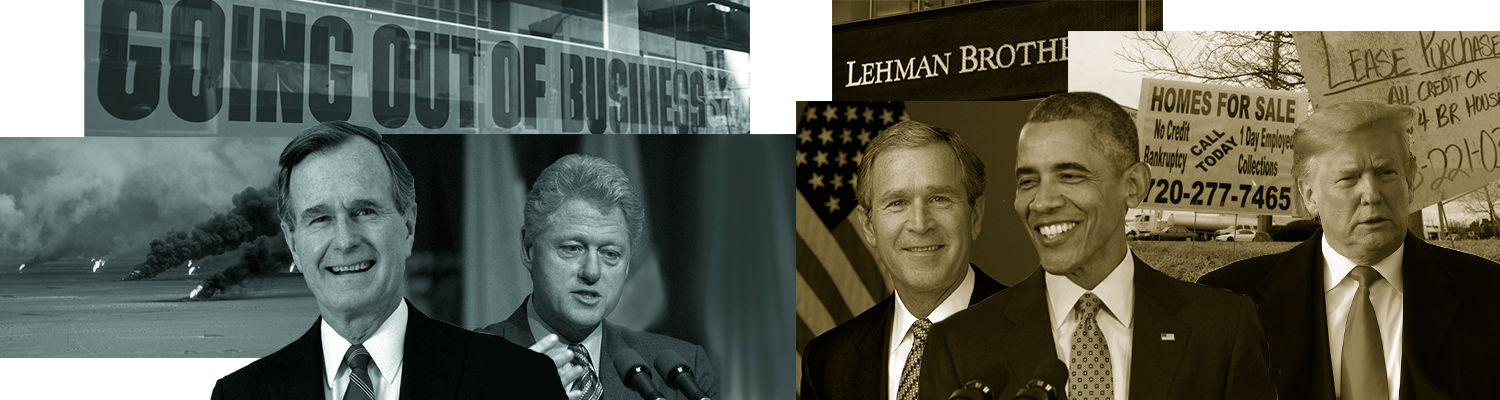

Two Recessions, Two Recoveries

Compare the two longest episodes in U.S. history with our interactive tool

The Great Recession of 2007-2009 was one of the deepest downturns of the U.S. economy since World War II. Triggered by crises in the housing and financial markets, the recession evokes memories of homes in foreclosure, the collapse of Lehman Brothers, and bailouts for businesses in the auto, banking and financial sectors.

The subsequent expansion began in July 2009 and is now at 125 months and counting, making it the longest economic recovery dating back to the mid-19th century. Yet, homeownership and family wealth are struggling to rebound, and the presidential campaigns of Sens. Bernie Sanders and Elizabeth Warren manifest growing concern with economic inequities. A leading economist has labeled this an era of “secular stagnation.”

This is different from the more optimistic public mood of the 1990s, the only other time the U.S. experienced a decade-long economic expansion. Following a recession that coincided with the Gulf War of 1990-1991, the expansion sent the homeownership rate and family wealth on the way to record highs. Even as the public was witness to the dot-com bubble and the rise of AOL millionaires, the Occupy Wall Street movement would not emerge for another decade. Alan Greenspan, then chairman of the Federal Reserve, seemed to find the mood too buoyant, warning of “irrational exuberance.”

The labor force consists of people 16 and older who are either employed or unemployed (people without a job who are looking and available for work).

The labor force participation rate is the share of the working-age population (ages 16 and older) that is in the labor force.

The employment rate is the share of the working-age population that is employed.

The unemployment rate is the share of the labor force that is unemployed.

Household income is the sum of incomes received by all members of the household ages 15 and older. Income is the sum of earnings from work, capital income such as interest and dividends, rental income, retirement income, and transfer income (such as government assistance) before payments for such things as personal income taxes, Social Security and Medicare taxes, union dues, etc. Non-cash transfers, such as food stamps, health benefits, subsidized housing and energy assistance, are not included. More detail on the measurement and collection of data on income is available from the Census Bureau.

The data for this analysis are derived from the Current Population Survey (CPS). Conducted jointly by the U.S. Census Bureau and the Bureau of Labor Statistics, the CPS is a monthly survey of approximately 55,000 households and is the source of the nation’s official unemployment statistics. Estimates of the unemployment rate, employment rate and the labor force participation rate are derived on a quarterly basis by combining three monthly CPS surveys. This allows for larger sample sizes of smaller demographic groups, such as Asian workers.

Estimates of household income are from the CPS Annual Social and Economic Supplements (ASEC), which is conducted in March of every year and is the basis for the Census Bureau’s reports on income and poverty in the United States. The ASEC surveys collect data on the income of a household for the preceding calendar year. For example, the latest ASEC was conducted in 2019 and contains data on income from 2018.

The 2015 ASEC used a redesigned set of income questions, so the household income figures reported for calendar years 2014 to 2018 may not be fully comparable to earlier years. The 2014 ASEC tested the new redesigned income questions by asking the traditional income questions of five-eighths of the sample and the redesigned questions of the remaining three-eighths of the sample. Median household income for calendar year 2013 was $53,585 (in 2013 dollars) based on the redesigned income questions compared with an estimated $51,939 using the traditional income questions. The difference reflects both the different questionnaire and the different sampled households responding to the questionnaires.

Methodological revisions in the CPS may also have an impact on the trends in household income. In particular, the 1993 revisions have an impact on the comparability of income data before and after that date.

The sample for the analysis consists of the civilian, non-institutionalized population ages 16 and older.

Estimates of household income refer to the calendar year. Household incomes are adjusted for household size, scaled to reflect three-person households, and expressed in 2018 dollars using the Consumer Price Index Research Series (CPI-U-RS).

Estimates of the unemployment rate, employment rate and the labor force participation rate are for the first quarter of each year from 1989 to 2001 and for the second quarter of each year from 2007 to 2019, non-seasonally adjusted. The 1990-1991 recession lasted from July 1990 to March 1991, with the ending aligned with the first quarter of 1991. The Great Recession lasted from December 2007 to June 2009, with the ending aligned with the second quarter of 2009. Drawing comparisons across the same quarter in each year avoids the effect of seasonal fluctuations.

The CPS microdata used in this report are the Integrated Public Use Microdata Series (IPUMS) provided by the University of Minnesota. The IPUMS assigns uniform codes, to the extent possible, to data collected in the CPS over the years. More information about the IPUMS, including variable definition and sampling error, is available at http://cps.ipums.org/cps/documentation.shtml.

Graphics by Michael Keegan and Chris Baronavski