Americans are broadly skeptical of the GOP’s far-reaching budget and tax bill, according to a Pew Research Center survey conducted June 2-8, 2025. The U.S. House of Representatives passed the bill in May, and the Senate is now considering it.

The legislation, officially titled the “One Big Beautiful Bill Act,” is President Donald Trump’s top legislative priority. But many Americans have doubts about it.

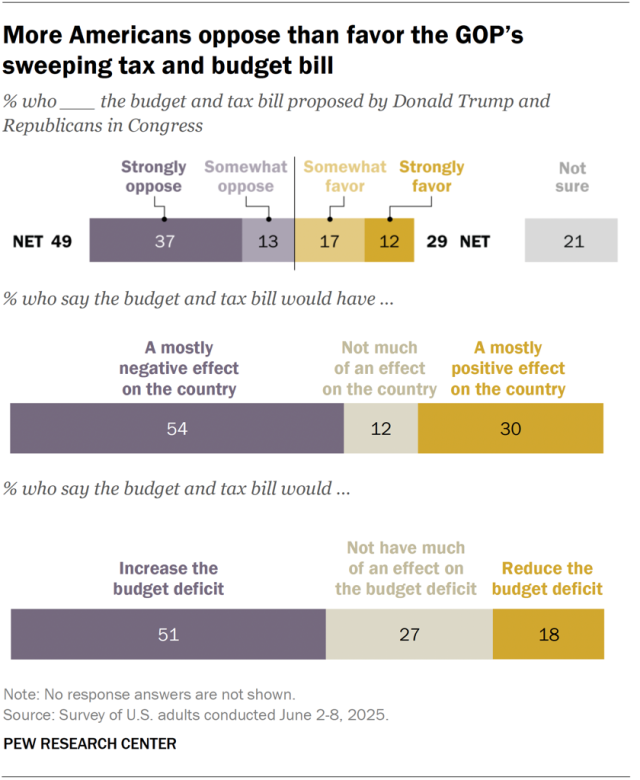

Far more Americans oppose the legislation than favor it. Nearly half (49%) oppose it, while 29% favor it. Another 21% are not sure.

A narrow majority says the legislation would have a negative impact on the country. While 54% say it would have a mostly negative effect on the country in the coming years, 30% say it would have a mostly positive effect. Another 12% think it would not have much of an impact.

About half (51%) expect the bill to increase the budget deficit. Just 18% of Americans say the bill would cut the deficit, and 27% say it would not have much of an effect.

Most Americans are doubtful they would benefit from the bill. While a majority says it would affect the country negatively, 47% say it would have a negative impact on them and their families. About a quarter (24%) expect its impact to be positive, while 26% say it would not have much of an effect.

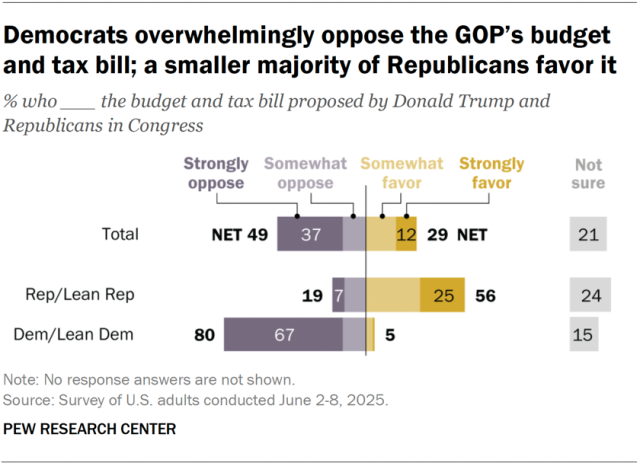

Opinions about the legislation are deeply partisan, though there is substantially more opposition among Democrats than support among Republicans.

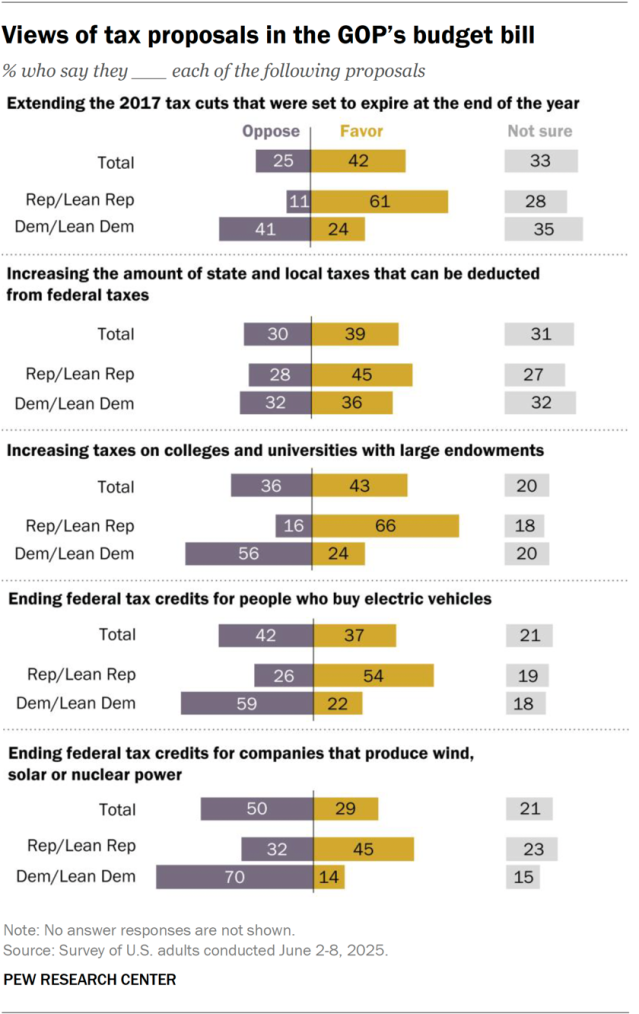

The public has a range of views toward specific proposals in the legislation, including changes to tax policy. There is more support than opposition for:

- Extending the 2017 tax cuts that are due to expire at the end of 2025

- Increasing the amount of state and local taxes (also known as SALT) that are deductible from federal taxes

- Increasing taxes on colleges and universities with large endowments

Who would the proposed legislation help – and hurt?

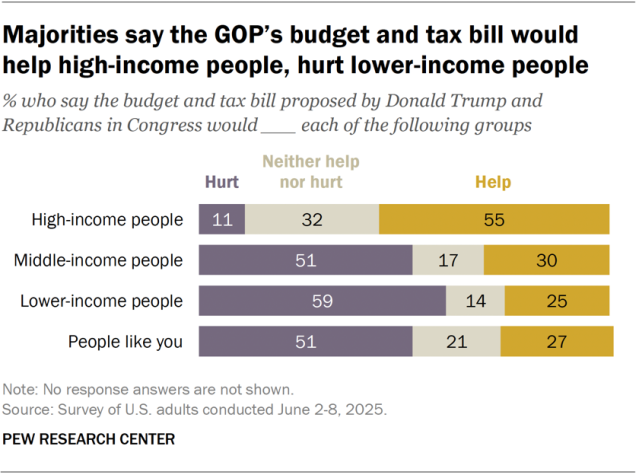

Americans expect the bill would result in greater benefits for high-income people than for those in other income groups.

A 55% majority says the bill would help high-income people, with 38% saying it would help them a lot. Only 11% say it would hurt high-income people, while 32% say it would neither help nor hurt them.

By contrast, 59% say it would hurt lower-income people and 51% think it would hurt middle-income people.

As far as the bill’s personal impact, more Americans say it would hurt (51%) than help (27%) people like them. Another 21% say it would neither help nor hurt.

Republicans and Democrats have very different perceptions of how groups would fare if the bill passed.

- Nearly three-quarters of Democrats and Democratic-leaning independents (73%) say the bill would help high-income people. Republicans and Republican leaners are more divided: 38% say it would benefit high-income earners, while 46% say it would not have an effect.

- Large majorities of Democrats also say the bill would hurt lower-income (88%) and middle-income people (77%). Roughly half of Republicans say it would help each of these groups (48% lower-income, 52% middle-income).

Wide partisan differences in views of the legislation and its likely effects

A 56% majority of Republicans say they favor the budget and tax bill, while 19% are opposed and 24% are not sure.

Democrats oppose the bill by an overwhelming margin (80% to 5%), with 15% not sure.

And their opposition to the bill is intense: Two-thirds of Democrats say they strongly oppose it. By comparison, just a quarter of Republicans strongly favor it.

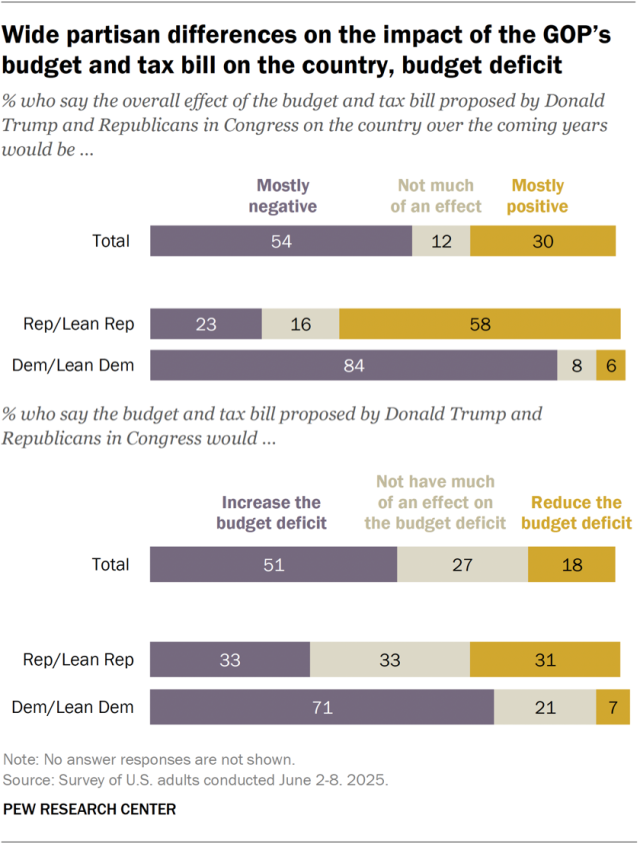

Similarly, 84% of Democrats say the bill’s effect on the country over the coming years would be mostly negative. A smaller majority of Republicans (58%) say it would have a mostly positive impact.

Republicans are nearly evenly divided on the bill’s impact on the budget deficit. About a third each say the bill would increase (33%), reduce (31%) or not have much impact (33%) on the deficit.

By contrast, 71% of Democrats say the bill would increase the deficit, while much smaller shares say it would either reduce the deficit (7%) or not have much of an effect (21%).

Views of tax changes in the bill

More Americans favor than oppose several tax policy changes in the bill, although significant shares also say they are not sure about each proposal we asked about:

Extending the 2017 tax cuts. About four-in-ten Americans (42%) favor extending these tax cuts, which are set to expire at the end of the year. A quarter are opposed, and a third are not sure.

Increasing the amount of SALT deductions. Nearly four-in-ten (39%) support increasing the amount of state and local taxes (also known as SALT) that are deductible from federal taxes. About three-in-ten each oppose the proposal or are not sure.

Increasing taxes on colleges and universities with large endowments. About four-in-ten Americans (43%) favor increasing taxes on these institutions, while 36% are opposed. Two-in-ten are not sure.

Americans are less favorable toward other tax policy changes in the bill:

Ending tax credits for electric vehicle purchases. Fewer than four-in-ten (37%) support ending federal tax credits for this, while 42% are opposed and 21% are not sure.

Ending tax credits for companies that produce wind, solar or nuclear power. Half of Americans are opposed to ending federal tax credits for these companies. Another 29% favor it, and 21% are not sure.

Related: Americans’ views of energy at the start of Trump’s second term

Partisan differences in support of tax policy changes

Republicans are much more likely than Democrats to favor four of the five tax proposals we asked about.

However, there are more modest partisan differences in views of increasing the amount of SALT deductions. While 45% of Republicans favor this, 28% are opposed. Among Democrats, 36% favor it and 32% oppose it.

Views of other possible policy changes

More Americans favor than oppose establishing work requirements for most adults who receive health insurance from Medicaid. Nearly half (49%) favor this, while 32% are opposed and 18% are unsure. (The bill passed by the House would establish work requirements for some, but not all, Medicaid enrollees.)

Americans are more divided on a proposal to provide additional funding for detaining and deporting immigrants who are in the U.S. illegally. More than four-in-ten (45%) are opposed, while 41% are in favor. Another 13% are not sure.

There also are wide partisan differences in views of these proposals. Large majorities of Republicans support establishing work requirements for most adults on Medicaid (68%) and increasing funding for deportations of immigrants who are in the country illegally (70%). Half of Democrats or more oppose each proposal.

Note: Here are the questions used for this analysis, the topline and the survey methodology.