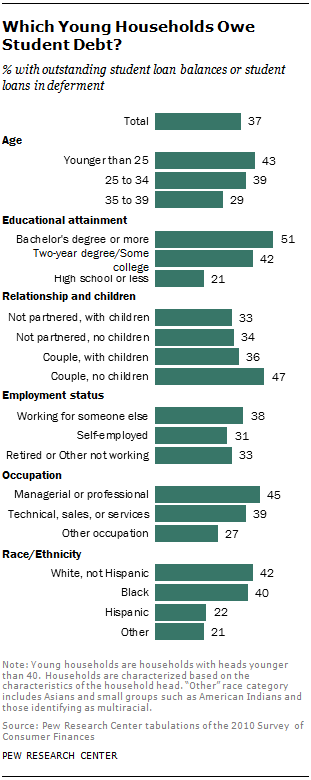

Among all households with heads younger than 40, 37% had outstanding student loans in 2010. Student debtor households tend to be younger. Among households in which the household head is younger than 25, 43% have outstanding student loan debt. Some 39% of households in which the household head is between the ages of 25 and 34 owe student debt, as do 29% of households headed by someone ages 35 to 39.

Not surprisingly, households owing student debt tend to be better educated and have higher occupational status than other young households. Among all young households, half (51%) of those in which the household head has at least a bachelor’s degree owe student debt. By comparison, only 21% of households with no education beyond high school owe student debt.

Occupational differences are also apparent. Among young households headed by a manager or professional, 45% have some student debt. In contrast among young households headed by an individual in the other occupational category (including operators, laborers, farmers, and production/craft/repair workers) only 27% owe student debt.

College graduates are more likely than less-educated adults to be married or be living with a partner. Thus, in examining student debt by family structure, households headed by a married or cohabiting person without children (47%) are significantly more likely to owe student debt than households headed by those without a partner (about a third owe student debt).

Among racial and ethnic groups, young white and black households are most likely have education debt (42% and 40%, respectively), and young Hispanic households are about half as likely to owe such debt (22%).

The Assets of Student Debtors

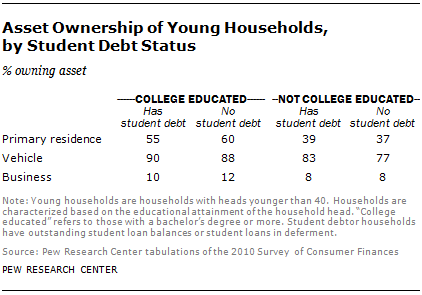

Prior economic studies have examined the relationship between student debt and ownership of assets on the basis of credit report data (Brown and Caldwell, 2013). The limitation here is that credit report data do not directly measure asset ownership, while the Survey of Consumer Finances possesses detailed information on both nonfinancial and financial asset ownership. The most recent survey does not provide strong evidence that young student debtors are less likely to own homes or cars.

Among households headed by those who do not at least have a bachelor’s degree, student debtors tend to be more likely to own a vehicle. Otherwise, there are not many differences in asset ownership between student debtors and student debt-free households.