There is a trendsetting technology elite in the U.S. who chart the course for the use of information goods and services.

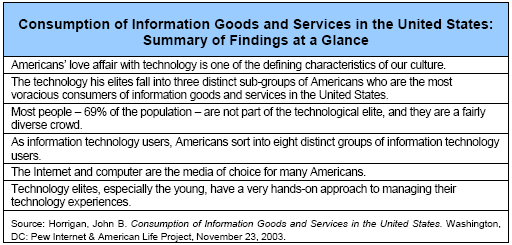

Americans’ love affair with technology is one of the defining characteristics of their culture.

For many Americans, having the latest electronic gadget or experimenting with the newest tech fad is a habit they develop at an early age and never break. Although these ardent technophiles are a minority of the population, their trendsetting ways often ripple widely in society. Many people, in time, wind up following the technological trail cleared by these pioneers. In fact, Americans have become steady adopters of devices and services that enable them to gather and distribute information, and these have given us flexibility in how we communicate, altered the patterns of how we stay in touch with others, and even influenced the content of our messages.

In this report, we take an inventory of the communications gadgets and services that American use and examine the variations within the population of technology users.

There is clearly a technology elite in the United States – the 31% of the population (Internet and non-Internet users alike) who are high-end technology adopters.

This elite comprises three distinct sub-groups of Americans who are the most voracious consumers of information goods and services in the United States.

- The Young Tech Elites make up one-fifth of the technology elite. The average age for this group is 22 years.

- Older Wired Baby Boomers make up the remaining one-fifth of the technology elite. The average age for these baby boomers is 52.

- Wired Generation Xers (GenXers) make up most of the technology elite (about 60%). The average age for this group is 36 years.

Technology elites in the United States have more than just a lot of technology, although they have plenty of that. For this group, the Internet, cell phone, digital videodisc player, and personal digital assistant are commonplace; many of them access the Internet wirelessly and are starting to pay for online content. What is distinctive about them is that new electronic communications technologies come first. They would rather do without their wireline telephone than their computer. For the Young Tech Elites, the cell phone is more important than the wireline phone, and email is as important as telephonic communication. For the Young Tech Elites, the Internet is a regular source for daily news and an indispensable element of their entertainment experience.

The tech elites are also very hands-on when it comes to their Internet experience. The tech elites choose what homepage comes up when they click on their browsers; they don’t let their Internet service providers (ISPs) do the choosing for them. They have switched ISPs before and, because they think ISPs differ in quality, they might switch again.

Most people – 69% of the population – are not part of the technological elite.

A lack of time, interest, and money seems to drive the relative tech apathy of this fairly diverse crowd. Some are young and seem to have neither the time nor the disposable income to dabble in cutting-edge technologies. Others appear to be devoting their energies to jobs and families, and therefore don’t immerse themselves in technology. The rest of those who are not ardently engaged with technology are older, mostly women who have lower incomes and are comfortable using older technology and media to get and exchange information.

As information technology users, Americans sort into eight distinct groups.

The typology of technology users developed for this report takes into account Americans’ use of information goods and services, attitudes about technology, online behavior, and demographic characteristics. To be specific, our October 2002 survey asked about the following goods and services: Internet, cable television, cell phones, computers, satellite dishes, premium television channels, pagers, digital videodisc players (DVDs), personal digital assistants (PDAs), and digital video recorders (DVRs). Here are the groups, listed from the most tech-intensive users to the least, starting with the three groups that comprise the technology elite in the United States:

The Trendsetting Tech Elite

- Young Tech Elites: Making up 6% of the U.S. population, these are the heaviest technology users. The average age in this group is 22 years and members are more likely to be male than female. All have Internet access, most have cell phones and DVD players (80% or more), and most are most engaged with the interactive aspects of the Internet, such as downloading music, creating online content, participating in online groups, or streaming audio and video clips. Their monthly spending on information goods and services averages $161.1

- Older Wired Baby Boomers: This group is 6% of the population, is mostly male, and has an average age of 52 years. These people spend the most money per month of any group (an average of $175), 100% have Internet access, and most (82%) have cell phones. They are very active information gatherers online, especially when it comes to news and work-related research, and they rate high when it comes to online transactions.

- Wired Generation Xers: This group comprises 18% of the U.S. population and a member of this cohort is as likely to be female as male. Relative to the other two groups in the tech elite, Wired GenXers have less online experience, but they have quickly embraced a wide range of information goods and services. All use the Internet and 82% have cell phones. They perform a range of online activities and are the second most active group (behind the Young Tech Elites) in pursuing the Net’s interactive features. They spend an average of $169 per month on information goods and services. The average age in this group is 36.

- Wired Senior Men: This is a very highly educated small cluster (1% of the sample) of mostly older men (average age is 70) who have a wealth of online experience, having been online for about 10 years. They limit their online activities to information gathering and some online transactions for ecommerce or finance.

Lower-tech groups

- Young Marrieds: This group is 15% of the population, with an average age of 24 years and evenly split between men and women. Two-thirds (66%) use the Internet and more than half (56%) have cell phones. Relative to the Young Tech Elites, this group is more likely to be married and have children and less likely to have a college degree. Their average monthly spending on information goods is $124.

- Low-Tech Older Baby Boomers: This other group of aging baby boomers has an average age of 54 years, is tilted toward women, makes up 21% of the population, and has a cell phone penetration rate that exceeds Internet penetration (60% to 51%). This group has lower-than-average educational and income levels and only a few years of Internet experience. Their average monthly spending on information goods is $124.

- Unwired Young Baby Boomers: This group makes up 16% of the population. Members of this group are slightly more likely to be women than men and the average age is 39 years. Internet penetration is modest (45%), but 69% have cell phones, which exceeds the national average. Their online habits are broad, but not as deep as others. Many in this group are married, have children, and are employed. They have a positive disposition toward information technologies, but not a lot of free time to devote to them. Their average monthly spending on information goods is $125.

- Low-Tech Elderly: Making up 16% of the population, more than half (58%) of this group is women and the average age is 73 years. Only 12% use the Internet, 39% have a cell phone, and much of their technology use is oriented to “old” media. Fully 68% subscribe to cable, 57% read the newspaper daily, and 78% watch TV news on the average day. The average monthly spending on information goods is $82.

The Internet and computer are the media of choice for many Americans.

Computers and the Internet are encroaching on the TV and the wireline telephone as important information and communication tools for a growing number of tech-loving Americans. Here is how the numbers look:

- Nearly three-quarters (74%) of the Young Tech Elites say it would be very hard for them to give up the computer, two-thirds (68%) say it would be very hard to give up the Internet, and 58% say it would be very hard to do without their cell phones. By contrast, 56% of the Young Tech Elites say it would be very hard to give up their telephones.

- Old media trail significantly for the Young Tech Elites. Not quite half (48%) say it would be very difficult to be without the TV, 37% say that about cable TV, and just 12% and 10%, respectively, say this about their newspapers and magazines.

- For older wired baby boomers, 64% say it would be very hard to give up the computer, with the telephone trailing modestly (57% say it would be very hard to give up their wireline telephones). About half of this group says it would be very hard to be without the TV, email, their cell phones, or the Internet (the numbers are 50%, 49%, 50%, and 55%, respectively, for these categories).

- The story is mixed for the wired GenXers. Two-thirds (67%) say it would be very hard to give up their wireline telephones, substantially more than say this about the cell phone (45%), the Internet (51%), computer (54%), and TV (46%).

- For remaining technology users in the United States – that is, people who do not fall into either of the elite categories but who use information technologies – the numbers are very different. The telephone and TV are the communication technologies these people feel would be difficult to do without; 63% say it would be very hard to give up the telephone and 48% say this about the TV. For newer technologies, less than one-third says it would be very hard to give up their cell phones (31%), the Internet (22%), or email (23%).

Technology elites, especially the young, have a very hands-on approach to managing their technology experiences.

They are choosy about their Internet service providers, have switched ISPs (some multiple times), and they choose the homepage that is displayed when they click on their browsers rather than accept the one the ISP provides. Technology elites also have clear ideas about the type of ISP they want.

- Five out of eight of the Young Tech Elites (62%) believe that one ISP is likely to be better than another. They are more than twice as likely to believe this than non-tech elites.

- Half (51%) of the Young Tech Elites have switched ISPs at least once since they first went online, and 41% of all Internet users have done this.

- Five in eight (64%) of the Young Tech Elites have switched from the homepage provided by their ISP to one of their choice. Only 30% of the non-tech elites have done this.

- When asked whether they would like an ISP that is a telephone company, a cable company, or an independent, half of the Young Tech Elites (50%) say they would prefer an ISP that is a cable company, 19% said an independent, and 16% said a telephone company.

- Non-tech elites reveal no strong preferences; 43% don’t know which they would choose, and the remainder is about evenly divided among preferring an independent, cable, or telephone company.

Use of emerging technologies

We asked about emerging technology behaviors such as connecting to the Internet wirelessly, paying for online content, or placing a phone call online. The Young Tech Elites dominate these activities, though wired GenXers are also likely to pay for content online.

- One in six (17%) of the Young Tech Elites has logged onto the Internet using a wireless Internet connection, compared with 6% of all Net users. Put differently, though they make up about 6% of the population, about one-quarter of all Americans who have gone online wirelessly are part of the Young Tech Elites.

- 13% of the Young Tech Elites have paid for online content such as subscriptions to Internet “zines” or music. This compares with 7% of the rest of the online population.

- 13% of wired GenXers have paid for online content.

- One in six (16%) of the Young Tech Elites has placed a telephone call online, twice the number for the rest of the online population and greater than the rate for other tech elites.

Wireline telephones

The plain old wireline telephone takes it on the chin from some of the Young Tech Elites.

- For cell phone subscribers (62% of all Americans), only a handful – just 3% – say that they have cancelled their wireline telephone in favor of using their cell phone exclusively.

- Though the impact is still modest for the Young Tech Elites, many more (9%) of these cell phone subscribers (and 80% of them have cell phones) have cancelled their wireline phones in favor of their cell phones.

- About one-fifth (21%) of all Americans with cell phones say they have “very” or “somewhat” seriously considered canceling a home telephone line since they got a cell phone. This number is the same whether respondents have one or multiple phone lines in the home.

- This trend is more pronounced for the three groups in the tech elite, especially those with one phone line. Among the tech elite with a single wireline phone in the house, 27% say they have “very” or “somewhat” seriously considered canceling a home telephone line since getting a cell phone.

- Should Americans, particularly the two-thirds with a single line in the house, follow through with their serious consideration of canceling home phone lines, one can imagine anywhere from 7% to 12% of U.S. households not having a wireline phone. A recent Federal Communications Commission rule requires phone companies to let people use their home number as their cell phone number; this may encourage people to cancel some or all of the wireline telephones into the home.

- The Internet’s overall impact on telephone calling is somewhat negative. One in five (19%) Internet users and a quarter of the Young Tech Elites say the Internet decreases the number of phone calls they make. Nine percent of all Americans (and 16% of the Young Tech Elites) say the Internet increases the number of phone calls they make.