How Black adults define personal and financial success, and the pressures they feel to achieve their goals

Pew Research Center conducted this study to explore Black Americans’ views on personal and financial success in the United States and their current assessments of their financial situation.

We surveyed 4,736 U.S. adults who identify as Black and non-Hispanic, multiracial Black and non-Hispanic, or Black and Hispanic. The survey was conducted from Sept. 12 to Sept. 24, 2023, and includes 1,755 Black adults on the Center’s American Trends Panel (ATP) and 2,981 Black adults on Ipsos’ KnowledgePanel.

Respondents on both panels are recruited through national, random sampling of residential addresses. Recruiting panelists by mail ensures that nearly all U.S. Black adults have a chance of selection. This gives us confidence that any sample can represent the whole population (see our Methods 101 explainer on random sampling). For more information on this survey, refer to its methodology and questionnaire.

The terms Black Americans and Black adults are used interchangeably throughout this report to refer to U.S. adults who self-identify as Black, either alone or in combination with other races or Hispanic identity.

Throughout this report, Black, non-Hispanic respondents are those who identify as single-race Black and say they have no Hispanic background. Black Hispanic respondents are those who identify as Black and say they have Hispanic background. Multiracial respondents are those who indicate two or more racial backgrounds (one of which is Black) and say they are not Hispanic.

In this report, immigrant refers to people who were not U.S. citizens at birth – in other words, those born outside the U.S., Puerto Rico or other U.S. territories to parents who were not U.S. citizens.

To create the upper-, middle- and lower-income tiers, respondents’ 2021 family incomes were adjusted for differences in purchasing power by geographic region and household size. Respondents were then placed into income tiers: Middle income is defined as two-thirds to double the median annual income for the entire survey sample. Lower income falls below that range, and upper income lies above it.

Throughout this report, Black adults with upper incomes are those who have family incomes in the upper-income tier. Black adults with middle incomes and Black adults with lower incomes have family incomes in the middle- and lower-income tier, respectively. For more information about how the income tiers were created, read the methodology.

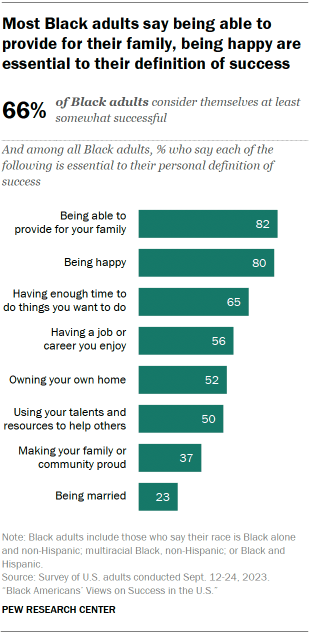

Most Black Americans consider themselves at least somewhat successful (66%). When asked to define what success means to them personally, 82% of Black adults point to the ability to provide for their family.

However, success isn’t exclusively related to financial achievements, a new Pew Research Center survey finds. Majorities of Black adults also cite quality-of-life measures such as personal happiness (80%), having enough time to do the things they want to do (65%) and having a job or career they enjoy (56%). A related analysis finds that most Black adults say they are at least somewhat happy and have enough time to do the things they want to do at least sometimes.

Roughly half of Black adults also say owning their own home (52%) and using their talents and resources to help others (50%) are essential to their personal definition of success.

Yet many of the measures Black adults use to define success are also major sources of pressure in their lives.

Among the pressures Black adults experience, the top two cited relate to personal finances: 71% say they face a great deal or fair amount of pressure to have enough money to do the things they want to do, and 68% say the same about being able to provide for their family.

Financial pressures are widespread among Black adults even when accounting for differences in family income.1

- 73% of Black adults with lower family incomes, 70% of those with middle incomes and 69% with upper incomes say they face a great deal or fair amount of pressure to have enough money to do the things they want to do.

- 70% of Black adults with lower incomes, 68% with middle incomes and 64% with upper incomes say the same about pressures to provide for their family.

- 53% of Black adults with lower incomes, 48% with middle incomes and 50% with upper incomes say they feel that pressure to own their own home.

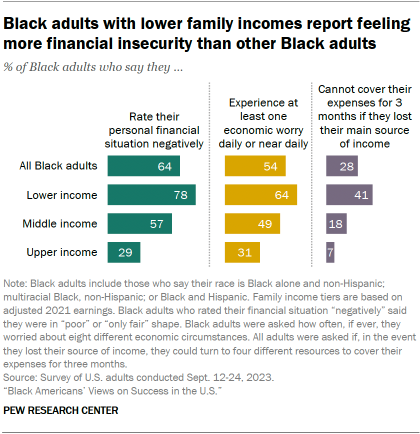

Although many Black adults experience similar levels of financial pressure, particular subgroups experience more financial insecurity than others. For example, Black adults with lower family incomes are more likely than those with middle or upper incomes to rate their personal financial situation negatively (78% vs. 57% and 29%, respectively).

Similarly, Black adults with lower incomes are more likely than those with middle or upper incomes to experience economic worries on a daily or near daily basis (64% vs. 49% and 31%). They are also more likely to say that if they lost their main source of income, they could not cover three months’ worth of expenses using several financial means we asked about (41% vs. 18% and 7%).

Black Americans’ assessment of their financial situation today

While national economic conditions improved some in 2023, inflation slowed and unemployment rates hovered near record lows, Black Americans are downbeat about their financial situation. Overall, 64% of Black adults rate their personal financial situation negatively, or in only fair or poor shape.

The new survey also finds many Black adults are not financially prepared for the sudden loss of their main source of income. We asked if they could use four different resources to cover expenses for three months if they lost their income: personal savings, credit cards, loans from family or friends, or the value of their assets.

- 45% say they could cover their expenses for three months with personal savings.

- 37% say they could borrow from family or friends.

- 28% say they would not be able to use any of the four resources we asked about to cover three months’ expenses.

Additionally, a majority of Black adults experience at least one of eight financial worries on a daily or near daily basis.

- Roughly three-in-ten worry about paying their bills (31%), the amount of debt they have (29%), and being able to save enough for their retirement (28%) on a daily or near daily basis.

- 24% worry about being able to buy enough food for themselves and their family every day or almost every day.

- 54% worry about at least one economic concern either every day or almost every day, such as paying bills, the amount of debt they hold, saving for retirement, and being able to buy enough food for their families.

In 2022, Black households had the lowest median income out of all racial and ethnic groups in the United States, at $52,860, according to the Census Bureau. And while Black household wealth rose during the pandemic, it remains significantly lower than other racial or ethnic groups’. Notably, 24% of all single-race, non-Hispanic Black households had no or negative wealth in December 2021, despite gains during the pandemic.

Earlier Pew Research Center findings show that Black Americans typically experience higher levels of economic insecurity than other Americans, are increasingly dissatisfied with capitalism, and believe the economic system in the U.S. does not treat Black people fairly. Nonetheless, Black adults are optimistic about their financial futures.

How Black Americans define financial success

No matter their financial situation, Black Americans define financial success in many ways. Among Black adults:

- Roughly two-thirds say being debt-free (67%) and having enough money to do the things they want to do (65%) are essential to their definition of financial success.

- About half (49%) say the same about owning a home.

- Fewer than half say being able to pass down financial assets to future generations (44%), having multiple streams of income (43%), being able to retire early (35%), or owning a business (22%) are essential to their definition of financial success.

For this report, we surveyed 4,736 Black adults in the U.S. from Sept. 12 to 24, 2023, in English and Spanish, to find out how they view personal and financial success in America, and to learn about the economic challenges they experience.

The following chapters take a closer look at:

How Black Americans view personal success

How Black Americans view financial success and the financial challenges they experience