten Millennials, Gen Xers, Boomers and Silents say this is a responsibility.

And most adults agree that parents are not obliged to take in their adult children. Only about one-third from each generation says parents have a responsibility to allow their adult child to live in their home if the child wants to. Roughly two-thirds from each generation say this is not a parent’s responsibility.

Whether or not it is viewed as a responsibility, many families are living together in multi-generational households these days. A recent Pew Research analysis of data collected by the U.S. Census Bureau showed that a record share of Americans now reside in a multi-generational household and that, for many, this has become an economic lifeline. An earlier Pew Research analysis showed that during the recession, many Millennials moved back in with their parents (as many as one-in-four adults ages 18-24 did this). (For more, see Pew Social & Demographic Trends’ “Fighting Poverty in a Bad Economy, Americans Move in with Relatives,” Oct. 3, 2011.)

Families Providing Financial Support

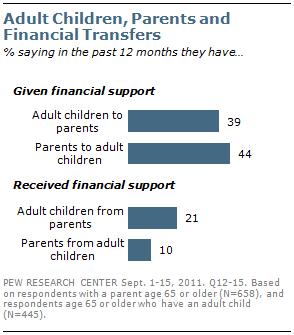

Within families, generations support each other financially – and the support runs both ways. Among adults who have a parent age 65 or older, 39% say they have given financial support

to their parent in the past 12 months. Among adults ages 65 and older, a similar share (44%) say they have given financial support to an adult child.

This financial assistance tends to be more for ongoing expenses than a one-time gift or loan. Among adult children who have given their parents money over the past year, eight-in-ten say that money was for ongoing expenses. Similarly, among older adults who have given money to their adult children, about seven-in-ten say the money was for ongoing expenses.

Survey respondents are more willing to acknowledge giving financial support than they are to say they have received support. Among adult children with a parent age 65 or older, 21% say they have received money from their parent in the past 12 months. Among older adults, just 10% say they have received financial support from their adult children.

The share of adult children who have provided financial support for an elderly parent is significantly higher among blacks and Hispanics than among whites. Fully 64% of black and Hispanic adults with a parent or parents age 65 or older say they have given their parents money in the past year. Among non-Hispanic whites with a parent age 65 or older, only 30% have given money to a parent.