As employers contend with growing numbers of younger employees quitting in the great resignation, the COVID-19 recession and gradual labor market recovery has also been accompanied by an increase in retirement among adults ages 55 and older.

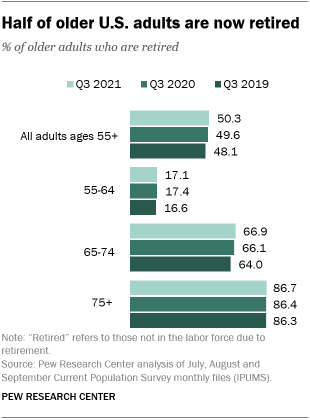

As of the third quarter of 2021, 50.3% of U.S. adults 55 and older said they were out of the labor force due to retirement, according to a Pew Research Center analysis of the most recent official labor force data. In the third quarter of 2019, before the onset of the pandemic, 48.1% of those adults were retired. In regard to specific age groups, in the third quarter of 2021 66.9% of 65- to 74-year-olds were retired, compared with 64.0% in the same quarter of 2019.

The leading edge of the Baby Boomer generation reached age 62 (the age at which workers can claim Social Security) in 2008. Between 2008 and 2019, the retired population ages 55 and older grew by about 1 million retirees per year. In the past two years, the ranks of retirees 55 and older have grown by 3.5 million.

The COVID-19 recession caused millions of Americans to leave the labor force, including many older workers. The recovery began in April 2020, and labor markets have tightened. Retirement is not necessarily permanent, as some retired adults may subsequently reenter the labor market. The track of the retirement rate sheds some light on how durable or long-lasting the employment disruptions are proving to be among older adults.

The share of retired U.S. adults is derived from the monthly Current Population Survey (CPS), conducted by the U.S. Census Bureau for the Bureau of Labor Statistics. The CPS is the nation’s premier labor force survey and is the basis for the monthly national unemployment rate released on the first Friday of each month. The CPS is based on a sample survey of about 70,000 households. The estimates are not seasonally adjusted.

“Retired” in this analysis is based on labor force status. Those who cite “retired” as the reason for not being in the labor force (neither employed nor seeking work) constitute the retired population. This is a moment-in-time measure, and increases reflect the net change of adults moving both into and out of “retirement” due to changes in labor force participation.

The CPS microdata files analyzed were provided by the IPUMS at the University of Minnesota.

The COVID-19 outbreak has affected data collection efforts by the U.S. government in its surveys, especially limiting in-person data collection. This resulted in about an 8 percentage point decrease in the response rate for the CPS in September 2021. It is possible that some measures of retirement and labor market activity and its demographic composition are affected by these changes in data collection.

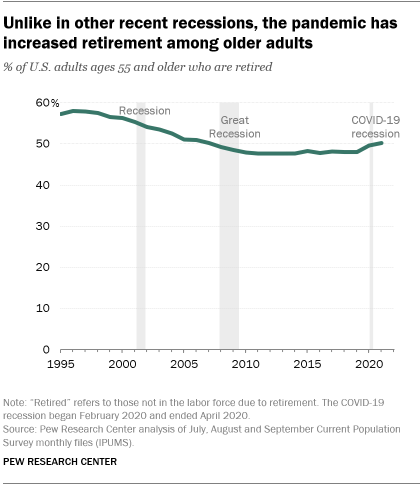

The large impact of the COVID-19 recession – February 2020 to April 2020 – on retirement differs from recent recessions and marks a significant change in a long-standing historical trend toward declining or steady retirement rates among older adults.

During the Great Recession and its aftermath, retirement rates declined. By the third quarter of 2010, 48% of adults ages 55 and older were retired, down from 50% in the same quarter of 2007. The prior recessions did not disrupt the longer-running trend of rising labor force participation and declining retirement among older Americans that began around 1997. Gradually declining retirement reflected in part rising education levels among older Americans as well as gains in their health. In addition, there were policy changes in Social Security that may have impacted retirement decisions. (For example, in 2000 the earnings test on benefit claimants was no longer applied to those who had reached full retirement age.)

The financial context in which older adults are making retirement decisions during the pandemic is markedly different from the Great Recession. During that period – December 2007 to June 2009 – there was a steep decline in the value of financial assets as well as home prices. The resulting loss of wealth induced some older workers to remain in the labor force and postpone retirement. In contrast, household wealth has been rising since the onset of the pandemic. House prices have been rising in most markets. The stock market did have a sharp sell-off in March 2020 but reached new record highs by August 2020.

The retirement uptick among older Americans is important because, until the pandemic arrived, adults ages 55 and older were the only working age population since 2000 to increase their labor force participation. Labor force participation for the entire working age population declined from an annual average of 67% in 2000 to 63% in 2019. This partly reflects a steep drop in participation among 16- to 24-year-olds (66% to 56%) as young people increasingly pursued schooling rather than employment. Participation has also been declining this century among the “prime working age” population, those ages 25 to 54. The overall decline in labor force participation would have been larger if adults 55 and older had not increased their labor force participation (from 32% in 2000 to 40% in 2019).

It is unclear whether the pandemic-induced increase in retirement among older adults will be temporary or longer lasting. Newly published labor force projections from the Bureau of Labor Statistics suggest it will be temporary. BLS projects large increases in labor force participation among older adults from 2020 to 2030, with nearly 40% of 65- to 69-year-olds being in the labor force by 2030, up from 33% in 2020.

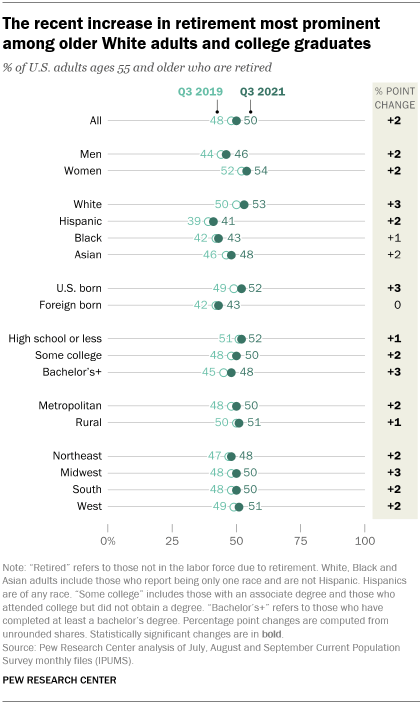

The recent retirement spike has not been uniform across demographic groups. The share of older White adults who are retired increased 3 percentage points from Q3 of 2019 to Q3 of 2021. The retirement rate of older Black adults did not significantly increase. The retirement rate of U.S.-born adults ages 55 and older rose 3 points from 2019 to 2021, while the rate for their foreign-born peers was unchanged.

Retirement among those 55 and older who have completed at least a bachelor’s degree rose 3 percentage points over this period. Among older adults who have a high school diploma or less the rate increased 1 point. The retirement rate increased for older adults living in metropolitan areas (2 points) and also increased for older adults in rural areas (1 point).