Overview

Public dissatisfaction with the tax system has grown over the past decade, and the focus of the public’s frustration is not how much they themselves pay, but rather the impression that wealthy people are not paying their fair share.

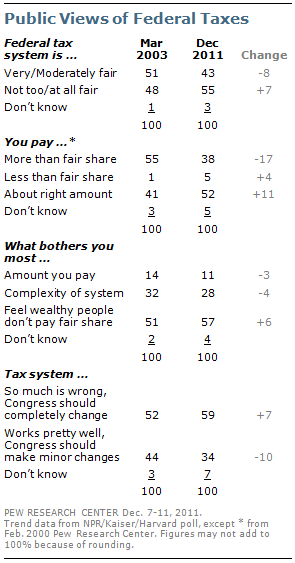

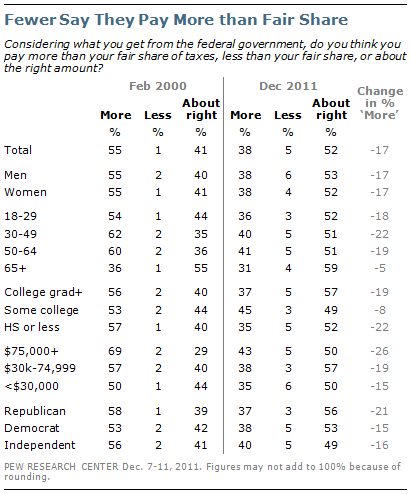

The number of Americans who feel they pay more than their fair share in federal taxes has dropped significantly over the past decade, from 55% in 2000 to 38% today. About half (52%) now say they pay the right amount in taxes. Yet at the same time, fewer see the overall tax system as even moderately fair (43%, down from 51% eight years ago), and roughly six-in-ten (59%) say that so much is wrong with the tax system that Congress should completely change it.

The latest national survey by the Pew Research Center for the People & the Press, conducted Dec. 7-11, 2011 among 1,521 adults, finds that this sense of unfairness centers on the perception that wealthy Americans are not paying their fair share of taxes; 57% say this is what bothers them most about the tax system, while half as many (28%) point to the complexity of the system, and just 11% say that the high amount they have to pay is what bothers them the most.

Republicans and Democrats agree on the need for tax reform; majorities across party lines see the system as unfair and in need of a complete overhaul. Yet they differ substantially in their concerns, with Democrats overwhelmingly pointing to the share wealthy people pay as the biggest concern, while many Republicans identify the complexity of the system as the biggest problem.

Points of Partisan Agreement, Division

While Republicans and Democrats often take opposing positions on policy questions about taxes, they agree on several key evaluations of the performance of the tax system and the amount they themselves pay.

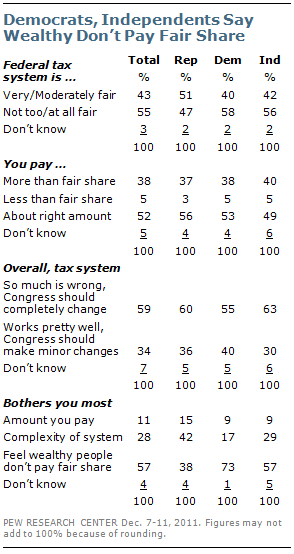

Across party lines, relatively few feel that they are required to pay more than their fair share in federal taxes. Instead, most Republicans (56%) and Democrats (53%) say that, considering what they get from the federal government, they pay about the right amount in taxes, and a slim plurality of independents agree (49%).

There is also no partisan divide in the need for an overhaul of the tax system, with majorities in all partisan groups saying there is so much wrong with the federal tax system that Congress should completely change it.

Where partisans diverge is over the question of what bothers them most about taxes. A broad majority of Democrats (73%) along with 57% of independents say the feeling that some wealthy people get away with not paying their fair share is their biggest complaint about taxes. By contrast, about as many Republicans say the complexity of the system is their biggest complaint (42%) as say wealthy people don’t pay their fair share (38%). Very few Republicans, Democrats or independents cite the amount they themselves pay as their chief complaint about taxes.

Democrats and independents also differ somewhat from Republicans in views of the overall fairness of the system. Majorities of Democrats (58%) and independents (56%) say the tax system is not too or not at all fair. While 47% of Republicans say the system is unfair, about as many (51%) say it is very or moderately fair.

Household Income and Views of Taxes

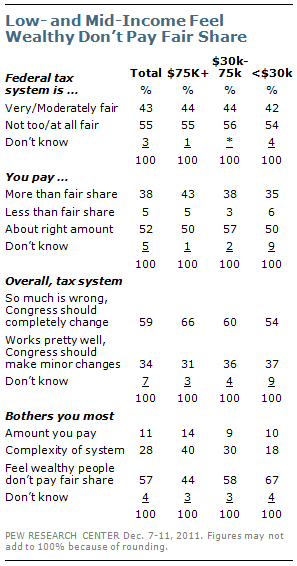

While federal taxes affect higher- and lower-income Americans in different ways, there is remarkable agreement on several fundamental questions about taxes across income groups. Comparable majorities at all income levels say that the federal tax system is not fair. And there is similar agreement that there is so much wrong with the tax system that Congress should completely change it.

Fewer than half in any income bracket complain that their own taxes are too high. Whether one’s income is over $75,000, less than $30,000, or somewhere in between, half or more say they are paying about the right amount in taxes. And when asked what bothers them most about taxes, very few in any income group say the amount they themselves have to pay is their greatest concern.

But households of different incomes offer different complaints about the way the tax system is structured. Two-thirds (67%) of those in less-affluent households say what bothers them most about taxes is the feeling that some wealthy people don’t pay their fair share. Most (58%) with incomes between $30,000 and $74,999 agree. This falls to just 44% of those earning $75,000 or more annually.

Instead, those in higher-income households are more likely to point to the complexity of the tax system as their biggest complaint – 40% say this bothers them most, compared with just 18% of people with incomes under $30,000.

Republicans Divided over Tax Concerns

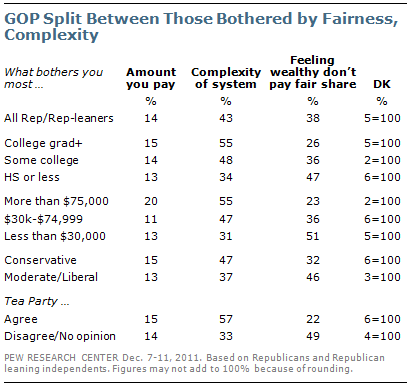

When it comes to what bothers them most about the federal tax system, Republicans and Republican-leaning independents are split between those who cite the complexity of the tax system (43%) and those worry that wealthy people are not paying their fair share (38%). This overall division reflects substantial intra-party differences along socioeconomic and ideological lines.

By more than two-to-one, most Republicans with college degrees and those in households earning more than $75,000 a year say the complexity of the system is what bothers them most about taxes. By contrast, Republicans with no college experience and those in households earning less than $30,000 a year are more likely to say the feeling that some wealthy people don’t pay their fair share is what bothers them most.

Republicans who agree with the Tea Party movement are among the most likely to say the complexity of the tax system is what bothers them most – 57% say this. Among Republicans who do not agree with the Tea Party, 49% say the feeling that some wealthy people don’t pay their fair share is their biggest complaint about taxes; just 33% cite the complexity of the tax system.

Fewer Feel Overtaxed

Over the past decade, there has been a dramatic decline in the percentage saying they pay more than their fair share in federal taxes. In February 2000, 55% said they paid more than their fair share, considering what they got from the federal government; 41% said they paid about the right amount and just 1% said they paid less than their fair share.

In the current survey, only 38% say they pay more than their fair share – a 17-point decline. Most now say they pay the right amount in taxes (52%), considering what they get from the federal government; very few continue to say they pay less than their fair share (5%).

The decline in the percentage saying they pay more than their fair share in taxes has occurred across most demographic groups. Double-digit declines have taken place among Democrats and Republicans as well as among households of all income levels. But the drop has been particularly steep among higher-income households, narrowing what had been a wide income difference. In 2000, people with higher incomes ($75,000 or more) were 19 points more likely than those with lower incomes (under $30,000) to believe they paid more than their fair share in taxes (69% vs 50%). Today, that gap has narrowed to just eight points (43% vs. 35%), with half in each group saying they pay about the right amount in taxes.