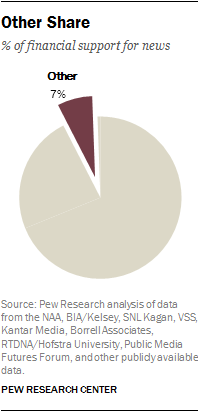

The continued pressures on audience and advertising revenue have led some news producers to begin to experiment with other forms of earned revenue, some of which are tied directly to the news product and some of which are not. These include events, digital marketing services, e-commerce, content licensing and even commercial printing and delivery. For now they account for a relatively small piece of the revenue pie: 7% of total estimated news revenues.

Events

Event-hosting has become a prominent part of the conversation about the future sustainability of journalism. Revenue potential here is two-fold, streaming in from corporate sponsorships and ticket sales. Once again, hard numbers are scarce, given that many news companies do not break out events in their earnings reports. The evidence on record suggests that this category remains small, but for some is an important part of the pie.

Tech sites have traditionally been leaders in the event arena. Before its rebranding, AllThingsD charged $5,500 to attend its spring conference, and in May 2013 generated $2.75 million from ticket sales alone (corporate sponsors are said to add more revenue to the event even than tickets do). And TechCrunch Disrupt events have become an important part of that company’s revenue portfolio, with one “quite profitable” event in San Francisco charging $2,000-$3,000 per ticket.

Print publishers have been active in this space, too. The New York Times hosted 16 events in 2013, up from just one in 2011, and plans to continue them in 2014. The Chattanooga Free Press has built events into its business model and now generates 14% of its annual revenue from them, a figure “well into seven figures,” according to industry analyst Ken Doctor. Atlantic Media puts on more than 200 events a year and garners 20% of the company’s total revenue. And The New Yorker Festival has been a Manhattan mainstay for more than a dozen years.

Events have become a significant revenue stream for some nonprofit outlets. A recent Pew Research survey of nearly 100 digital nonprofits found that 28% generated at least some revenue from events in 2011, amounting to roughly $1.3 million. (Here The Texas Tribune is a leader. In 2013, the nonprofit brought in more than $1 million in events.) A 2013 Knight Foundation report profiling 18 digital nonprofit news outlets, found that events accounted for just 4% of the total revenue pie in 2012, also about $1.3 million. That number was up just slightly from $1.1 million in 2011.

As with other financial details, most private media companies are reluctant to share information on revenue generated by events, and so it is hard to know how much of an impact they are having on the industry revenues. A report produced by the Newspaper Association of America in April 2013 found that seven of 15 newspaper companies that reported detailed data on different revenue categories said they generated revenue from events. However, event revenue dropped 9% year-over-year for those companies.

Such a drop serves as a reminder of the inherent fragility of the event business. As SNL Kagan senior analyst Derek Baine noted in an e-mail message to Pew Research Center, the event sector tends to be cyclical and is not recession-proof.15 While events may be a growing revenue generator, and an important supplement to other revenue streams, they do not come with guarantees.

Marketing Services and Ad Networks

A number of news organizations have brought online marketing services for local business into their revamped business model. Newspaper companies see themselves as well positioned to provide these services since they already have many local business clients and have had to do some of this work on their own in the past. The Santa Rosa (Calif.) Press Democrat launched its version of this in October 2011. In its first year, the effort accounted for 25% of the paper’s digital revenue and was expected to grow revenue by about 60% in 2013. Other efforts, including those of The Dallas Morning News and the Gannett chain, have industry taking notice. A Newspaper Association of America study found that among nine companies that had developed digital marketing services, revenues in that sector rose 91% from 2011 to 2012. And on the television side, LIN Media, which operates 43 local stations, acquired Federated Media, a digital marketing company, in early 2014.

Several news organizations have created their own ad networks as an alternative revenue stream. Digital First Media is one of these, having launched AdTaxi, a private exchange advertising network, in 2012. The idea here is that a news publisher takes over the broker role in the advertising market, helping clients place ads themselves. Other newspapers, such as The Columbia (Tenn.) Herald, have created online ticket sales programs that allow customers to buy tickets to shows, concerts and sporting events, with the newspaper taking a commission on each transaction. The Herald started this in 2012.

At the community level, some small town and rural papers are trying to bring in more revenue by publishing things like real estate guides, phone directories or niche newspapers, says the Newspaper Association of America’s Tonda Rush. One now circulates a Civil War newspaper throughout the country. Others have opened small stores in their towns. “Office supply stores are not uncommon,” says Rush, and one community newspaper even opened a fudge shop in the front of its office.