U.S. government data shows that Hispanics’ financial situation has improved in some ways. Between 2023 and 2024, the median income of Hispanic households increased by 5.5%, and the poverty rate among Hispanics decreased from 16.6% to 15.0%.10

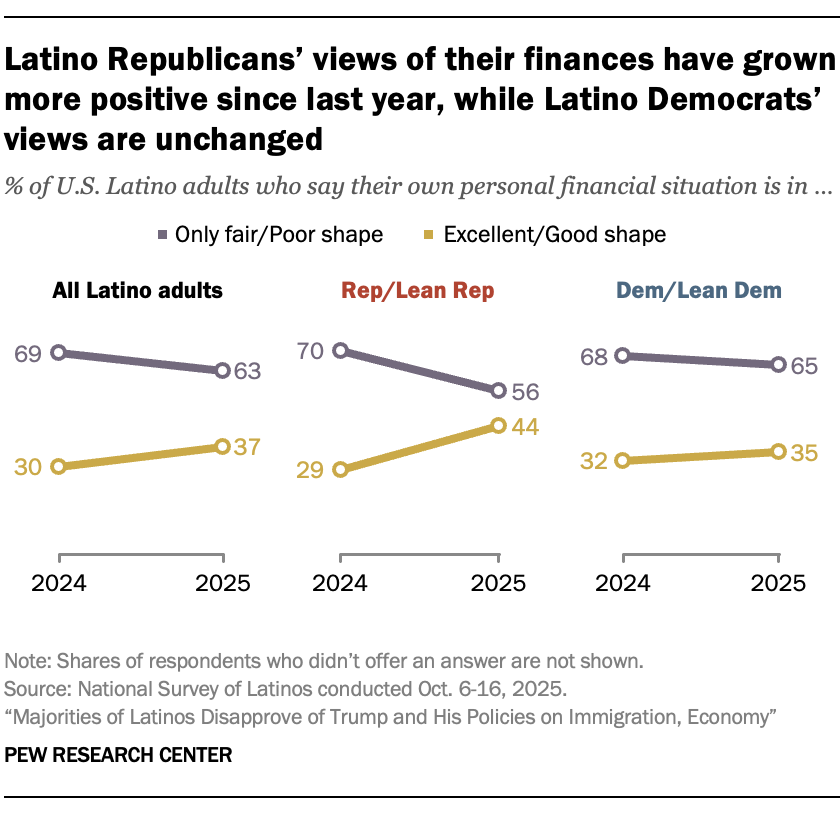

Despite these improvements, nearly two-thirds of Latinos today say their own financial situation is in only fair or poor shape. Still, Latinos are fairly optimistic about their financial future: Half say they think their and their family’s financial situation will improve in the coming year.

These findings come from Pew Research Center’s National Survey of Latinos, a nationally representative, bilingual survey including 4,923 U.S. Latino adults, conducted Oct. 6-16, 2025.

This is the third of six detailed sections in a report on Latinos’ views of Trump’s second administration and their situation in the country. For Latinos’ views of the U.S. economy, visit Chapter 4. For a summary of the report’s findings, visit the overview.

Most Latinos are downbeat about their finances, but many see better times ahead

As of October 2025, 63% of Hispanics rate their personal financial situation as only fair or poor, while 37% say they’re in good or excellent shape. Despite most seeing their situation negatively, some also have hope for their financial future: Half (50%) say they expect their and their family’s financial situation to improve, while smaller shares expect it to stay the same (33%) or worsen (17%).

Latinos’ views of their finances have remained mostly negative since last year. However, the views of some partisans have shifted. Among Latinos, Republicans’ and Republican-leaning independents’ ratings of their finances have improved, while the views of Democrats and Democratic leaners are essentially unchanged.

Today, Latinos’ rating of their financial situation varies across other demographic groups:

- 91% of upper-income Latinos say their finances are in excellent or good shape, versus 51% of middle- and 21% of lower-income Latinos.

- 58% of college graduates rate their finances positively, versus 42% with some college experience and 26% with a high school diploma or less.

- 43% of U.S.-born Latinos rate their finances positively, versus 28% of Latino immigrants.

- 41% of men rate their finances positively, versus 32% of women.

These demographic differences among Hispanics echo differences among all U.S. adults.

Hispanics are also more likely to rate their current situation negatively than Americans overall (63% vs. 54%). But Hispanics are more optimistic about the future, with a higher share saying they expect their finances to improve (50% vs. 38%).

Latinos’ financial challenges and gains

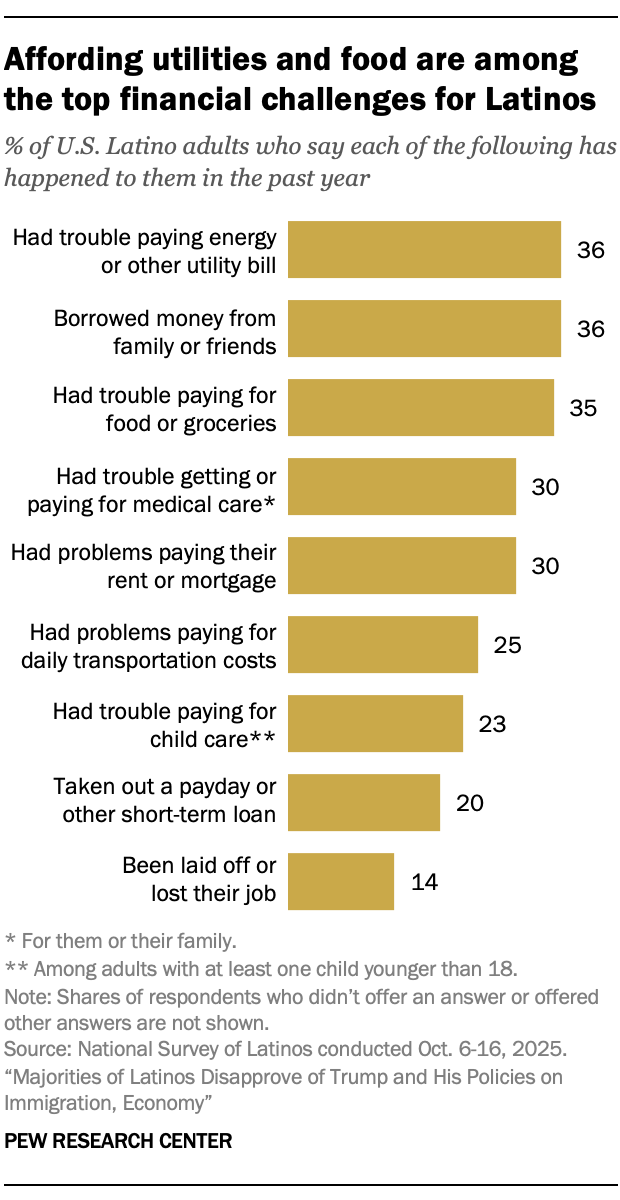

The survey also asked about specific financial challenges and gains Latinos have experienced in the last year.

Roughly a third of Latinos (36%) say they’ve borrowed money from family or friends in the last year. At least one-in-four also say they’ve struggled to afford daily necessities such as:

- Electricity or other utilities (36%)

- Food (35%)

- Medical care (30%)

- Housing (30%)

- Transportation (25%)

Notably, Latinos who work full time are just as likely as those who are unemployed to say they’ve struggled to pay for food, medical care and housing. For instance, 30% of full-time workers have had trouble paying their rent or mortgage in the last year, as have 33% of unemployed Latinos.

Still, some Hispanics have also had more positive financial experiences in the last year:

- 36% have been able to save money for the future.

- 25% have gotten a pay raise at their current job or gotten a better job.

Hispanic Republicans and Democrats are just as likely to say each of these experiences has happened to them in the past year.

Are Latinos prepared for financial emergencies?

One-in-three Latinos (33%) say they have emergency or rainy-day funds that would cover their expenses for three months in case of sickness, job loss, economic downturn or other emergencies.

Some groups of Latinos are more likely to have these funds than others:

- Older Latinos are more likely to have an emergency fund. About half of those 65 and older (47%) have this fund, compared with a quarter of adults under 30 (25%).

- Those with a college degree are more likely to have an emergency fund (53%) than those who have some college experience (38%) or a high school diploma or less (23%).

- Men are more likely than women to have an emergency fund (38% vs. 28%).

- Full-time workers are more likely than part-time workers to have an emergency fund (38% vs. 27%).

Similar shares of Latino Republicans and Democrats report having an emergency fund (36% and 33%, respectively).

This September, the unemployment rate among Hispanic workers ages 16 and older was 5.5%. This was higher than a year before, when the unemployment rate was 5.1%.11

Some Latino workers worry about job or pay loss if they have to take time off unexpectedly

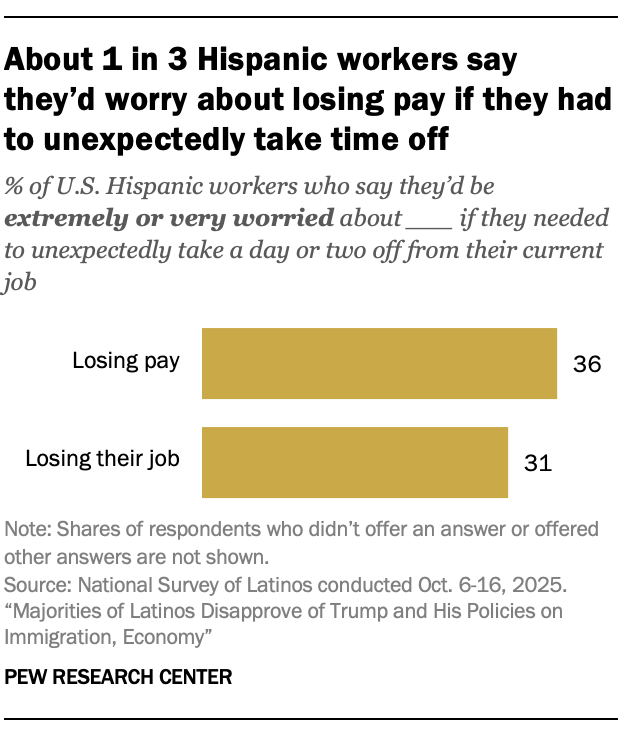

The survey also asked Latino workers how worried they would be about losing pay or losing their job if they had to unexpectedly take a day or two off. Some 36% would be extremely or very worried about losing pay while they take time off, and 31% would be extremely or very worried about losing their job.

This concern varies across some demographic groups of Hispanic workers:

- Part-time workers are more likely than full-time workers to be worried about losing pay (47% vs. 31%) and losing their job (37% vs. 29%) if they had to take time off.

- Women are more likely than men to say they’d be worried about losing pay (42% vs. 31%) and about losing their job (36% vs. 27%).

- Democrats are more likely than Republicans to say they’d be worried about losing pay (38% vs. 31%) and losing their job (35% vs. 24%).

- Adults under 50 are more likely than older Hispanics to be worried about losing pay (40% vs. 25%). Similar shares across age groups say they’d be worried about losing their job (32% and 29%).

Compared with other Americans, Latinos feel more at risk if they unexpectedly had to take leave from their jobs. Among workers:

- 31% of Latinos say they’d be worried about losing their job if they had to take time off, compared with 15% among all U.S. adults.

- 47% of Latinos say they wouldn’t be worried much or at all, compared with 67% among all U.S. adults.