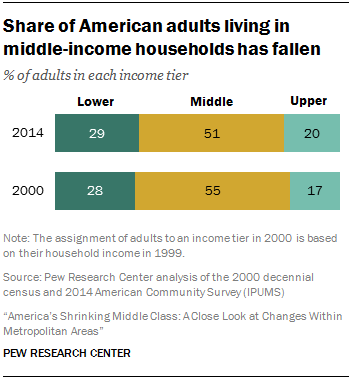

The share of the American adult population that lives in middle-income households has fallen since 2000. The trend this century is the continuation of a long-running decline. An earlier analysis by the Pew Research Center, which looked at the period from 1971 to 2015, demonstrated that the middle class in the U.S. has been shrinking steadily for more than four decades. 18

Nationally, the movement out of the middle from 2000 to 2014 has been accompanied by rising shares of adults in both upper-income and lower-income tiers. Notably, however, when looked at as a whole, the share of Americans who are upper income increased more than the share that are lower income. But, as shown in later chapters, this is not a pattern that describes the experience of all metropolitan areas—in almost half the areas examined, there has been more movement down the ladder than up.

These findings emerge from a new Pew Research Center analysis of data from the 2000 decennial census and the 2014 American Community Survey (ACS), both conducted by the U.S. Census Bureau. 19 Adults are classified as lower, middle or upper income based on their household income adjusted for the number of people in their household. Additionally, incomes are adjusted for the cost of living in a metropolitan area relative to the country overall. The analysis covers 229 of 381 metropolitan areas in the U.S. accounting for 76% of the national population in 2014.

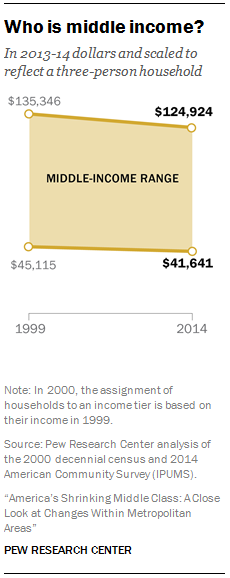

With the recession, the value of a ‘middle-class income’ diminished from 1999 to 2014

Middle-income households are defined as those with an income that is two-thirds to double that of the overall median household income, after having been adjusted for household size. Lower-income households have incomes less than two-thirds of the median, and upper-income households have incomes that are more than double the median. 20

Because the median household income in the U.S. has fallen since 1999, the minimum amount it takes to be middle income has also fallen. Specifically, the median household income in the U.S. decreased from $67,673 in 1999 to $62,462 in 2014, after adjusting for household size and scaling to a household of three. Thus, the minimum income needed to be a middle-income household fell from $45,115 in 1999 to $41,641 in 2014. 21

The top end of the middle-income range also decreased, from $135,346 in 1999 to $124,924 in 2014. The downward trend in what it means to be middle income is the result of the 2001 recession and the Great Recession of 2007-09, and the slow economic recoveries after each.

A smaller share of adults are middle income

Notwithstanding the lowering of the threshold to be defined as middle income, the share of American adults in middle-income households also decreased, from 55% in 2000 to 51% in 2014. At the same time, the share of adults in the upper-income tier increased from 17% to 20%. The share of adults in the lower-income tier also increased, from 28% to 29%. Thus, the distribution of adults by their household income has hollowed in the middle in this century.

The shrinking in the middle is more pronounced over the long haul. As previously reported by Pew Research, the middle-income share decreased from 61% in 1971 to 50% in 2015. Over this nearly 45-year period, the share of the upper-income tier rose from 14% to 21%, and the share in the lower-income tier increased from 25% to 29%. 22

The national middle-income standard defined previously—$41,641 to $124,924 for a three-person household in 2014—is also used to determine the economic status of households in all metropolitan areas. However, because the prices of goods and services in a metropolitan area are typically different from the prices nationally, it is necessary to adjust household incomes in each area for that difference in the cost of living. By this process, the incomes of households in relatively expensive areas are adjusted downward and the incomes of households in relatively cheaper areas are adjusted upward.

In this report, the metropolitan area cost-of-living adjustment is based on price indexes published by the U.S. Bureau of Economic Analysis (BEA). These indexes, known as Regional Price Parities, compare the prices of goods and services in a metropolitan area with the national average prices for the same goods and services. The latest available estimates for these indexes are for 2013 (details on Regional Price Parities are available at http://www.bea.gov/regional/index.htm).

The BEA’s Regional Price Parities show a wide range in the cost of living across metropolitan areas. Among the 229 areas covered in this report, the area with the lowest cost of living was Jackson, TN, with a price level that was 17% less than the national average. Urban Honolulu, HI, was one of the most expensive areas, with a cost of living about 22.5% greater than the national average.

Since Jackson is relatively inexpensive, households in that area need to receive an income of only about $34,600, or 17% less than the national standard of $41,641, to be considered a part of the American middle class. But a household in Urban Honolulu needs an income of about $51,000, or 22.5% more than the U.S. norm, to be considered middle class.

Once incomes of households in all metropolitan areas have been adjusted for cost-of-living differences and household size, they are assigned to the lower-, middle- or upper-income tier using the common national standard defined previously. Accounting for the cost of living naturally has an impact on the estimated distribution of adults by income tier. In Jackson, the share of adults who are upper income in 2014 increases from 8% before the cost-of-living adjustment to 15% after the adjustment. In Urban Honolulu, the share of adults who are upper income falls from 27% to 15% after accounting for the cost of living, and the shares who are lower income and middle income rise.