164% increase in online banking since early 2000

The convenience of conducting business on the Internet has been a consistent theme in Pew Internet Project studies. Internet users pursuing health information, political news, and holiday gifts all cite convenience as a factor in their choice to go online to find what they are looking for. Internet users also say email helps them stay in touch with friends and family without having to spend so much time talking to them. And Internet users who have a high-speed connection at home take advantage of “always on” access to get more online tasks accomplished in a typical day than the average dial-up user.

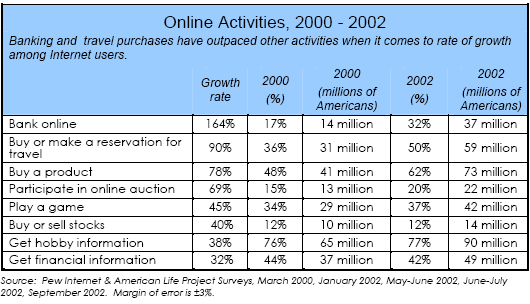

In March 2000, when we first asked about certain “convenience” activities like banking or making travel reservations online, not many Internet users had sampled them. Seventeen percent of Internet users (about 14 million Americans) had ever done any banking online. Thirty-six percent of Internet users (about 31 million Americans) had ever made a travel purchase online. We now find that 32% of Internet users (about 37 million Americans) have now done their banking online and 50% of Internet users (about 59 million Americans) have made a travel purchase online. Of all seventy activities we track, none have seen as much growth as online banking and online travel purchases.

When it comes to a “typical day” online, online banking has evolved into a fairly common task, nearly equal to instant messaging in its popularity. On a typical day in March 2000, 5% of Internet users conducted bank business online. On a typical day in September 2002, 10% of Internet users conducted bank business online (11% of Internet users IM on a typical day). By contrast, Internet users are no more likely to make travel purchases now than they did in March 2000 – about 1% of Internet users do this on a typical day.

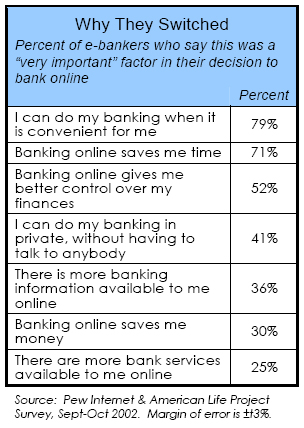

It is likely that convenience is not the only factor driving the popularity of online banking and travel purchases. Some users are using the Internet to save money – 30% of e-bankers say this was a “very important” reason why they decided to bank online. One online bank, NetBank, now charges $3 for each paper statement and many companies are strongly encouraging their customers to accept an electronic bill.1 Some airlines reward online consumers with special discounts – and reap the benefits of increased traffic to their Web sites.2 In both cases, the industry is educating consumers about Internet transactions by making them pay for off-line equivalents.

The rise in the popularity of online banking builds on the Federal Reserve’s recent report about a drop in the number of paper checks written by consumers. In 1995, the Fed processed 49.5 billion checks. In 2000, the Fed processed 42.5 billion checks – a 14% drop.3 Our numbers also match those of Internet users who enjoy the convenience of donating money to charities online. About one-third of online donors also do their banking and bill-paying online according to surveys conducted by Craver, Mathews, Smith & Company.4

Convenience is king

Convenience is the number one attraction for all online bankers, but younger Internet users are the most passionate about saving time. Eight out of ten (79%) e-bankers say that convenience was “very important” to their decision to first bank online – 82% of 30-49 year-old e-bankers agree, compared to 73% of 50-64 year-old e-bankers. Seven out of ten (71%) e-bankers say that the idea of saving time was “very important” to making that leap – 79% of 30-49 year-old e-bankers agree, compared to 66% of 50-64 year-old e-bankers.

The other reasons to switch to online banking elicited strong feelings from e-bankers, but they were consistent across the board. No one group felt more strongly than another about the advantages of better control over finances, not having to talk to anybody, getting more information, saving money, or using a wider menu of bank services online.

Online banking attracts younger, more educated group of Internet users

Men are somewhat more likely than women to bank online – 35% of male Internet users have done so, compared to 30% of female Internet users. Younger Internet users are more likely to be e-bankers – 33% of Internet users between 18 and 29 years old, 36% of Internet users between 30 and 49 years old, 27% of Internet users between 50 and 64 years old, and just 16% of Internet users age 65 and older have done it. Education and affluence are also associated with online banking. Forty-one percent of college graduate Internet users are e-bankers compared to 23% of Internet users with a high school degree. Forty-four percent of Internet users living in the highest-income households ($75,000 or more per year) have banked online, compared to 21% of Internet users living in the lowest-income households (less than $30,000 per year).

The longer someone has been online, the more likely they are to port their banking business to the Internet. Thirty-nine percent of those who have been online for four or more years have banked online, compared to 20% of those with two to three years of experience and 6% of those with one year of experience online. Internet users with a high-speed connection at home are also much more likely to bank online – 49%, compared to 30% of dial-up users.

E-banking stands apart from other online financial activities

While these demographics do not seem surprising at first glance, it is important to note that e-bankers do not fit neatly into our portrait of Internet financial services consumers. For example, while older Internet users (65 years or older) are the most likely to get financial information, like stock quotes, online, they are the least likely to bank online. More than half (52%) of wired seniors have gotten financial information online, compared to 28% of 18-29 year-old Internet users, but only 16% of wired seniors have banked online, compared to 33% of 18-29 year-old Internet users). And while men outpace women in gathering financial information (51% vs. 33%), women are nearly even with men when it comes to taking care of bank business online (35% vs. 30%). Also, while we have seen tremendous growth in the percentage of Internet users banking online, the percentage of Internet users seeking financial information online has held steady at about 42% since March 2000. And the same can be said for the e-trading crowd – while the Internet population has grown, the percentage of users who buy or sell stocks online has held steady at about 12% since March 2000.

E-banking also attracts a more diverse group of Internet users than other financial activities. When our summer and fall surveys are combined, to increase the number of respondents, we can say with relative certainty that online banking is equally popular with African American Internet users (30%) as it is with white Internet users (32%). And Hispanic Internet users are just as enthusiastic – 33% of them have done their banking online. It is interesting to note that minority Internet users, while taking part in online banking, are not as likely as white Internet users to get financial information online. While 44% of white Internet users have done this, 36% of African American Internet users and 34% of Hispanic Internet users have gotten financial information online.

Methodology

This report is based on the findings of a daily tracking survey on Americans’ use of the Internet. The results in this report are based on data from telephone interviews conducted by Princeton Survey Research Associates between September 9 and October 6, 2002, among a sample of 2,092 adults, 18 and older. For results based on the total sample, one can say with 95% confidence that the error attributable to sampling and other random effects is plus or minus 2 percentage points. For results based Internet users (n=1,318), the margin of sampling error is plus or minus 3 percentage points. In addition to sampling error, question wording and practical difficulties in conducting telephone surveys may introduce some error or bias into the findings of opinion polls.