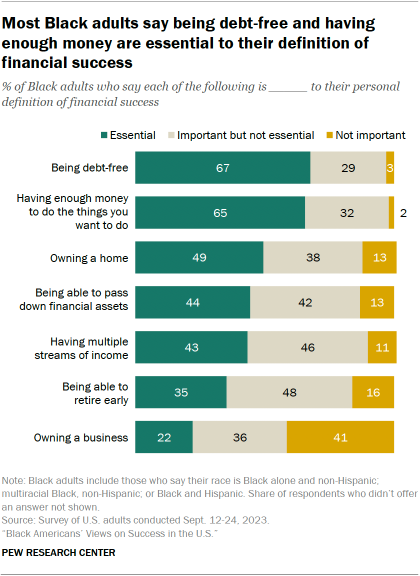

Black adults are clear on their financial goals and priorities, with majorities saying being debt-free (67%) and having enough money to do the things they want to do (65%) are essential to their personal definition of financial success.

Defining financial success

Majorities of Black adults say being debt-free (67%) and having enough money to do the things they want to do (65%) are essential to their personal definitions of financial success.

Roughly half say the same about owning a home (49%), while about four-in-ten say this about being able to pass down financial assets (44%) and having multiple streams of income (43%). Smaller shares say being able to retire early (35%) or owning a business (22%) are essential in defining financial success.

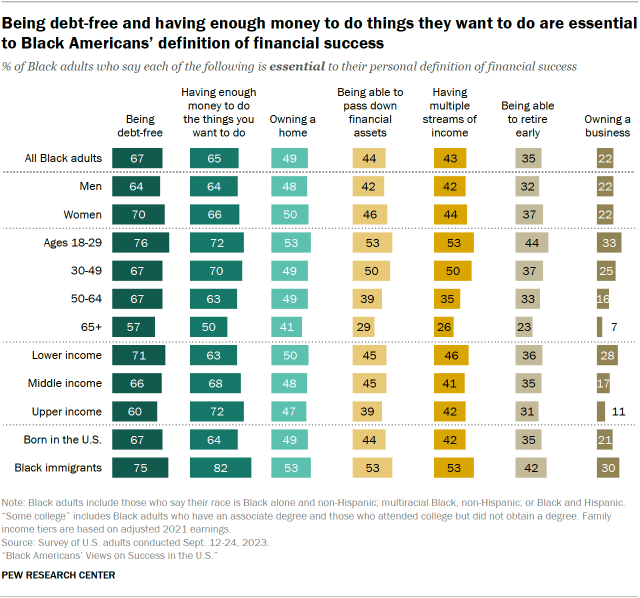

By gender

Black women are more likely than Black men to say being debt-free, being able to pass down financial assets and being able to retire early are essential to their personal definition of financial success.

By age

Overall, Black adults ages 18 to 29 are more likely than older Black adults to say being debt-free and owning a business are essential to their personal definition of success. Meanwhile, Black adults under 50 are more likely than older Black adults to say nearly all of these measures are essential to their definition of financial success. Black adults 65 and older are less likely than younger Black adults to say any of these measures are essential to financial success.

By income

Black adults with lower levels of family income are more likely than those with middle or upper incomes to say being debt-free and owning a business are essential to their personal definition of financial success. Black adults with middle and upper incomes are more likely than those with lower incomes to cite having enough money to do things they want to do as an essential measure of financial success.

By nativity

Black immigrants are more likely than Black adults born in the U.S. to say being debt-free, having enough money to do the things they want to do, being able to pass down financial assets, having multiple streams of income and owning a business are essential to their personal definition of financial success.

Financial challenges Black Americans experience

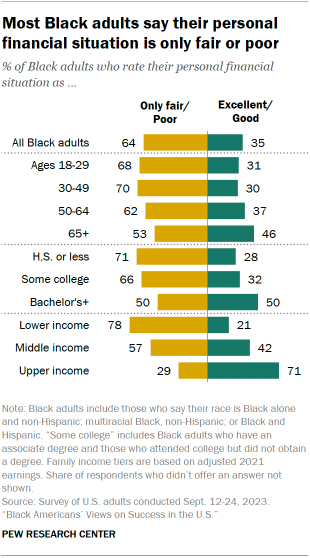

Most Black adults rate their personal financial situation negatively (64%). More than half experience at least one economic worry every day or almost every day (55%), and roughly three-in-ten (28%) say they wouldn’t be able to cover their expenses for three months if they lost their main source of income.

Personal financial situation

Majorities of Black adults (64%) rate their personal financial situation as only fair or in poor shape, while fewer than four-in-ten (35%) say their financial situation is excellent or in good shape.

By age

Black adults under 50 are more likely than those 50 and older to rate their financial situation negatively.

By education

Black adults with a high school diploma or less education and those with some college education are more likely than those with a bachelor’s degree or higher to rate their personal financial situation negatively.

By income

Black adults with lower levels of income are more likely than those with middle or upper incomes to rate their financial situation negatively. About one-third of Black adults with upper incomes rate their personal financial situation negatively.

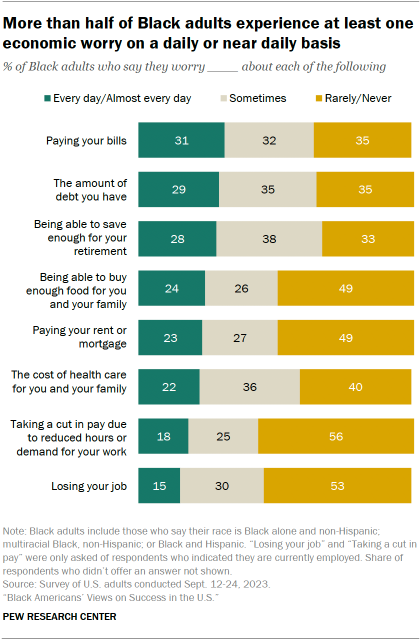

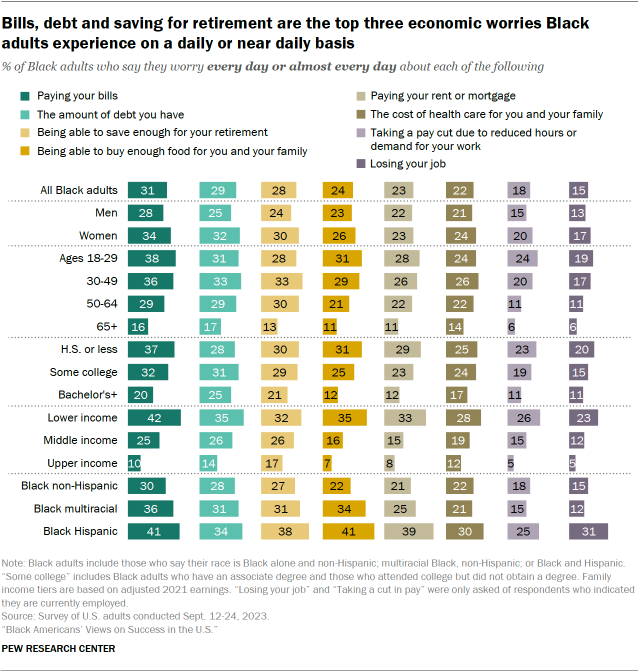

Economic worries

Nearly three-in-ten Black adults say they worry daily or almost daily about paying their bills (31%), the amount of debt they have (29%) and being able to save enough for their retirement (28%). Roughly one-quarter say the same about being able to buy enough food for themselves and their family (24%) or paying their rent or mortgage (23%). And 22% say they worry daily or almost daily about the cost of health care for themselves and their family.

Among employed Black adults, 18% worry about taking a cut in pay due to reduced hours or demand for their work and 15% worry about losing their job.

More than half of Black adults (54%) experience at least one of these economic worries on a daily or nearly daily basis.

By gender

Black women are more likely than Black men to experience daily or near daily worries about paying their bills, the amount of debt they have, saving for retirement, taking a cut in pay due to reduced hours or demand for their work, and losing their job.

By age

Black adults under 65 are more likely than those 65 and older to experience each of these economic worries on a daily or almost daily basis.

By education

Black adults with a high school diploma or less education and those with some college experience are more likely than those with at least a bachelor’s degree to experience nearly all of these economic worries on a daily or almost daily basis.

By income

Black adults with lower levels of income and those with middle incomes are more likely than those with upper incomes to experience each of these economic worries either every day or almost every day.

By ethnicity

Black Hispanic adults are more likely than Black, non-Hispanic and multiracial Black adults to experience daily or near daily worries about paying their rent or mortgage and losing their job. They are also more likely than non-Hispanic Black adults to worry every day or almost every day about paying their bills, being able to save enough for retirement, and being able to buy enough food for themselves and their family.

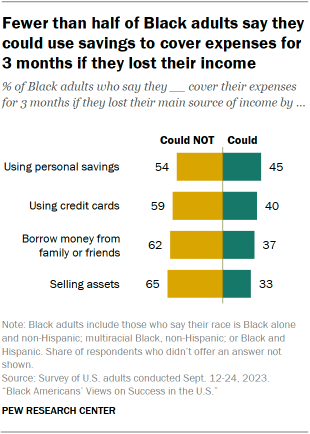

Financial preparedness

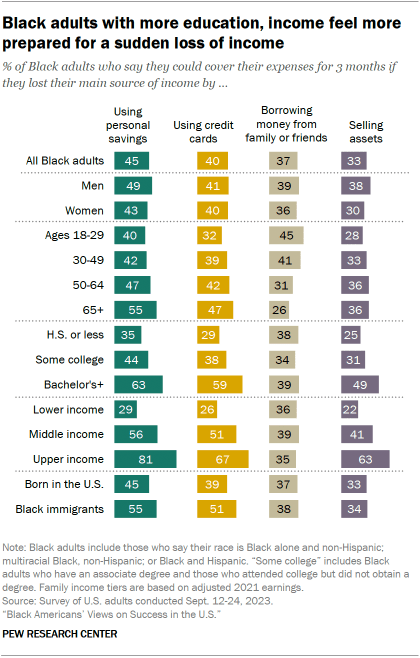

Seven-in-ten Black adults are financially prepared to cover their expenses for three months if they were to lose their main source of income, either by using personal savings, using credit cards, borrowing money from family or friends, or selling assets. Roughly three-in-ten (28%) say they could not rely on any of these resources to cover three months of expenses.

By gender

Black men are more likely than Black women to say they could cover their expenses for three months by using personal savings and selling assets.

By age

Black adults under 50 are more likely than those 50 and older to be able to cover their expenses by borrowing money from family or friends. Meanwhile, Black adults 50 and older are more likely than younger Black adults to be able to cover their expenses by using credit cards or personal savings and selling assets.

By education

Black adults with at least a bachelor’s degree are more likely than those with less education to be able to cover their expenses for three months by using credit cards or personal savings and selling assets.

By income

Black adults with upper levels of income are more likely than those with lower or middle incomes to be able to cover their expenses for three months by using personal savings, using credit cards or selling assets. Similar shares of Black adults with lower, middle and upper incomes say they could borrow money from family or friends.

By nativity

Black immigrants are more likely than Black adults born in the U.S. to be able to cover their expenses for three months in the event of job loss by using credit cards and personal savings.