Student debt is the only kind of household debt that continued to rise through the Great Recession, eclipsing credit card debt to become the second largest type of debt owed by American households, after mortgages. According to a new Pew Research report, a record 37% of young households had outstanding student loans in 2010, up from 22% in 2001 and 16% in 1989. The median student debt owed by these young households was $13,000. Here are 5 key findings about young households with student debt.

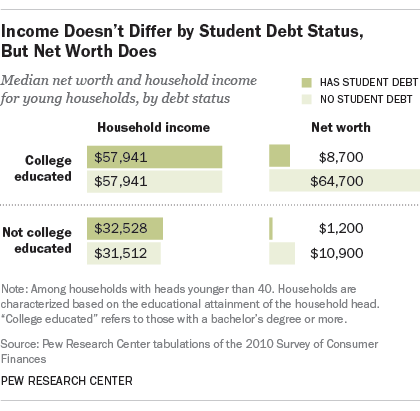

College-educated households with student loans to repay have a lower net worth than those with no student debt. Young college-educated households with no student debt have the highest net worth by far. They have about seven times the net worth of households with student debt. Non-college educated households with outstanding student debt are in the worst position in terms of wealth accumulation. They lag behind their fellow student debtors who graduated from college, and they also trail young adults without a college degree who are free of student debt.

While taking on debt to finance a college education is associated with lower net worth, it doesn’t seem to have an impact on income. In college-educated households, the median income is roughly the same, regardless of whether the household head has outstanding student debt. And it is nearly twice the income of households whose head does not have a bachelor’s degree.

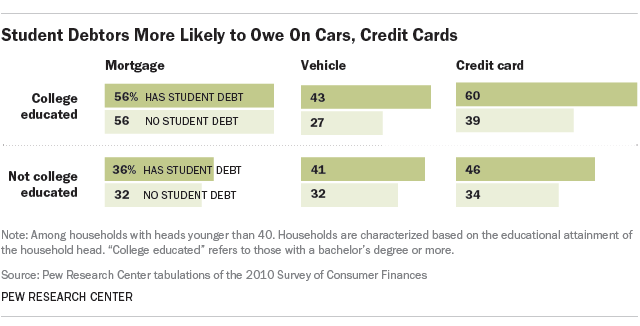

Young households with student debt are much more likely to have car loans and credit card debt, too. And their typical total indebtedness (including mortgage debt, vehicle debt, credit cards, as well as student debt) is almost twice the overall debt load of similar households with no student debt.

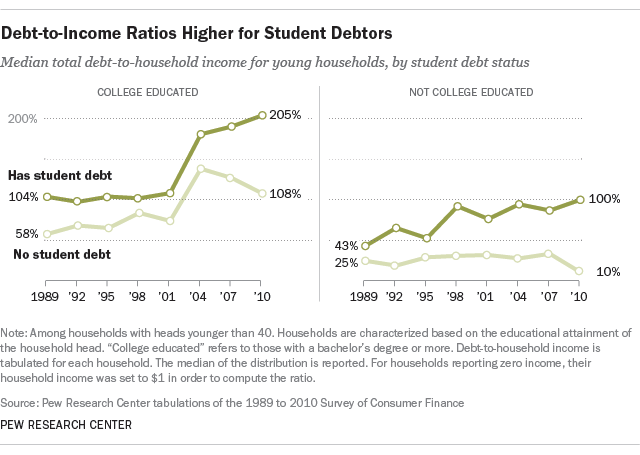

Debts are growing for households that have student loans to repay.

Debt-to-income ratios have increased for young student debtors, even as they have declined for other young households since 2008. The typical young, college-educated student debtor household has debts equivalent to two years of income. Young, college-educated households with no student debt and less-educated households with student debt carry half this debt load, or the equivalent of one year of income.

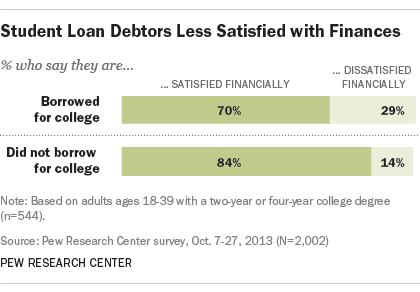

Young households that borrowed for college are less satisfied with their personal financial situation than those who didn’t and are less likely to say their education has paid off.