The new federal fiscal year begins on Oct. 1, and Congress hasn’t passed any of the dozen appropriations bills it’s supposed to enact every year. Nor has it passed a stopgap spending law to buy itself more time. That raises the prospect of yet another forced shutdown of large chunks of the federal government – which, if it happens, would be the fourth in the past decade.

With the federal government once again staring at a funding gap, we decided to update our historical look at the federal budgeting and appropriations process – and Congress’ chronic difficulties in adhering to its own rules.

For this analysis, we used Congress.gov, an official online repository of legislation and legislative data. We identified every appropriations bill enacted since 1976, when the new process laid out in the 1974 Congressional Budget Act (CBA), began to take effect. We coded each of these laws as a regular, continuing or supplemental appropriation. We also noted which appropriations area or areas each measure covered, as well as the date it became law, so we could compare it against the deadlines laid out in the CBA.

Similarly, we identified all budget resolutions agreed to since 1975 and when they passed relative to the CBA deadlines.

For explanations of how the budget and appropriations process is supposed to work, we relied primarily on a series of reports by the Congressional Research Service. We used historical spending data published by the Office of Management and Budget to calculate mandatory and discretionary spending shares.

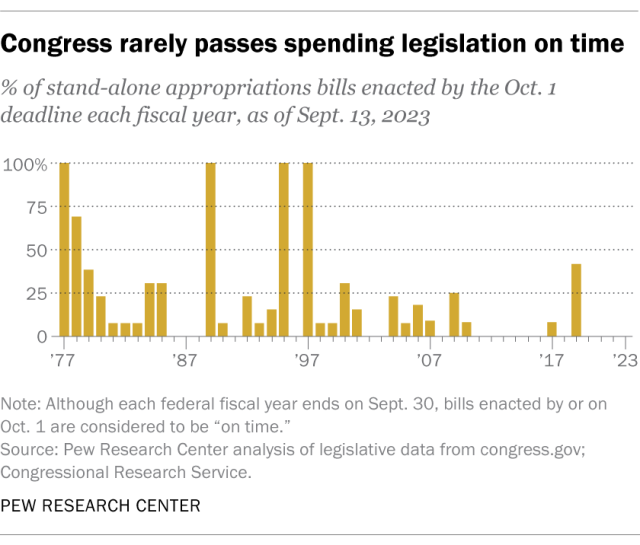

Congress’ chronic inability to follow its own appropriations process is hardly new. In fact, in the nearly five decades that the current system for budgeting and spending tax dollars has been in place, Congress has passed all its required appropriations measures on time only four times: fiscal 1977 (the first full fiscal year under the current system), 1989, 1995 and 1997. And even those last three times, Congress was late in passing the budget blueprint that, in theory at least, precedes the actual spending bills.

In short, the typical appropriations process isn’t the orderly one laid out in the 1974 Congressional Budget Act. Instead, it’s a hodgepodge of late budget blueprints, temporary spending measures to keep the government running, and sprawling omnibus appropriations packages that often are passed in the waning days before one Congress ends and the next one begins.

It wasn’t supposed to be that way.

First step: The budget resolution

Timetable of the congressional budget process (in law, if not always in practice)

First Monday in February: President submits proposed budget.

Feb. 15: Congressional Budget Office submits report on economic and fiscal outlook to the House and Senate budget committees.

Six weeks after president submits budget: Other House and Senate committees submit their views and estimates to the budget committees.

April 1: Senate Budget Committee reports concurrent resolution on the budget.

April 15: House and Senate agree to a concurrent resolution on the budget.

May 15: Annual appropriations bills may be considered in the House.

June 10: House Appropriations Committee reports its last annual appropriations bill.

June 15: Congress completes action on reconciliation legislation.

June 30: House completes action on all annual appropriations bills.

Oct. 1: Fiscal year begins; all annual appropriations bills enacted by this date.

Source: Adapted from “Introduction to the Federal Budget Process,” report #R46240, Congressional Research Service.

Once the president submits a budget proposal – which is supposed to happen (but often doesn’t) by the first Monday in February – the House and Senate start work on a budget resolution. This is a concurrent resolution, agreed to by both chambers but not presented to the president. While it doesn’t have the force of law, the budget resolution serves as an overall revenue and spending plan for the coming fiscal year. It guides lawmakers as they assemble the detailed appropriations bills.

But even this initial step has often proven problematic. Although the Congressional Budget Act sets an April 15 target date for the budget resolution, Congress has seldom met that deadline. The budget resolution, in fact, has been late for 30 of the past 49 fiscal years, counting fiscal 2024. The resolution for fiscal 2021 was delayed the longest. It didn’t pass until February 2021 – more than five months into the fiscal year, and only two months before the next year’s resolution was due (that one was late too).

Increasingly, Congress effectively punts on the budget resolution. In nine of the past 15 years, the House and Senate have instead adopted a variety of legislative substitutes called deeming resolutions. A deeming resolution is used when the two chambers can’t agree on a budget resolution, and typically only binds each chamber’s own appropriators. Born in disagreement, they often foreshadow future spending conflicts between the two chambers. (For the upcoming fiscal year, provisions in this summer’s debt-ceiling deal effectively serve as a budget resolution, although House appropriators are pushing to spend billions less than that deal authorizes.)

Next step: The appropriations bills

After a budget resolution is adopted, Congress is supposed to pass a series of separate bills funding various federal agencies and activities. For more than a decade, the number of spending bills has stood at 12, one for each pair of subcommittees on the House and Senate appropriations committees. The deadline for doing that is Oct. 1, when the new fiscal year starts.

But that hasn’t actually happened since 1996, when the final three appropriations bills for fiscal 1997 (one of them a six-bill omnibus package) became law on Sept. 30, the day before the new fiscal year began. Since then, Congress has never passed more than five of its 12 regular appropriations bills on time. Usually, it’s done considerably less than that: In 11 of the past 13 fiscal years, for instance, lawmakers have not passed a single spending bill by Oct. 1.

Instead, Congress regularly buys itself extra time by relying on continuing resolutions (CRs). Continuing resolutions typically extend funding levels from the prior fiscal year, but only for existing programs. They’ve lasted as little as one day and as long as the rest of the fiscal year – a “full-year CR.”

Continuing resolutions keep the government functioning but permit the appropriations process to drag out for weeks or months past its theoretical deadline. Between fiscal 1998 and 2023, there have been an average of 113 days – or almost four months – between the start of each fiscal year and the date that year’s final spending bill became law. In the most extreme case, the final spending bill for fiscal 2017 didn’t become law until May 2017, more than seven months into the fiscal year.

Rather than pass individual spending bills as envisioned in the 1974 budget law, Congress has increasingly resolved its annual spending disputes by using omnibus bills – which bundle several appropriations measures into a single, giant law – or full-year continuing resolutions.

The first such omnibus measure was passed in 1950 as a one-off experiment, and the tactic was used a couple of times in the mid-1980s. However, omnibus bills have become much more frequent in the past two decades. In all but two fiscal years since 2007, in fact, all or nearly all of the regular appropriations bills were combined into such after-deadline package deals.

Different types of federal spending

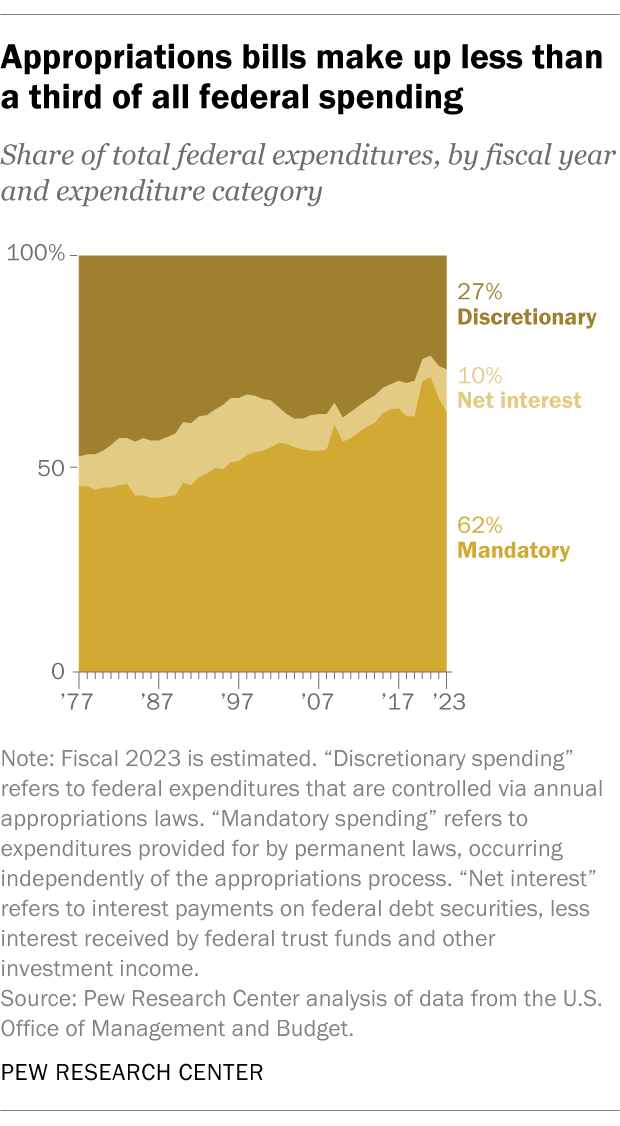

For all the energy that goes into the annual appropriations process and all the attention it attracts, it covers less than a third of all federal spending.

Most federal spending, including spending on Social Security, Medicare, Medicaid, unemployment compensation and other entitlement programs, is mandated by the statutes governing those programs. Such mandatory spending is estimated to total nearly $3.98 trillion in the current fiscal year, or 62.4% of all federal outlays.

The appropriations process, by contrast, covers discretionary spending – everything from the military and space programs to disaster relief and farm price supports. This year, discretionary spending is expected to total about $1.74 trillion, or 27.2% of total outlays. (The remaining 10.4% represents net interest paid on the national debt.)

How common are government shutdowns?

Should the Oct. 1 deadline pass without either a new set of spending bills or a continuing resolution, operations considered nonessential would be forced to shut down. (That could include things like national parks and monuments, passport applications and military training exercises.) There have been five shutdowns since 1995, excluding a nine-hour funding gap (the interval between the expiration of one continuing resolution and the enactment of another) in the overnight hours of Feb. 8-9, 2018. The most recent such shutdown lasted 35 days, from Dec. 22, 2018, to Jan. 25, 2019.

The impact of a shutdown depends on how long it lasts and which parts of the government are forced to close their doors. During the 2018-19 standoff, for instance, only about 300,000 of an estimated 2.1 million federal workers were furloughed, largely because five of the 12 spending bills – those covering the Defense, Education, Health and Human Services departments and other major parts of the federal government – had already become law. Still, the Congressional Budget Office estimated that the shutdown shaved about $3 billion, or 0.02%, off that year’s gross domestic product.

This is an update of a post originally published on Jan. 16, 2018.