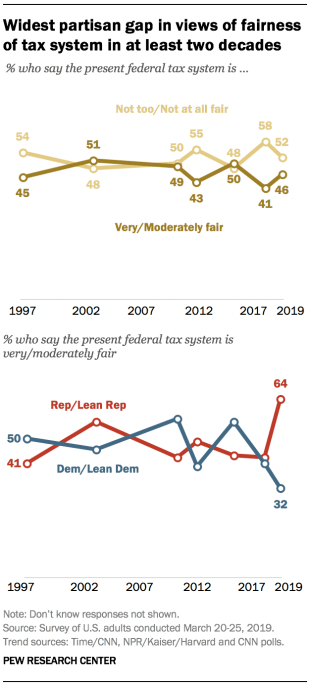

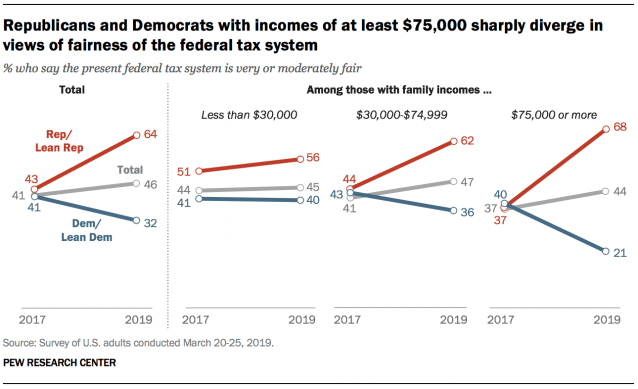

As the April 15 tax deadline approaches, overall public views of the fairness of the nation’s tax system have changed only modestly since 2017, before passage of major tax legislation. However, partisan differences on tax fairness have increased considerably since then, and now are wider than at any point in at least two decades.

Two years ago, Republicans and Democrats had similar views of the fairness of the tax system. Today, 64% of Republicans and Republican-leaning independents say the present tax system is very or moderately fair; just half as many Democrats and Democratic leaners (32%) view the tax system as fair. The share of Republicans who say the tax system is fair has increased 21 percentage points since 2017. Over this period, the share of Democrats viewing the tax system as fair has declined nine points.

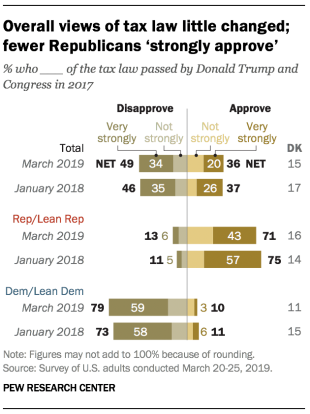

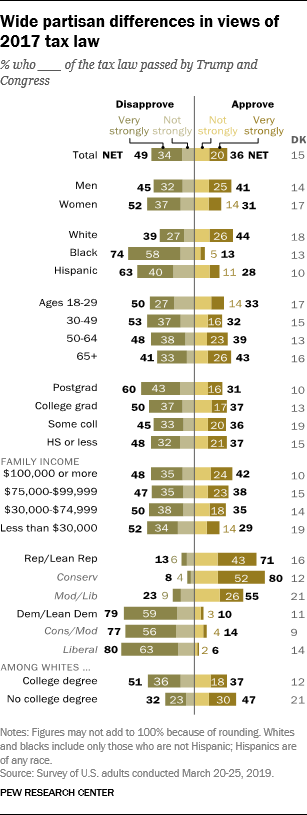

The survey by Pew Research Center, conducted March 20-25 among 1,503 adults, finds that more than a year after the new tax law was enacted, public approval remains relatively unchanged (36% approve of the tax law, while 49% disapprove). However, fewer Republicans strongly approve of the law than did so in January 2018.

About seven-in-ten Republicans (71%) approve of the tax law, including 43% who strongly approve. Early last year, about the same share of Republicans approved of the tax law (75%), but a majority (57%) strongly approved.

Most Democrats continue to express negative views of the tax law. Today, 79% of Democrats disapprove, including 59% who strongly disapprove.

Americans are about as likely to say they understand how the tax law affects them as was the case in January 2018. A majority of Americans say they understand how the tax law has affected them and their family “very well” (26%) or “somewhat well” (37%). However, a third say they understand the law’s impact not too well or not at all well.

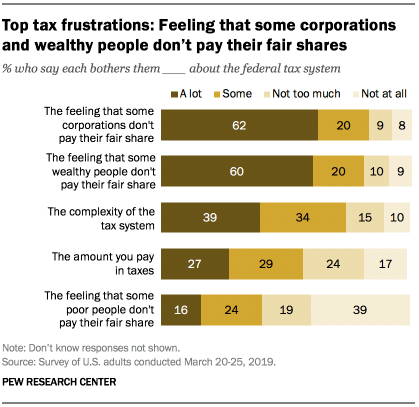

The public’s overall frustrations with the federal tax system have changed little since April 2017, the survey finds.

Overall, about six-in-ten Americans say they are bothered “a lot” by the feeling that some corporations (62%) and wealthy people (60%) do not pay their fair share in taxes.

Fewer American express strong concerns about the complexity of the tax system (39% say they are bothered a lot by this), the amount they pay in taxes (27%) and whether poor people pay their fair share in taxes (16%).

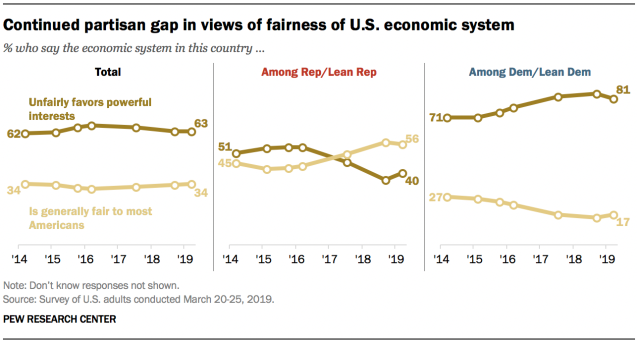

The public’s views of the fairness of the U.S. economic system have changed little in recent years – and remain deeply divided along partisan lines. Currently, 63% of Americans say the “economic system unfairly favors powerful interests,” while just 34% say it is “generally fair to most Americans.” About twice as many Democrats (81%) as Republicans (40%) say the country’s economic system is unfair.

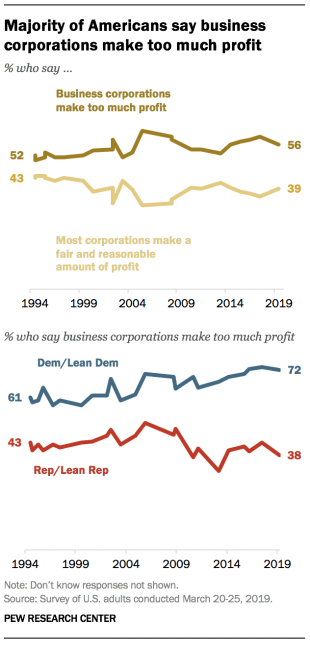

Similarly, opinions on whether corporate profits are excessive have been stable. A 56% majority says business corporations make too much profit, compared with 39% who say their profits are “fair and reasonable.” While 72% of Democrats say corporations make too much profit, only 38% of Republicans say the same.

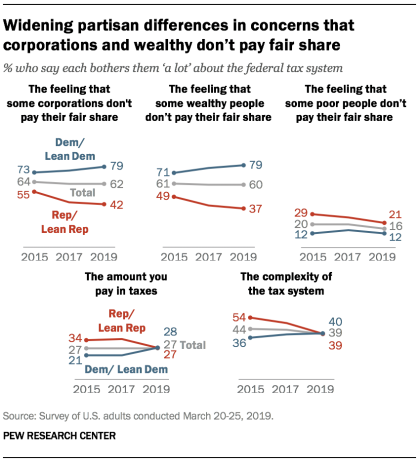

Partisans close divisions on some concerns over the tax system as other divisions widen

While increasing shares of Democrats say they are bothered “a lot” by the feeling that some corporations and wealthy people do not pay their fair share in taxes (79% of Democrats say this about each), Republicans’ concerns over these issues have lessened.

Today, 42% of Republicans say they are bothered a lot by the feeling that some corporations do not pay their fair share of taxes (down from 55% in 2015). And just 37% of Republicans are bothered a great deal by the feeling that some wealthy people do not pay their fair share (49% said this in 2015).

Republicans’ concerns over the complexity of the tax system and how much they pay in taxes also have declined. About four-in-ten Republicans (39%) say they are bothered a lot by the complexity of the tax system, down 15 percentage points since 2015 and 10 points since 2017. Democrats’ views have changed little since 2015; today, 40% say they are bothered a lot by the complexity of the tax system.

There has been a modest decrease in the share of Republicans who say they are bothered a lot by the amount they pay in taxes (27% now, 35% two years ago). Over the past two years, there has been a comparable rise in the share of Democrats saying they are bothered a lot by how much they pay in taxes (28% now, 21% in 2017).

Stark differences in views of tax fairness between higher-income Republicans and Democrats

Today, about two-thirds of Republicans and Republican leaners (64%) say the present federal tax system is very or moderately fair; only about a third of Democrats and Democratic leaners (32%) say the same. In October 2017, there was not a significant gap in Republicans’ and Democrats’ views of the fairness of the tax system.

While Republicans and Democrats across income categories differ in their views of tax fairness, the gaps are widest – and the shift most pronounced – among those with family incomes of $75,000 or more. Currently, 68% of Republicans with incomes of at least $75,000 say the tax system is very or moderately fair, up from just 37% in 2017. By contrast, the share of Democrats who view the tax system as fair has declined 19 percentage points since then (from 40% to 21%).

Assessments of 2017 tax law more negative than positive in many demographic groups

Across many demographic groups, assessments of the 2017 tax law are more negative than positive overall. And partisan differences in the law, which were evident in January 2018 shortly after it was enacted, are about as wide today as they were then.

Democrats, regardless of ideology, overwhelmingly disapprove of the tax law, while there are wider ideological differences among Republicans.

Overall, 71% of Republicans and Republican leaners approve of the law. Conservative Republicans are more likely than moderate and liberal Republicans to approve of the tax law (80%, compared with 55%).

By contrast, sizable majorities of both liberal (80%) and conservative and moderate (77%) Democrats and Democratic leaners say they disapprove of the law.

Adults 65 and older are divided in their views of the tax law: 43% approve, while 41% disapprove. Among younger age cohorts, more disapprove than approve of the law.

While views of the tax law are more negative than positive across all educational groups, those with postgraduate degrees are more likely than others to say they disapprove of the law (60% say this, compared to 48% of those with less education).

Among whites, views of the tax law are significantly different between those with and without a college degree. About half of whites with a college degree or more (51%) disapprove of the law, while 37% approve. Among whites without a college degree, the balance of opinion is roughly the reverse: 47% approve; 32% disapprove.

Views of economic fairness

Most Americans (63%) say the economic system in the United States unfairly favors powerful interests; only about a third (34%) say it is generally fair to most Americans. The share saying the economic system is unfair has remained largely stable since 2014.

Republicans’ and Democrats’ attitudes about the fairness of the economic system have been moving in opposite directions over the past few years. In 2014, there was a 20 percentage-point gap between the shares of Republicans (51%) and Democrats (71%) who said the economy unfairly favors powerful interests; that gap is now 41 points (40% of Republicans vs. 81% of Democrats). While about eight-in-ten Democrats and Democratic leaners say the economic system is unfair, a majority of Republicans and Republican leaners (56%) now say the economic system is generally fair to most Americans.

The public continues to say that “business corporations make too much profit.” Today, 56% of the public says corporations make too much profit; 39% say “most corporation make a fair and reasonable amount of profit.” These views have held largely steady since 1994.

Nearly three-quarters of Democrats and Democratic leaners (72%) say corporations make too much profit, while about a quarter (24%) say corporate profits are reasonable. Conversely, 56% of Republicans and Republican leaners say most businesses’ profits are fair and reasonable, while 38% say businesses are profiting too much.