Economic Profile of the Five Cities

The five cities studied in this report have a variety of characteristics, with several being among the most highly wired cities in the United States (Austin, Portland, and Washington, DC), some being centers of high-tech manufacturing (Austin and Portland), others being service oriented (Nashville and Washington), and one traditional manufacturing center (Cleveland). The following tables present portraits of the five cities.

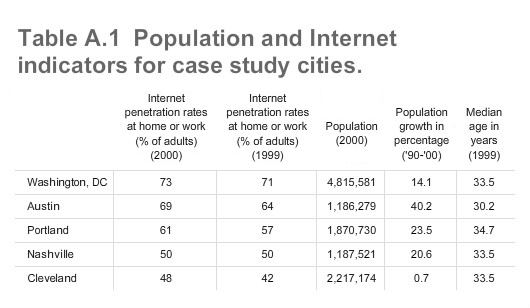

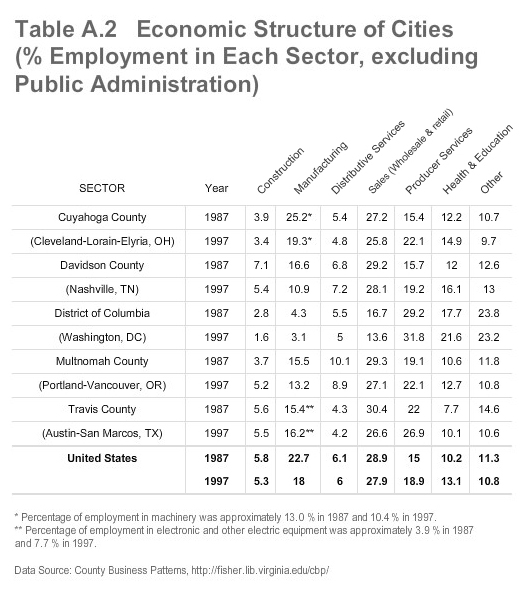

As the tables show, Washington has the highest Internet penetration rate, with 73% of adults with Internet access, followed closely by Austin at 69% and Portland with 61%. Cleveland (48%) and Nashville (50%) have the lowest Internet penetration rates of the five cities (Scarborough Research, 2001). By the end of 2000, overall Internet penetration in the United States for adults was 56% (Pew Internet and American Life Project, 2001). In terms of distribution of employment, Cleveland, Austin, and Portland lead the way in manufacturing, with Austin and Washington leading in producer services followed by Cleveland and Portland. Washington’s high share of “other services” is accounted for by the many membership organizations located in the U.S. capital. Nashville rates very low in manufacturing, but relatively high in health care services and education.

Although not disaggregated in Table 2, Austin and Portland are known as centers of manufacturing in electronics, with Austin specializing in semiconductors, computers, and semiconductor manufacturing equipment (SME), and Portland in semiconductors, SME, displays, and silicon wafers. The Washington, DC metro area, another tech center, specializes in telecommunications and Internet services. In 1997, overall high-tech employment location quotients (with high-tech sectors defined as computer and electronic manufacturing, software publishing, information services and data processing, and computer systems design) were 3.5 for Austin, 2.2 for Washington, D.C., and 2.0 for Portland (Cortright and Mayer, 2001). Making causal statements about economic structure and Internet penetration is risky, but it seems that Austin, Portland, and Washington have high Internet penetration rates because of a workforce accustomed to being very wired. That is, because people’s jobs produce the infrastructure for the information economy and use it in production processes, they demand such products for themselves at home.

Other measures of regional economies show the variability in the five economies. The Progressive Policy Institute has developed the Metropolitan Economy Index to describe how well suited to the New Economy metropolitan economies are. The report uses 16 indicators in the index that fall into five categories: knowledge jobs, globalization (the export orientation of the area’s manufacturing sector), economic dynamism and competition, transformation to the digital economy (e.g., the number of adults online, the number of “dot-com” domain names registered), and technological innovation capacity (e.g., the number of patents issued.

San Francisco rates highest in the PPI’s index, but among the top 10 two cities from this study appear, Austin (ranked 2nd) and Washington (ranked 6th). Portland is ranked number 15, Nashville comes in at 32, and Cleveland at 33. In terms of specific categories, Austin ranked very well in online population (2), share of managerial and professional jobs (3), share of high-tech jobs (1), patents (3), and availability of venture capital (1). Austin had relatively low ratings in measure of economic dynamism, ranking 22nd in share of high growth companies (called “gazelles” by PPI) and 13th in job churning (the creation and destruction of new companies). Washington rates first in managerial and professional jobs as well as technical literacy of its workforce. The District does not do as well in measure of innovation and dynamism, with 31st in patents, 9th in venture capital availability, and 29th in “gazelles.” Portland’s ranking reflects its high tech manufacturing base, with a strong ranking (11) in manufacturing exports, share of high tech jobs (11); its ranking of 10 in venture capital availability is good, though the amount of venture capital available drops off quickly after the top five cities. By other measures of dynamism, Portland’s rankings are unremarkable; it is 26th for “gazelles” and 28th in job churning.

The less high tech cities, Nashville and Cleveland, are in the middle of PPI’s pack, but they have a few bright spots. Nashville ranks 9th in managerial and professional jobs and 9th in job churning, reflecting the entrepreneurial image Nashvilleans have of their city. Nashville also rated 16th in terms of the availability of broadband connections. Cleveland rates fairly well in managerial jobs (17th) and patents (20th), as well as use of computers in schools (10). However, venture capital is relatively scarce in Cleveland (42); this contrasts with Nashville’s rating of 20. And in job churning, it rates only 44.