As analysts start to consider what an economic recovery might look like and who is likely to benefit, disparities across income groups in the United States come into stark relief – particularly when it comes to those who own stocks and those who do not.

About one-third of U.S. adults (35%) said they personally owned stocks, bonds or mutual funds outside of retirement accounts in a Pew Research Center survey from September 2019. And upper-income Americans were much more likely than lower-income Americans to be invested in the market.

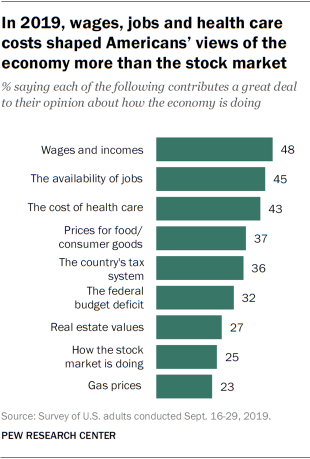

That same survey found that more Americans said wages, the availability of jobs and the cost of health care mattered in their assessment about how the economy is doing, rather than how the stock market is performing. To be sure, the labor market, the health care system and the stock market have been shaken over the past six months. For those who have experienced job or wage loss during the coronavirus pandemic, the job situation may be even more top of mind now.

During much of the pandemic, the stock market has seemed like it is on a different trajectory than the economy overall, carrying implications for how Americans are faring during the downturn. To explore what this means to Americans across income tiers, we drew on a survey of 6,878 U.S. adults from Sept. 16-29, 2019, in order to analyze who is invested in the market and whether people see its performance as a good measure of the economy. Everyone who took part is a member of Pew Research Center’s American Trends Panel (ATP), an online survey panel that is recruited through national, random sampling of residential addresses. This way nearly all U.S. adults have a chance of selection. The survey is weighted to be representative of the U.S. adult population by gender, race, ethnicity, party affiliation, education and other categories. Read more about the ATP’s methodology.

To create the upper-, middle- and lower-income tiers, family incomes were adjusted for differences in purchasing power by geographic region and for household size. Respondents were then placed into income tiers using a similar methodology to the Center’s previous work on the American middle class: Middle income is defined as two-thirds to double the median annual income for the survey sample. Lower income falls below that range, and upper income falls above it.

Here are the questions used for the report, along with responses. For more information about how the survey was conducted and how the income tiers were created, see its methodology.

Overall, in 2019, more than four-in-ten Americans pointed to wages and incomes (48%), the availability of jobs (45%) and health care costs (43%) as contributing a great deal to their overall opinion about how the economy is doing. Roughly one-quarter or fewer said real estate values (27%), how the stock market is doing (25%) and gas prices (23%) contributed a great deal to shaping their views of the economy.

Americans differ by party in the factors that contribute to their ratings of the economy. For example, Republicans and independents who lean to the Republican Party (53%) were more likely than Democrats and Democratic leaners (39%) last year to say the availability of jobs contributed a great deal to their opinion about how the economy is doing. Democrats, on the other hand, were more likely than Republicans to point to the cost of health care as having a big impact on their economic ratings (55% of Democrats vs. 28% of Republicans said this). And while Republicans were somewhat more likely than Democrats to see the stock market as a good indicator for how the economy is doing, relatively small shares of both groups said this (29% of Republicans vs. 22% of Democrats).

Among Republicans, perceptions of the stock market as an economic indicator differ by income. Republicans in upper-income households (37%) were much more likely than middle-income (29%) or lower-income Republicans (21%) to say the stock market contributed a great deal to their opinion of how the economy is doing. Among Democrats, there were not differences on this measure by income level.

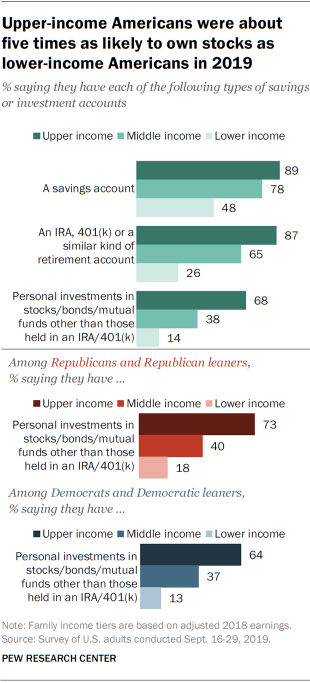

Across parties, upper-income Americans were much more likely than lower-income Americans to own stocks, bonds

About one-third of Americans (35%) said they were personally invested in stocks, bonds or mutual funds other than those held in an IRA or 401(k) in 2019. More Americans were invested in an IRA, 401(k) or similar kind of retirement account (55%) or had a savings account (69%).

Upper-income Americans were especially likely to have each of these financial holdings. About nine-in ten upper-income Americans had savings (89%) and retirement accounts (87%), and 68% had stocks or other personal investments. In fact, upper-income Americans were about five times as likely to own stocks as lower-income Americans (68% vs. 14%).

While Republicans (40%) were slightly more likely than Democrats (32%) to be invested directly in the stock market, there were wide income differences within each of the party coalitions. Among Republicans, 73% of those with higher incomes owned stocks, compared with 18% of those in lower-income households. There was a similar divide among Democrats, though upper-income Republicans were more likely than upper-income Democrats to be invested in the market (73% vs. 64%).

Lower-income Americans, many of whom do not have investments in the stock market, have been the hardest hit by the economic fallout related to the coronavirus pandemic. According to a recent Pew Research Center survey, 46% of lower-income adults say they have had trouble paying their bills since the pandemic started, and a similar share say they or someone else in their household has lost a job or taken a cut in pay because of the coronavirus outbreak.

Note: Here are the questions used for the report, along with responses, and its methodology.